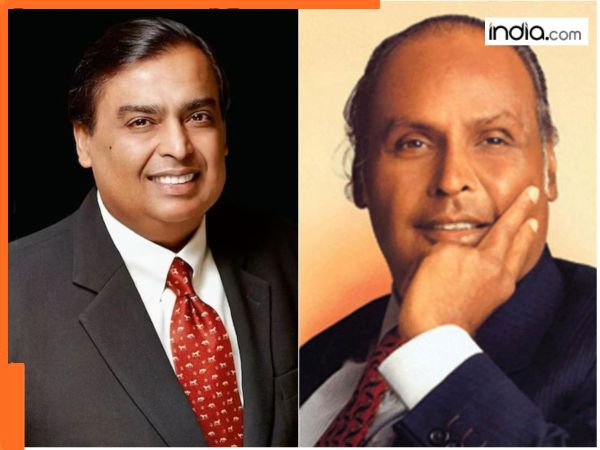

Mukesh Ambani’s father Dhirubhai’s Reliance didn’t pay tax for 30 years? Govt also couldn’t do anything because…

GH News January 31, 2025 03:06 PM

Reliance Industries Limited (RIL) headquartered in Mumbai is one of India’s most profitable conglomerates. The company operates across diverse sectors including energy petrochemicals textiles natural resources and telecommunications. However for 30 years following its listing (1966-1996) Reliance didn’t pay any taxes and earned the reputation of being a ‘zero-tax profit-making company’ as it avoided paying corporate income tax on its profits.

According to media reports this phenomenon led to the introduction of the Minimum Alternative Tax (MAT) by the Indian Income Tax Department aimed at ensuring that profit-making companies like Reliance contributed their fair share to the treasury.

What Is Zero-Tax Company?

A zero-tax company is one that reports significant book profits pays dividends to its investors but avoids paying corporate income taxes. During this era many Indian companies including Reliance exploited legal loopholes leading to a significant loss of tax revenue for the government.

How Could Reliance Avoid Taxes?

The issue arose due to a conflict between two business tax laws in India:

Income Tax Act: Determined the company’s tax liability based on its taxable income.

Companies Act: Guided the preparation of Profit & Loss (P&L) accounts.

This discrepancy allowed companies to report book profits in their P&L accounts while declaring negligible or zero taxable income under the Income Tax Act. Reliance masterfully leveraged these loopholes to its advantage.

Reliance’s Strategy to Avoid Taxes

Depreciation Tactics:

In the 1983-84 Union Budget Finance Minister Pranab Mukherjee attempted to curb such practices by mandating a 30% tax on profits calculated after depreciation but before deductions.

Reliance responded by capitalizing future interest payable on borrowings for new projects. This move significantly inflated the company’s asset base in one go allowing them to claim higher depreciation deductions which in turn reduced taxable income to near zero.

Heavy Dividend Payouts:

While Reliance minimized its tax obligations it compensated its shareholders with generous dividends. The company consistently provided at least a 25% return on the face value of shares earning investor loyalty and maintaining a robust reputation.

Despite being asset-heavy and not India’s most profitable company by net worth Reliance ensured steady rewards for its investors solidifying its position as a reliable entity in the market.

Introduction of MAT to Counter Zero-Tax Companies

The government eventually introduced the Minimum Alternative Tax (MAT) to ensure companies paid a minimum tax based on their book profits thereby addressing the loophole that Reliance and others had exploited for decades. This reform marked a turning point in India’s corporate tax landscape.

The introduction of MAT was a direct response to such practices ensuring greater equity in corporate taxation. Despite the controversies Reliances investor-friendly policies and growth trajectory established it as one of India’s leading conglomerates.

Reliance Industries Limited (RIL) headquartered in Mumbai is one of India’s most profitable conglomerates. The company operates across diverse sectors including energy petrochemicals textiles natural resources and telecommunications. However for 30 years following its listing (1966-1996) Reliance didn’t pay any taxes and earned the reputation of being a ‘zero-tax profit-making company’ as it avoided paying corporate income tax on its profits.

According to media reports this phenomenon led to the introduction of the Minimum Alternative Tax (MAT) by the Indian Income Tax Department aimed at ensuring that profit-making companies like Reliance contributed their fair share to the treasury.

What Is Zero-Tax Company?

A zero-tax company is one that reports significant book profits pays dividends to its investors but avoids paying corporate income taxes. During this era many Indian companies including Reliance exploited legal loopholes leading to a significant loss of tax revenue for the government.

How Could Reliance Avoid Taxes?

The issue arose due to a conflict between two business tax laws in India:

Income Tax Act: Determined the company’s tax liability based on its taxable income.

Companies Act: Guided the preparation of Profit & Loss (P&L) accounts.

This discrepancy allowed companies to report book profits in their P&L accounts while declaring negligible or zero taxable income under the Income Tax Act. Reliance masterfully leveraged these loopholes to its advantage.

Reliance’s Strategy to Avoid Taxes

Depreciation Tactics:

In the 1983-84 Union Budget Finance Minister Pranab Mukherjee attempted to curb such practices by mandating a 30% tax on profits calculated after depreciation but before deductions.

Reliance responded by capitalizing future interest payable on borrowings for new projects. This move significantly inflated the company’s asset base in one go allowing them to claim higher depreciation deductions which in turn reduced taxable income to near zero.

Heavy Dividend Payouts:

While Reliance minimized its tax obligations it compensated its shareholders with generous dividends. The company consistently provided at least a 25% return on the face value of shares earning investor loyalty and maintaining a robust reputation.

Despite being asset-heavy and not India’s most profitable company by net worth Reliance ensured steady rewards for its investors solidifying its position as a reliable entity in the market.

Introduction of MAT to Counter Zero-Tax Companies

The government eventually introduced the Minimum Alternative Tax (MAT) to ensure companies paid a minimum tax based on their book profits thereby addressing the loophole that Reliance and others had exploited for decades. This reform marked a turning point in India’s corporate tax landscape.

The introduction of MAT was a direct response to such practices ensuring greater equity in corporate taxation. Despite the controversies Reliances investor-friendly policies and growth trajectory established it as one of India’s leading conglomerates.

Reliance Industries Limited (RIL) headquartered in Mumbai is one of India’s most profitable conglomerates. The company operates across diverse sectors including energy petrochemicals textiles natural resources and telecommunications. However for 30 years following its listing (1966-1996) Reliance didn’t pay any taxes and earned the reputation of being a ‘zero-tax profit-making company’ as it avoided paying corporate income tax on its profits.

According to media reports this phenomenon led to the introduction of the Minimum Alternative Tax (MAT) by the Indian Income Tax Department aimed at ensuring that profit-making companies like Reliance contributed their fair share to the treasury.

What Is Zero-Tax Company?

A zero-tax company is one that reports significant book profits pays dividends to its investors but avoids paying corporate income taxes. During this era many Indian companies including Reliance exploited legal loopholes leading to a significant loss of tax revenue for the government.

How Could Reliance Avoid Taxes?

The issue arose due to a conflict between two business tax laws in India:

Income Tax Act: Determined the company’s tax liability based on its taxable income.

Companies Act: Guided the preparation of Profit & Loss (P&L) accounts.

This discrepancy allowed companies to report book profits in their P&L accounts while declaring negligible or zero taxable income under the Income Tax Act. Reliance masterfully leveraged these loopholes to its advantage.

Reliance’s Strategy to Avoid Taxes

Depreciation Tactics:

In the 1983-84 Union Budget Finance Minister Pranab Mukherjee attempted to curb such practices by mandating a 30% tax on profits calculated after depreciation but before deductions.

Reliance responded by capitalizing future interest payable on borrowings for new projects. This move significantly inflated the company’s asset base in one go allowing them to claim higher depreciation deductions which in turn reduced taxable income to near zero.

Heavy Dividend Payouts:

While Reliance minimized its tax obligations it compensated its shareholders with generous dividends. The company consistently provided at least a 25% return on the face value of shares earning investor loyalty and maintaining a robust reputation.

Despite being asset-heavy and not India’s most profitable company by net worth Reliance ensured steady rewards for its investors solidifying its position as a reliable entity in the market.

Introduction of MAT to Counter Zero-Tax Companies

The government eventually introduced the Minimum Alternative Tax (MAT) to ensure companies paid a minimum tax based on their book profits thereby addressing the loophole that Reliance and others had exploited for decades. This reform marked a turning point in India’s corporate tax landscape.

The introduction of MAT was a direct response to such practices ensuring greater equity in corporate taxation. Despite the controversies Reliances investor-friendly policies and growth trajectory established it as one of India’s leading conglomerates.