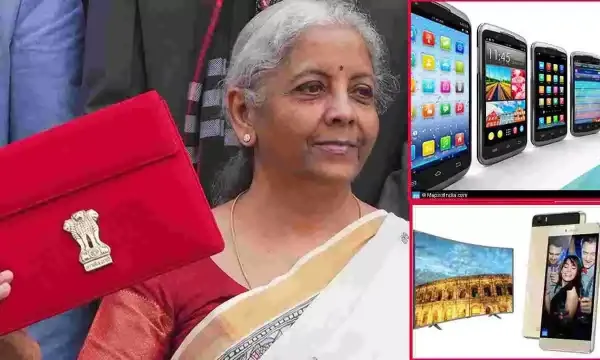

Basic customs duties (BCD) on necessary electronic components have been significantly reduced in the Union Budget 2025–2026, opening the door for more reasonably priced TVs and smartphones. Finance Minister Nirmala Sitharaman highlighted plans to boost India’s electronics manufacturing sector and lower the cost of imported products as she presented the budget.

The budget has made significant adjustments, including lowering the 20% customs duty on printed circuit board assemblies (PCBAs), mobile phones, and mobile chargers to 15%. It is anticipated that this change would lower the price of imported handsets, especially expensive models like certain iPhones that are not made in India. The most recent reduction is seen as a move toward more accessible technology, but the government had previously increased this levy to 20% in 2018 to promote domestic manufacturing.

Industry analysts have responded favorably to the move. The president of Xiaomi India, Muralikrishnan B, thinks that lowering customs taxes on smartphones and their parts as well as granting raw material exemptions would boost local manufacturing. Similarly, Itel and Tecno CEO Arijeet Talapatra has praised the move to lower smartphone prices in India’s growing industry.

Tariff reduction may lower production costs, but it’s unclear how this would affect consumer pricing. Only a 1% to 2% drop in smartphone pricing is anticipated, according to Tarun Pathak, Research Director at Counterpoint Research. Low-cost cellphones may experience little to no price adjustment since they already have limited profit margins. The government prioritizes workforce development and regional manufacturing.

In addition to lowering import taxes, the budget prioritizes skill-building initiatives to bolster the domestic workforce in the electronics industry. Initiatives to upgrade skills strengthen India’s manufacturing capacity and promote an independent electronics sector.

Similar actions have already been taken by the government to assist the sector. For instance, the removal of customs taxes on smartphone camera lenses in February 2023 reduced manufacturing costs.

The way producers pass on the savings will determine the real effect on retail pricing even with the tariffs being reduced. Instead of lowering consumer prices, some companies could utilize the cost reductions to offset growing manufacturing costs. However, by promoting domestic production and raising market competitiveness, the action is anticipated to support long-term development in India’s electronics industry.

By lowering customs taxes on essential parts, India’s electronics manufacturing industry would grow and cellphones and TVs will become more reasonably priced.