Like the classic novel , there are two sides to the Good Glamm Group. One that’s always flexing and one that seems to be in flux.

The Darpan Sanghvi-led company made big claims about profitability, plans for an IPO, international expansion, entry into the premium segment and more. But a lot of this seems to be smoke and mirrors — the reality is completely stark to this sunny optimism.

Forget the plans and the ambitions: here’s what has actually happened in the past year at the Good Glamm Group (GGG).

Even as it has fulfilled a portion of its acquisition obligations related to Sirona and The Moms Co in the past few months, Good Glamm Group’s house of brands and ecommerce platform seems to be on the edge.

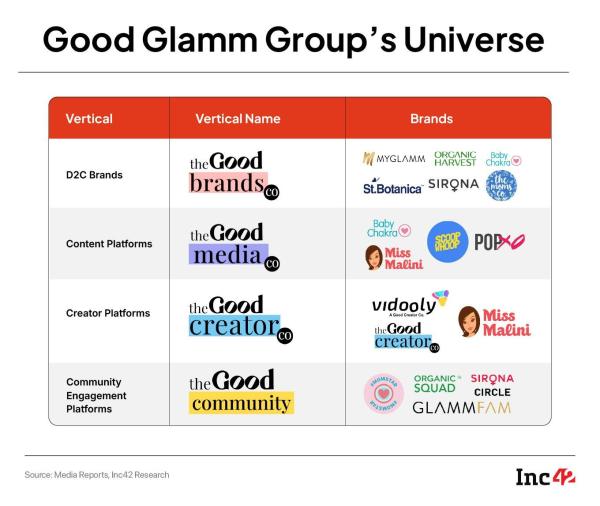

The company’s content-to-commerce play has crumbled, and changes to operational and management structures are alleged to have derailed acquired brands and left them in disarray. The company’s bullishness on omnichannel growth has also faded in the past 15 months.

Sources close to the management told Inc42 that GGG is in talks with multiple investors to raise INR 240 Cr in funding, but given its accumulated losses and hefty debt of more than INR 450 Cr, how far will this infusion go?

Going From Beauty To BYJU’S“Good Glamm Group is becoming the BYJU’S of the commerce world,” one source aware of the current state of the debt-ridden company remarked.

Worryingly, the Amazon-backed startup, which was valued at over $1.2 Bn valuation just two years ago, is looking to raise funds at a valuation of close to INR 1,000 Cr (just under $120 Mn today). Investors that backed the company in the early days stand to incur a heavy loss on their investment.

That’s a 90%-plus haircut on its previous valuation, showing how the company’s promise of becoming a house of brands has disintegrated. Despite acquiring more than 10 companies — GGG, like BYJU’S — failed to create the commerce flywheel that could sustain all these brands.

Sources that have worked with the company over the past few years also claim the group’s management tweaked product formulations for several SKUs, leading to a drop in quality and bad reviews.

Presence on marketplaces and key new channels such as quick commerce is another major challenge for the house of brands, and the revolving door at the leadership level does not help matters.

Here’s a laundry list of the issues at the Good Glamm Group:

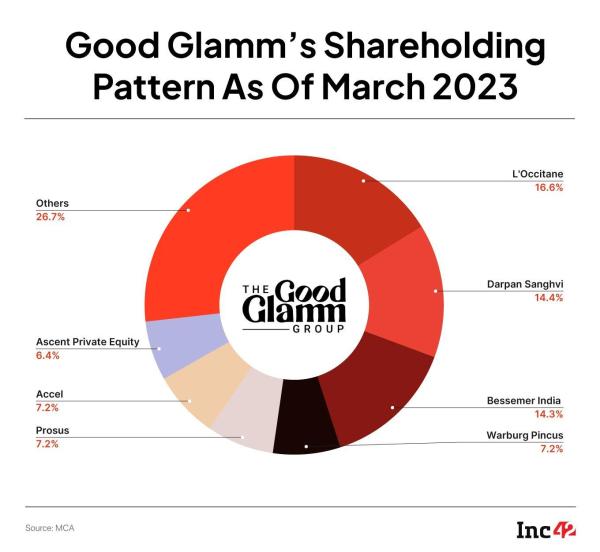

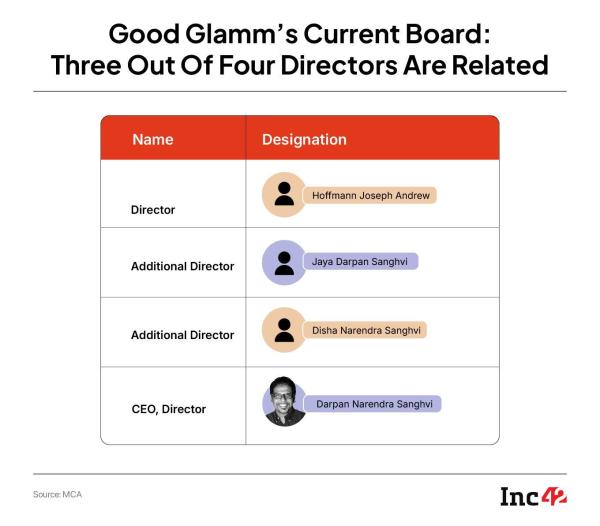

As per sources, the existing investors were asked to step aside from its board as the company is looking to bring in a new majority shareholder at a lower valuation, in the hope of turning around its financial state.

At the same time, Darpan Sanghvi, MD and CEO of the Good Glamm Group (GGG), who is based out of Singapore, and two other members of the Sanghvi family currently sit on the board, along with former L’Occitane CEO André J. Hoffmann.

L’Occitane remains the largest shareholder in the company as per its existing cap table.

But all that could change if GGG manages to raise funds from new investors. Sources claim the company is raising between INR 150 Cr ($17 Mn) and INR 250 Cr ($28 Mn) in an equity funding round at a post-money valuation of up to INR 1,000 Cr ($120 Mn).

The round is likely to be led by Gujarat-based debt provider and investment broker and is conditional on GGG bringing in other investors for the round. In that case, Veloce would invest up to INR 85 Cr and become the lead shareholder of the company.

Sources added that as per the terms floated by the incoming investor, the group of incoming investors would have 70% stake in the company, with existing CCPS holders forced to dilute their equity to 10%. Founder Darpan Sanghvi would hold 15% of the company after this deal, while the rest would be allocated to ESOPs.

The investors are also likely to compel GGG to forgo interest payments to venture debt investors and other creditors, sources claimed.

Indeed, given the recent exits from the board, it would not be a surprise if GGG announces the new round soon.

A new round at a heavily discounted valuation indicates serious problems with the business. At the very least it shows that the company does not have the revenue growth to attract investors at its previous valuation. It could also indicate a rights issue by the company to allow existing shareholders to continue holding some equity in case there is a positive outcome.

However, at the moment, given the fact that many existing investors would continue to hold some stake in the company, GGG is not a complete write-off for them.

Inc42 sent a number of questions to Good Glamm Group about the various issues related to its financial performance and the struggle to raise funds and meet debt obligations.

In response to our questions about the fundraise, a company spokesperson said, “The Good Glamm Group received Term Sheets for a new funding round in December and is now in the final stages of closing. While we will not be making any further comments until the fundraise is complete, we would like to clarify that the majority of the query contains factual inaccuracies, which will be clarified once the process is concluded. Our focus remains on executing our strategic priorities, and we will share updates once the fundraise is finalised.”

Further, in response to our questions about investing in GGG, a representative for Veloce told Inc42, ”We do not comment on speculations and the questions posed are too pre-mature for any response.”

“It is at an early stage of discussion. We are yet to decide on a lot of things. It can take even months, if at all this funding takes place,” said a person overlooking investment at Veloce Fintech.

But sources claim that the investment is conditional on the Good Glamm Group using a specified portion of all future fundraise to pay off its debt.

Indeed, a lot of the fundraise will go towards settling due payables and bank working capital lines. But the condition of clearing debt with future fundraise indicates that Good Glamm Group would not entirely be free from its debt obligations with its next fundraise — unless it is a significantly large round.

Sources added that the investment is also conditional on the founders and promoters of Good Glamm Group taking the company to EBITDA breakeven in India within 6 months.

This is a tall ask from Good Glamm Group. Given the company’s dire state in terms of operations and product development, can a turnaround even be expected?

Where Good Glamm Group Went BadCoinciding with the downturn at Good Glamm Group is the rise of beauty marketplaces fuelled by VC money as well as corporate-backed marketplaces such as Reliance Retail’s Tira in 2022, and now Tata’s Zudio Beauty in 2024.

Mamaearth’s parent Honasa went public in 2023, and has churned out profits, while also restructuring its distribution and supply chain. Nykaa has continued to inch forward on growth and profitability, but the Good Glamm Group seems to be stuck in a rut.

A major reason: the company has not been able to extract the best of its dozens of acquisitions.

Former employees, including CEOs of some companies acquired by the Good Glamm Group, allege that the management and group CEO Darpan Sanghvi overlooked key matters pertaining to corporate governance and misled international business partners.

The management is also alleged to have overpromised on the growth projections to investors in 2021, which it has failed to keep up with.

Those formerly leading product and operations at acquired brands such as The Moms Co, Sirona, Organic Harvest claimed that the transition to Good Glamm Group’s structure — where sales, hiring and marketing were centralised — has resulted in lapses on the product development front and marketing budgets, leading to poor sales and a drop in the quality of skincare products.

The beauty-centric D2C platform is alleged to have also sidelined key members of the product and marketing teams of these acquired companies, which has resulted in brand dilution and pushed many of these brands further away from profitability.

While Good Glamm was earning 80% of its revenue from online channels in early 2021, it had to pivot to omnichannel mode and as a result, burnt plenty of cash to achieve this.

For instance, GGG went for premium retail spaces for its offline presence, and also paid retail outlets more for preferred shelf placement. This visibility charge ate into GGG’s retail margins, which were already quite thin due to the premium third-party retail presence. However, the brands’ products never lived up to the premium positioning, as per sources who worked closely on brand development.

At one point, GGG ran discounting offers such as products for INR 1 (with fulfillment charges of INR 99), which was not a sustainable model. Plus, each retail space required dedicated manpower such as beauty experts which added to the cost.

Good Glamm Group took the call to shut the majority of its brand-owned outlets in mid-2023, and cut off supply to non-performing third-party outlets. It stopped distributing products to the bottom 30%-40% of stores and only stocked up its performing outlets.

This extreme dilution on the omnichannel front resulted in demand mismatch and damaged the brand name quite a bit.

The resulting cash crunch — after burning millions — pushed the startup under a pile of vendor dues. Many stockists and distributors are said to have given up on Good Glamm Group, which has marred retail sales.

As per sources, currently the group company is selling around one-tenth of what it was selling a year ago.

“What was the board doing? Were they not aware of the payment obligations in India when approving the plans for investing in the US market? Were they sleeping at the wheel in the name of corporate governance?” a former Good Glamm Group employee said.

The board has clearly taken at least one step now with the resignation of three directors, reasons for which are currently unknown, but it’s not one that fills anyone with confidence about the company’s future.

Mail sent to Prosus and Accel didn’t elicit any responses whereas text messages sent to Bessemer’s Vishal Gupta went unanswered.

Besides acquiring a host of brands in 2021 and 2022, Good Glamm Group also looked to create a content-to-commerce platform through acquisitions such as Vidooly, , , Tweak India, Ms Malini, Winkl, and popXO. Some of the key leaders associated with these companies also claimed that the Good Glamm Group has not been compliant with the terms of their acquisition deals.

While the parent company (Sanghvi Beauty & Technologies Pvt Ltd) has not filed its FY24 financials, sources claimed the company’s top line or GMV grew to around INR 900 Cr in FY24, with losses at around INR 600 Cr.

Besides, founders of the acquired companies have already left the company, and many of those leading central functions have also quit.

For instance, last year, Priyanka Gill — in charge of the media business — quit, followed by the resignation of the CEO of the beauty business Sukhleen Aneja. Chief business officer Bhavesh Singhal and CPTO Deep Gantara are also on their way out.

While GGG raised close to $30 Mn from its existing investors in January 2024, this is just a drop in the bucket for the company given its operational scale, employee base and product development needs at the time.

It was also using a lot of this infusion to fuel its foray into international markets. For instance, CEO Sanghvi claimed the company has invested INR 250 Cr (around $30 Mn) for . And this is even before the brand expands and scales up in the US.

Many of those associated with the Indian D2C brands acquired by Good Glamm Group claim that the company has ignored key issues and growth challenges for these brands, while prioritising the US launch.

There’s also discontent because the acquisitions have been leveraged by GGG in signing the deal with tennis star Williams in the US. But on ground, the reality is starkly different. Brands have been starved of growth capital, we were told, and there’s a fear that these brands will die a slow death.

Back To Square OneBesides this, the GGG management told employees about a severe cash crunch and hurdles in fundraising. According to the management, the company is looking to offload acquired brands including Sirona, Organic Harvest, and The Moms Co.

Even if GGG raises funds, it’s not clear whether it will continue to retain some of the brands it had acquired in the past.

As per sources, the company has been in the market for the past year looking for a buyer for its acquired brands. As per Moneycontrol, GGG is said to have held talks with Nykaa, Mamaearth, Mensa Brands, and even Purplle to sell either one or multiple brands.

“They are desperate to sell these brands. From startups to FMCG brands, and even HNIs, they have approached everyone. When selling these brands in a bundle to one player didn’t work, they started to sell one brand at a time,” one of the people aware of the matter told Inc42.

Sources claim Sanghvi has also gone back to the original founders of the acquired brands to sell their companies back to them. Sirona’s founders — Deep Bajaj and Mohit Bajaj — could buy back the brand from GGG for INR 150 Cr to INR 200 Cr. Incidentally, GGG acquired Sirona for INR 450 Cr ($51 Mn)

However, sources also added that nothing has been finalised yet. It’s not clear whether Good Glamm Group will offload its acquired brands even if it ends up raising funds. Some of the brand names — Sirona and The Moms Co., for instance — have stronger recall in the market than any of Good Glamm Group’s own brands, including MyGlamm.

It also goes without saying that any incoming investors would want the company to sign covenants related to exit options, either through IPOs, secondary sales, or buybacks. This has become a standard ask in shareholder agreements since 2021.

But Good Glamm Group cannot hope to ride the IPO wave just yet. Any infusion that comes in is only going to go towards its debt obligations and it’s not clear how much capital the company will be left with to push forward on the growth front.

The current situation is not unlike several other companies that showed unbridled appetite for acquisitions in 2020 and 2021, only to end up with a problem in their hands.

Good Glamm Group wanted to build a house of brands, but without a solid foundation, the walls are coming down.

Edited By Nikhil Subramaniam

The post appeared first on .