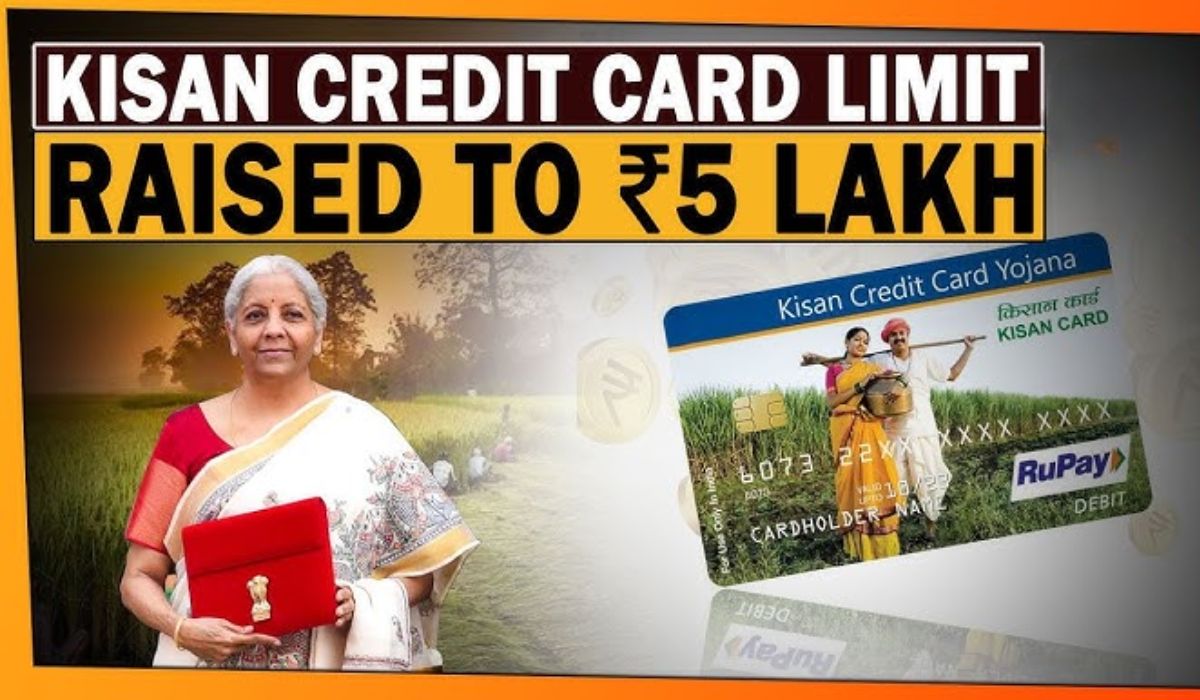

Kisan Credit Card (KCC) is an important financial facility for farmers, which provides loans at low interest rates for farming. Recently, the central government has increased the loan limit under KCC from three lakhs to five lakh rupees. The objective of this scheme is to provide easy and cheap loans to farmers, so that they can meet the farming related requirements without any financial constraints.

If you want to get a Kisan Credit Card and want information about eligibility, application process and documents for it, then this article is for you.

Kisan Credit Card Scheme was launched by the government in 1998. Under this scheme, farmers get agricultural loans at low interest rates, so that they can get financial assistance for seeds, fertilizers, pesticides, equipment, animal husbandry, horticulture, and fisheries.

The following people can avail the benefits of Kisan Credit Card Scheme:

The following documents are required to get KCC made:

| Required Documents | Description |

| Aadhar card | Required as Identity Proof |

| PAN card | For financial transactions and tax purposes |

| land papers | To prove that the farmer has cultivable land |

| Passport size photo | To be attached with the application form |

There are two ways to apply for Kisan Credit Card:

Farmers get the following benefits under Kisan Credit Card:

Loan limit increased: Earlier, under KCC, loan up to ₹3 lakh was available, which has been increased to ₹5 lakh.

Low interest rate: Loans are made available to farmers at an interest rate of just 4% per annum.

KCC loan tenure and interest rate information:

| Amount of loan | interest rate | Discounts given by the government | Total interest rate |

| Up to ₹50,000 | 7% | 5% | 2% |

| Up to ₹1,00,000 | 7% | 5% | 2% |

| Up to ₹3,00,000 | 9% | 5% | 4% |

| Up to ₹5,00,000 | 10% | 6% | 4% |

The interest rate reduces further if the loan is repaid on time.

Farmers who pay on time get more benefits. The loan received from KCC cannot be used for any purpose other than farming. The loan amount is decided based on the condition of the agricultural land and needs of the farmer.

Kisan Credit Card Scheme is very beneficial for farmers, because under this, a loan of up to Rs 5 lakh can be availed at a low interest rate. The application process is very easy, and farmers can apply online or by visiting the bank. An additional discount of 3% is also available on the interest rate on repaying the loan on time. The government wants to benefit more and more farmers by promoting this scheme.

If you are a farmer and want to apply for Kisan Credit Card, then apply soon by visiting the nearest bank or official website and avail the benefits of this scheme.