Consumer goods sales picked up in the December quarter and vehicle registrations rose in January from a year-ago high base, pointing to positive news on the broader economic front ahead of the RBI’s monetary policy announcement on Friday, with India’s rural areas performing markedly better than its cities. This comes amid income tax relief in finance minister Nirmala Sitharaman’s February 1 budget that’s expected to provide a boost to consumption and lift growth, which had been forecast in January at a lower-than-expected 6.4% in FY25—the slowest in four years.

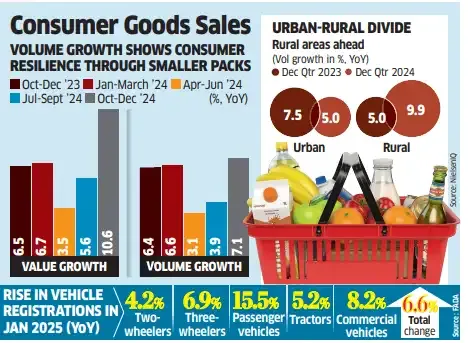

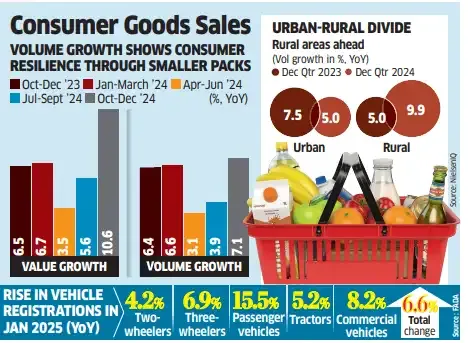

Growth in small and medium consumer goods companies, small unit packs and an increase in rural demand lifted India’s packaged consumer goods sales to 10.6% value growth in the October-December festive period, researcher NielsenIQ said in its quarterly update released Thursday.

Metro cities continued to lag and despite a slowdown in the top eight metros, ecommerce continued to disrupt buying behaviour.

Large consumer goods firms including Hindustan Unilever Ltd (HUL), Godrej Consumer Products, Colgate and Nestle reported muted revenues of 2-5% year-on-year in October-December 2024, with demand in villages outpacing cities.

This is the fourth consecutive quarter that saw rural markets outpace growth in urban India. The country’s cities have been battling a protracted slowdown that companies such as HUL, Nestle, Britannia and Godrej Consumer Products have attributed to steep food and fuel inflation as well as static wages. That’s persuaded urban consumers to either put off purchases or downtrade to smaller packs. Rural consumers, on the other hand, have led the fast-moving consumer goods (FMCG) growth story, aided by good monsoon rain, employment schemes and the government’s agriculture incentives. Rural sales volumes increased 9.9%, while urban volumes continued to lag growth in India’s villages, expanding at 5.7%, NielsenIQ said.

Vehicle registrations or actual sales to customers increased 6.6% to 2.29 million units last month on the back of new launches and better credit availability, indicating a sustained recovery in consumer demand, according to the Federation of Automobile Dealers Associations (FADA) of India. Retail sales of automobiles rose 32.4% in October driven by festive demand but fell in November and December, raising concerns about a slump. Vehicle registrations declined in six out of 10 months in the ongoing fiscal year, and by 12% to 1.79 million units in December.

“Our observations indicate that each vehicle category—two-wheeler, three-wheeler, passenger vehicle, tractor and commercial vehicles—witnessed positive momentum, pointing toward sustained consumer confidence and steady market recovery,” said FADA president CS Vigneshwar.

In the two-wheeler segment, while urban markets continued to outpace rural centres on the back of demand for scooters, car sales were stronger in the villages, according to data collated by FADA from the Vahan portal of the Ministry of Road, Transport & Highways (MoRTH).

Rural sales of two-wheelers rose 3.85% in January, compared with growth of 4.54% in urban centres. In the passenger vehicle segment, rural sales rose 18.57% compared with 13.72% in urban areas. In January, the share of rural markets in two-wheeler and passenger vehicle sales stood at 56.3% and 38.2%, respectively.

The continuing marriage season, fresh product launches and strategic promotional activities are likely to sustain customer footfalls, Vigneshwar said. Furthermore, improved inventory management, better financing options from select lenders and an order backlog in certain segments, such as commercial vehicles, will aid auto sales. In the NielsenIQ report, both urban and rural markets reported recovery sequentially. However, India’s villages reported twice the growth rate of the cities. NielsenIQ said sales volume rose 9.9% in rural markets in the December quarter, increasing 5.7% from the previous quarter.

Budget with ET

Tax calculator

Metro cities continued to lag and despite a slowdown in the top eight metros, ecommerce continued to disrupt buying behaviour.

Large consumer goods firms including Hindustan Unilever Ltd (HUL), Godrej Consumer Products, Colgate and Nestle reported muted revenues of 2-5% year-on-year in October-December 2024, with demand in villages outpacing cities.

This is the fourth consecutive quarter that saw rural markets outpace growth in urban India. The country’s cities have been battling a protracted slowdown that companies such as HUL, Nestle, Britannia and Godrej Consumer Products have attributed to steep food and fuel inflation as well as static wages. That’s persuaded urban consumers to either put off purchases or downtrade to smaller packs. Rural consumers, on the other hand, have led the fast-moving consumer goods (FMCG) growth story, aided by good monsoon rain, employment schemes and the government’s agriculture incentives. Rural sales volumes increased 9.9%, while urban volumes continued to lag growth in India’s villages, expanding at 5.7%, NielsenIQ said.

Vehicle registrations or actual sales to customers increased 6.6% to 2.29 million units last month on the back of new launches and better credit availability, indicating a sustained recovery in consumer demand, according to the Federation of Automobile Dealers Associations (FADA) of India. Retail sales of automobiles rose 32.4% in October driven by festive demand but fell in November and December, raising concerns about a slump. Vehicle registrations declined in six out of 10 months in the ongoing fiscal year, and by 12% to 1.79 million units in December.

“Our observations indicate that each vehicle category—two-wheeler, three-wheeler, passenger vehicle, tractor and commercial vehicles—witnessed positive momentum, pointing toward sustained consumer confidence and steady market recovery,” said FADA president CS Vigneshwar.

In the two-wheeler segment, while urban markets continued to outpace rural centres on the back of demand for scooters, car sales were stronger in the villages, according to data collated by FADA from the Vahan portal of the Ministry of Road, Transport & Highways (MoRTH).

Rural sales of two-wheelers rose 3.85% in January, compared with growth of 4.54% in urban centres. In the passenger vehicle segment, rural sales rose 18.57% compared with 13.72% in urban areas. In January, the share of rural markets in two-wheeler and passenger vehicle sales stood at 56.3% and 38.2%, respectively.

The continuing marriage season, fresh product launches and strategic promotional activities are likely to sustain customer footfalls, Vigneshwar said. Furthermore, improved inventory management, better financing options from select lenders and an order backlog in certain segments, such as commercial vehicles, will aid auto sales. In the NielsenIQ report, both urban and rural markets reported recovery sequentially. However, India’s villages reported twice the growth rate of the cities. NielsenIQ said sales volume rose 9.9% in rural markets in the December quarter, increasing 5.7% from the previous quarter.