As the government-backed Open Network for Digital Commerce (ONDC) completes two years of operations, network participants (NPs) have mixed views about the ambitious project that aimed to democratise e-commerce, with some praising its effectiveness and others complaining about lack of growth and business potential.

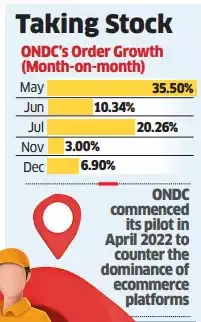

After hitting double-digit, month-on-month order growth in May (35.5%), June (10.34%) and July (20.26%), there was a slump to single-digit expansion in November (3%) and December (6.9%).

ONDC commenced its pilot in April 2022 to counter the dominance of ecommerce platforms such as Amazon and Flipkart and break the hold of aggregators like Swiggy and Zomato in the food and beverage space. The network was meant to get traditional players, excluded from the ecommerce transformation, gain salience in the online world.

These included neighbourhood stores, home enterprises, artisans and vendors who hadn’t digitised their wares nor had the wherewithal to pay commissions to ecommerce sites. ONDC expanded nationwide with grocery, mobility and food offerings in January 2023. It achieved a cumulative 173.5 million transactions on January 31.

Some network participants said that breaking even on ONDC orders seems to get farther every year and that they have reduced the number of people working on these transactions by a fourth. Even if the commission is less than that charged by the big players, the scale is not enough to make money, they said.

ONDC delayed imposing a network fee from January to April citing “feedback from sellers.” Others, however, swear by its great potential to break the monopoly of large players such as Amazon, Flipkart, Zomato and Swiggy. Officials also said that ONDC is growing despite lacking the marketing muscle of large brands and having almost zero advertisement spend.

Seller woes

“There is no chance of breaking even in the next two years, at least from the current demand. We had 14 people working at the peak of ONDC orders, currently we have five people,” said an NP, adding that the unit is unable to cover salaries with the current demand.

Another said the issue is one of scale.

“The NPs are custodians of single-digit percentage commissions which is not even north of 10%--it is 5% on the buyer side and 2% on the seller side,” the person said. “Until ONDC scales, it is not going to make financial success for any NP. Even the buyer apps have been burning money. Despite the commission, they spend more.”

Seller commissions alone can’t achieve breakeven, said the first NP cited above, even as ONDC plans to charge network fees of Rs 1.5 from April 1 on transactions above Rs 250 through seller apps.

There has also been a stagnation of orders, NPs said. In November, the network facilitated 14.45 million transactions, up from 13.9 million in October, a marginal rise. Out of the 14.45 million orders, mobility accounted for 6.6 million and the rest numbered 7.7 million.

ONDC response

“In December last year, ONDC clocked 4.9 lakh transactions per day which grew to 5 lakh transactions per day in January this year,” an ONDC spokesperson told ET. “In November last year, it was clocking 4.8 lakh transactions per day.”

While there are no exact numbers on daily or monthly transactions on the leading platforms, according to information available, Flipkart can handle a high volume, reaching up to 95 million per second during peak events such as the Big Billion Days sale. Amazon currently has more than 100 million registered users and sells around 168 million products to Indian customers, with more than 1 million sellers actively using the platform.

The NP cited earlier said, “Brands now have access to different channels for sales--D2C, quick commerce, and traditional marketplaces like Amazon, and Flipkart. ONDC as a channel needs to find significance.”

Food and beverage is the only segment that seems to work on the platform, NPs said.

“F&B is the only category where there is a market fit for ONDC. There is no other category where there are signs of market fit except maybe mobility. We have already finished two to three years of journey but we’re still not able to answer why you would buy a product on ONDC rather than Amazon or Flipkart,” said the first NP cited. “The answer is not clear to anyone. The argument of it being cheap on ONDC doesn’t hold good. It’s the same price on the ecommerce giants too.”

Asked why demand generation is low, the NP said, “It is not the focus of any buyer apps to drive demand. Other than Ola and Namma Yatri, nobody is successful in this.”

ONDC told ET that on the buyer side, more than 20 NPs generate on average more than 1,000 orders per day with around 12 having more than 20,000 transactions per day. On the seller side, the transactions are more widely spread, with more than 30 NPs generating significant daily transactions.

It further said that being a network, NPs have diverse business models--be it in the verticals they operate, roles they play, or the unique value proposition--with many of them like magicpin, Growth Falcon, Uengage, Ola, Namma Yatri, Chartr growing several-fold and “a few of them being laggards with stagnant transaction levels.”

ONDC is an attempt at democratising ecommerce that has never been attempted anywhere else in the world, the network told ET.

“At the same time, ONDC has, and will continue to experiment with and adopt, toolkits from the current ecommerce ecosystem, and test them in an open network environment,” it said. “We strongly believe that the network has to grow by means of the collective support by the ecosystem partners and not by ballooning financial freebies.”

The flagbearers

NPs in the F&B sector however said they only rely on ONDC for growth in transaction volumes.

“We’re almost close to breaking even. In April-May last year, we used to do 200-300 orders per day. Now we do 15x to 20x of those orders. We’re completely ONDC-focussed,” said Girish Pai, chief executive of Growth Falcons, a seller app in the F&B sector. “All our orders come from the ONDC buyer apps. We don’t have orders coming from outside. ONDC is an alternative to the existing duopoly in the market, which even the Bruhath Bangalore Hotels Association that we work with feel. We charge 7.5% commission. The two major food aggregators charge at least 23%.”

Ola Consumer has announced the pan-India expansion of Ola Food and its logistics services in 100 cities and 4,000 pin codes, said Kapish Malhotra, head, commerce, Ola Consumer. Ola is among the top two demand generators on ONDC in F&B.

“We have 20% of Bengaluru’s F&B market share. Ola Dash contributes to 10% of this. We’re fully ONDC, be it food delivery, groceries or logistics. We’re 100% committed to building our commerce stack on ONDC to the extent that our last-mile logistics services are offered only to players on ONDC,” he said. “We have a 75% market share in ONDC last-mile logistics with the largest two-wheeler fleet in India. We have about five lakh monthly active riders on ONDC logistics fleet.”

To be sure, Ola Cabs is not part of the ONDC buyer ecosystem.

The network told ET that it has 17 logistics providers that support significant volumes of both inter-city and intra-city deliveries.

“ONDC is a great concept and holds great promise but the actual experience for sellers and buyers still has a long way to go,” said Rahul Mathur, part of the investment team at venture capital firm DeVC. “Seller apps must do heavy lifting to onboard new sellers. Local kirana stores that have stock keeping units (SKUs) and record inventory levels offline need to key in each of the SKUs into the seller app and upload photos.”

It would be better if either the seller apps or ONDC provided an inventory master listing that included stock images, pre-defined product weights and pre-defined product categories for standard products, he said.

“The user experience has scope for improvement as well,” Mathur said. “The logical in-app buying experience is to select the item and then the store. But with ONDC, on a buyer app, for example, Pai Platforms, one selects the store and then an item. Also, customers cannot choose between different product weights in ONDC stores. This can either be fixed by ONDC or the buyer apps.”

Delhi Elections Live

Tax calculator

ONDC commenced its pilot in April 2022 to counter the dominance of ecommerce platforms such as Amazon and Flipkart and break the hold of aggregators like Swiggy and Zomato in the food and beverage space. The network was meant to get traditional players, excluded from the ecommerce transformation, gain salience in the online world.

These included neighbourhood stores, home enterprises, artisans and vendors who hadn’t digitised their wares nor had the wherewithal to pay commissions to ecommerce sites. ONDC expanded nationwide with grocery, mobility and food offerings in January 2023. It achieved a cumulative 173.5 million transactions on January 31.

Some network participants said that breaking even on ONDC orders seems to get farther every year and that they have reduced the number of people working on these transactions by a fourth. Even if the commission is less than that charged by the big players, the scale is not enough to make money, they said.

ONDC delayed imposing a network fee from January to April citing “feedback from sellers.” Others, however, swear by its great potential to break the monopoly of large players such as Amazon, Flipkart, Zomato and Swiggy. Officials also said that ONDC is growing despite lacking the marketing muscle of large brands and having almost zero advertisement spend.

Seller woes

“There is no chance of breaking even in the next two years, at least from the current demand. We had 14 people working at the peak of ONDC orders, currently we have five people,” said an NP, adding that the unit is unable to cover salaries with the current demand.

Another said the issue is one of scale.

“The NPs are custodians of single-digit percentage commissions which is not even north of 10%--it is 5% on the buyer side and 2% on the seller side,” the person said. “Until ONDC scales, it is not going to make financial success for any NP. Even the buyer apps have been burning money. Despite the commission, they spend more.”

Seller commissions alone can’t achieve breakeven, said the first NP cited above, even as ONDC plans to charge network fees of Rs 1.5 from April 1 on transactions above Rs 250 through seller apps.

There has also been a stagnation of orders, NPs said. In November, the network facilitated 14.45 million transactions, up from 13.9 million in October, a marginal rise. Out of the 14.45 million orders, mobility accounted for 6.6 million and the rest numbered 7.7 million.

ONDC response

“In December last year, ONDC clocked 4.9 lakh transactions per day which grew to 5 lakh transactions per day in January this year,” an ONDC spokesperson told ET. “In November last year, it was clocking 4.8 lakh transactions per day.”

While there are no exact numbers on daily or monthly transactions on the leading platforms, according to information available, Flipkart can handle a high volume, reaching up to 95 million per second during peak events such as the Big Billion Days sale. Amazon currently has more than 100 million registered users and sells around 168 million products to Indian customers, with more than 1 million sellers actively using the platform.

The NP cited earlier said, “Brands now have access to different channels for sales--D2C, quick commerce, and traditional marketplaces like Amazon, and Flipkart. ONDC as a channel needs to find significance.”

Food and beverage is the only segment that seems to work on the platform, NPs said.

“F&B is the only category where there is a market fit for ONDC. There is no other category where there are signs of market fit except maybe mobility. We have already finished two to three years of journey but we’re still not able to answer why you would buy a product on ONDC rather than Amazon or Flipkart,” said the first NP cited. “The answer is not clear to anyone. The argument of it being cheap on ONDC doesn’t hold good. It’s the same price on the ecommerce giants too.”

Asked why demand generation is low, the NP said, “It is not the focus of any buyer apps to drive demand. Other than Ola and Namma Yatri, nobody is successful in this.”

ONDC told ET that on the buyer side, more than 20 NPs generate on average more than 1,000 orders per day with around 12 having more than 20,000 transactions per day. On the seller side, the transactions are more widely spread, with more than 30 NPs generating significant daily transactions.

It further said that being a network, NPs have diverse business models--be it in the verticals they operate, roles they play, or the unique value proposition--with many of them like magicpin, Growth Falcon, Uengage, Ola, Namma Yatri, Chartr growing several-fold and “a few of them being laggards with stagnant transaction levels.”

ONDC is an attempt at democratising ecommerce that has never been attempted anywhere else in the world, the network told ET.

“At the same time, ONDC has, and will continue to experiment with and adopt, toolkits from the current ecommerce ecosystem, and test them in an open network environment,” it said. “We strongly believe that the network has to grow by means of the collective support by the ecosystem partners and not by ballooning financial freebies.”

The flagbearers

NPs in the F&B sector however said they only rely on ONDC for growth in transaction volumes.

“We’re almost close to breaking even. In April-May last year, we used to do 200-300 orders per day. Now we do 15x to 20x of those orders. We’re completely ONDC-focussed,” said Girish Pai, chief executive of Growth Falcons, a seller app in the F&B sector. “All our orders come from the ONDC buyer apps. We don’t have orders coming from outside. ONDC is an alternative to the existing duopoly in the market, which even the Bruhath Bangalore Hotels Association that we work with feel. We charge 7.5% commission. The two major food aggregators charge at least 23%.”

Ola Consumer has announced the pan-India expansion of Ola Food and its logistics services in 100 cities and 4,000 pin codes, said Kapish Malhotra, head, commerce, Ola Consumer. Ola is among the top two demand generators on ONDC in F&B.

“We have 20% of Bengaluru’s F&B market share. Ola Dash contributes to 10% of this. We’re fully ONDC, be it food delivery, groceries or logistics. We’re 100% committed to building our commerce stack on ONDC to the extent that our last-mile logistics services are offered only to players on ONDC,” he said. “We have a 75% market share in ONDC last-mile logistics with the largest two-wheeler fleet in India. We have about five lakh monthly active riders on ONDC logistics fleet.”

To be sure, Ola Cabs is not part of the ONDC buyer ecosystem.

The network told ET that it has 17 logistics providers that support significant volumes of both inter-city and intra-city deliveries.

“ONDC is a great concept and holds great promise but the actual experience for sellers and buyers still has a long way to go,” said Rahul Mathur, part of the investment team at venture capital firm DeVC. “Seller apps must do heavy lifting to onboard new sellers. Local kirana stores that have stock keeping units (SKUs) and record inventory levels offline need to key in each of the SKUs into the seller app and upload photos.”

It would be better if either the seller apps or ONDC provided an inventory master listing that included stock images, pre-defined product weights and pre-defined product categories for standard products, he said.

“The user experience has scope for improvement as well,” Mathur said. “The logical in-app buying experience is to select the item and then the store. But with ONDC, on a buyer app, for example, Pai Platforms, one selects the store and then an item. Also, customers cannot choose between different product weights in ONDC stores. This can either be fixed by ONDC or the buyer apps.”