Global ecommerce platform Shein knows the pulse of the Indian market. What makes us say this? Well, it has a knack for entering India just at the right time. It is this unique ability of the platform that helped it make a fortune capitalising on India’s booming fashion ecommerce sector in 2018, attracting millennial shoppers looking for trendy, budget-friendly clothing.

After a five-year absence, following its ban in the country in 2020, Shein is back to cash in on the fast fashion boom, which is currently outpacing traditional fashion segments.

However, this time, Shein’s return is different from its earlier stint in India as Reliance Retail is overseeing the entire operation, from supply chain logistics to data security, to address the concerns that led to Shein’s original ban.

Reliance Retail, , has taken nearly two years to bring the brand back. Without any formal announcement, the company has now launched Shein as a standalone app, initially available in New Delhi, Mumbai, and Bengaluru, with plans for a nationwide rollout in the coming months.

Now, as to dominate India’s fast-fashion market, the question is how much it can cash in on Shein’s past glory.

While Shein claims on its app that ‘The OG is back’ and is wooing shoppers with free shipping and a no-questions-asked return policy, Indian consumers have evolved in the last five years.

Besides, while homegrown brands like Zudio, NEWME, and many other smaller D2C brands have already created strong brand recall among consumers, bigger players like Zara and H&M had enough time to flourish during Shein’s years of exile. Amid this, industry experts have opined that winning its market back won’t be a walk in the park.

While the launch of Shein impacted the shares of Trent, the parent company of Zudio, foreign brokerage Goldman Sachs said that the investors might be overestimating competitive threats.

Growth Hurdles For Shein’s Online-Only ModelAccording to an Elara Capital report, contrary to most fast fashion firms in the country, Shein has made an online-first debut. What this means is that Shein is directly competing with many other fast fashion brands on ecommerce platforms, which could lead to aggressive discounting and price wars.

Moreover, fast fashion typically has lower average selling prices (ASP) compared to mid-premium brands, which could make it hard for Shein to achieve profitability, and how can we forget high return rates (30 to 40%), which increase logistics costs and strain unit economics.

“The unit economics of online-only value fashion retail are weak. The average transaction value of a typical value apparel retailer is typically around the INR 1,000 mark or below and is very sticky at those levels, and typical gross margins are 30-40%, and the delivery costs are typically INR 120-130 per order irrespective of order value,” Goldman Sachs said in its report.

Besides, in fast fashion, shoppers often prefer to see and feel products before buying. Without a physical presence, Shein may take longer to build trust and convince customers about quality and fit.

Building A Local Supply Chain

In its report, Goldman Sachs mentions that the relaunch of Shein has been allowed by the Indian government on the condition that it will source all products only from India and make sure that all consumer data remains in India.

“…it takes several years to set up a value fast fashion supply chain before sales can meaningfully scale up,” it said.

An Elara Capital report, too, noted that fast fashion operates at a lower design-to-inventory cycle and needs a strong supply chain network, and establishing a reliable pan-India supply chain and delivery model could take one to two years.

Moving on, as per Elara Capital, Shein’s product assortment and styling resembles Zudio. However, the only difference is that Zudio is more competitively priced.

“Zudio with its unique fashion maintains a price moat and operates only below INR 999 in most cases, driven by an established supply chain network. Shein may also not pose competition for Nykaa Fashion, due to its higher average order value (AOV) of INR 4,000-5,000,” it added.

According to experts, managing product assortment effectively will be a major challenge for Shein, especially in comparison to dominant players like Zudio. Therefore, pricing and unit economics will play a crucial role in its success.

Threat From D2C Brands?

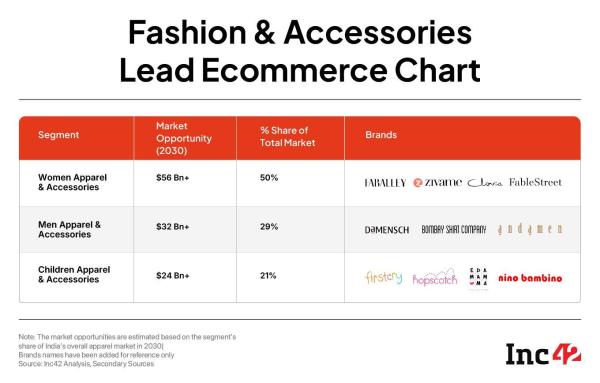

Besides major corporate brands, Shein will also face competition from numerous D2C players. The D2C fashion landscape is already crowded with brands like Fable Street, The Souled Store, and Bonkers Corner, presenting a direct challenge to Shein. Additionally, brand aggregators such as Mensa Brands and TMRW house multiple fashion labels across various categories, further intensifying competition.

“For all those who think that “the OG is back”, yes, it is, but Indian consumers have changed and homegrown brands like Zudio Trent Limited, NEWME and many others will thrive with this intense competition and whoever wins in execution and customer love will remain relevant to the consumers,” NEWME founder Sumit Jasoria wrote in a LinkedIn post.

Hence, standing out in this market won’t be easy, and Shein will have to carve out its place amid a highly competitive landscape. Therefore, to thrive, Shein needs to do more than just relaunch. It must rebuild trust, differentiate its offerings, and deliver consistently on price, quality, and convenience.

[Edited by Shishir Parasher]

The post appeared first on .