Mumbai-based investment technology platform ArthAlpha has raised $2 Mn (INR 17.5 Cr) in a funding round led by DSP, along with participation from a host of undisclosed family offices and wealth managers.

The platform plans to deploy the fresh proceeds to advance its AI-powered research tools, scale up data infrastructure and expand portfolio management services.Besides, it aims to develop a quantitative investment research platform for other investment firms.

“By combining cutting-edge AI with investment management, they are not just improving how investment decisions are made; they are reshaping the entire landscape,” said Aditi Kothari, vice chairperson at DSP Mutual Fund.

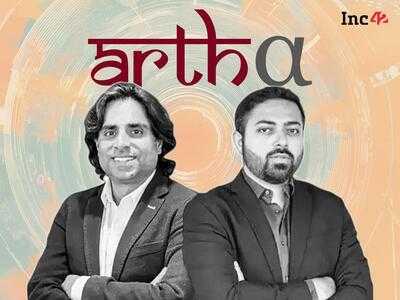

Founded by Rohit Beri and Rohit Jha, in 2024, ArthAlpha specialises in portfolio management services and AI-driven investment research.

“This funding is more than just a financial boost. With our investors’ support, we are accelerating the development of our AI-driven investment research platform to deliver smarter, more personalised insights and strategies,” Beri said.

The startup competes with several tech-driven investment platforms including 5paisa, Angel One, Axis Securities, Groww, Svatantra, Veritas Finance and Rang De in India’s rapidly evolving wealthtech sector.

The funding comes at a time when AI startups in India are gaining traction from a lot of investors.

Last month, Gurugram-based in a seed funding round led by Powerhouse Ventures. The B2B procurement platform claims to have turned profitable within 18 months of operations, reaching INR 300 Cr in annual recurring revenue.

In the same month, Bengaluru-based led by Arali Ventures to develop autonomous AI agents for mobile app testing.

Also, Mumbai-based edtech platform in Pre-Series A funding led by ah! Ventures. The startup claims to be 35% EBITDA profitable and 20% PAT profitable.

According to have raised over $600 Mn since 2019, with the GenAI market projected to cross $17 Bn by 2030. The surge in funding indicates growing investor confidence in AI-driven solutions across sectors, from investment management to procurement and quality assurance.

The post appeared first on .