Tata Sons is main pillar of Tata Group, its main source of income is…., know everything about Tata Group before putting your money in Tata Sons IPO?

GH News February 26, 2025 12:06 AM

Tata Sons IPO: In a welcome news for those interested in stock market the long-standing speculation has finally ended. While the Tata name alone might tempt you to invest in the Tata Sons IPO understanding the companys role and revenue sources will help you take the decisions in a better way. As the backbone of the Tata empire its IPO marks a significant milestone. Before investing its essential to analyze its financials growth prospects and market impact to make an informed choice.

Tata Sons is the principal investment holding company and promoter of Tata companies. 66% of the equity share capital of Tata Sons is held by philanthropic trusts which support education health livelihood generation and art and culture.

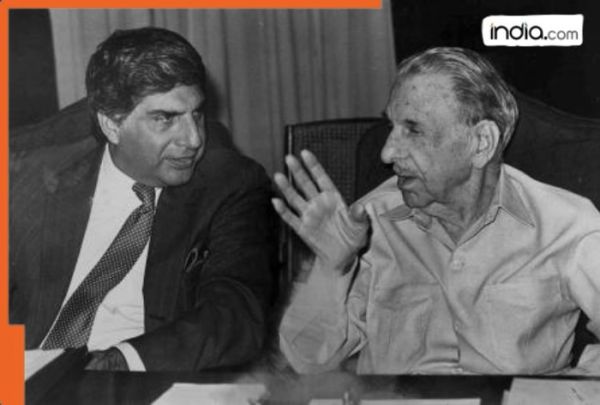

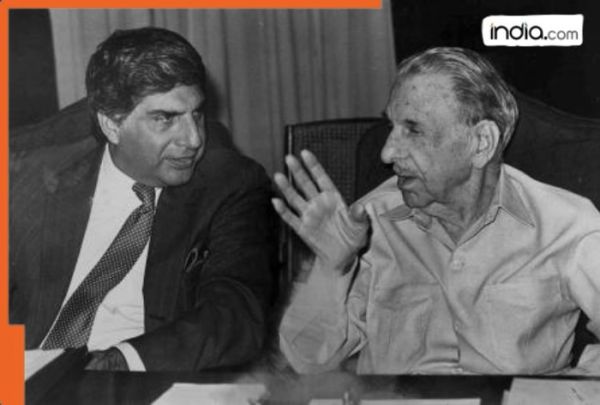

“The Tata philosophy of management has always been and is today more than ever that corporate enterprises must be managed not merely in the interests of their owners but equally in those of their employees of the consumers of their products of the local community and finally of the country as a whole.” JRD Tata said about the philosophy of Tata sons.

About Tata Group

The most unique and interesting thing about Tata Group is that it has more than 100 companies working in seven different business sectors covering operations in more than 100 countries in 6 continents.

Revenue sources of The Tata Group activities includes communication IT engineering products services energy consumer products and chemical companies. Tata Group has famous ventures like Tata Chemicals Tata Communication TCS Tata Elxsi Tata Global Beverages Tata Investment Corporation Tata Motors Tata Power Tata Steel Titan Trent and Voltas.

SIDBI signs MoU with Tata Capital Limited to strengthen financing avenues for MSMEs

Small Industries Development Bank of India (SIDBI) and Tata Capital Limited (TCL) signed an MoU for Partnership for financing MSMEs a release said on Tuesday.

According to SIDBI the focus is on the growth and development of the MSME ecosystem by way of providing funding avenues in the field of machinery/equipment financing working capital/CC/OD/business loans and loans against property etc.

Further risk sharing/ co-lending/ joint financing shall also be explored while extending credit facilities to MSMEs.

(With inputs from agencies)

Tata Sons IPO: In a welcome news for those interested in stock market the long-standing speculation has finally ended. While the Tata name alone might tempt you to invest in the Tata Sons IPO understanding the companys role and revenue sources will help you take the decisions in a better way. As the backbone of the Tata empire its IPO marks a significant milestone. Before investing its essential to analyze its financials growth prospects and market impact to make an informed choice.

Tata Sons is the principal investment holding company and promoter of Tata companies. 66% of the equity share capital of Tata Sons is held by philanthropic trusts which support education health livelihood generation and art and culture.

“The Tata philosophy of management has always been and is today more than ever that corporate enterprises must be managed not merely in the interests of their owners but equally in those of their employees of the consumers of their products of the local community and finally of the country as a whole.” JRD Tata said about the philosophy of Tata sons.

About Tata Group

The most unique and interesting thing about Tata Group is that it has more than 100 companies working in seven different business sectors covering operations in more than 100 countries in 6 continents.

Revenue sources of The Tata Group activities includes communication IT engineering products services energy consumer products and chemical companies. Tata Group has famous ventures like Tata Chemicals Tata Communication TCS Tata Elxsi Tata Global Beverages Tata Investment Corporation Tata Motors Tata Power Tata Steel Titan Trent and Voltas.

SIDBI signs MoU with Tata Capital Limited to strengthen financing avenues for MSMEs

Small Industries Development Bank of India (SIDBI) and Tata Capital Limited (TCL) signed an MoU for Partnership for financing MSMEs a release said on Tuesday.

According to SIDBI the focus is on the growth and development of the MSME ecosystem by way of providing funding avenues in the field of machinery/equipment financing working capital/CC/OD/business loans and loans against property etc.

Further risk sharing/ co-lending/ joint financing shall also be explored while extending credit facilities to MSMEs.

(With inputs from agencies)

Tata Sons IPO: In a welcome news for those interested in stock market the long-standing speculation has finally ended. While the Tata name alone might tempt you to invest in the Tata Sons IPO understanding the companys role and revenue sources will help you take the decisions in a better way. As the backbone of the Tata empire its IPO marks a significant milestone. Before investing its essential to analyze its financials growth prospects and market impact to make an informed choice.

Tata Sons is the principal investment holding company and promoter of Tata companies. 66% of the equity share capital of Tata Sons is held by philanthropic trusts which support education health livelihood generation and art and culture.

“The Tata philosophy of management has always been and is today more than ever that corporate enterprises must be managed not merely in the interests of their owners but equally in those of their employees of the consumers of their products of the local community and finally of the country as a whole.” JRD Tata said about the philosophy of Tata sons.

About Tata Group

The most unique and interesting thing about Tata Group is that it has more than 100 companies working in seven different business sectors covering operations in more than 100 countries in 6 continents.

Revenue sources of The Tata Group activities includes communication IT engineering products services energy consumer products and chemical companies. Tata Group has famous ventures like Tata Chemicals Tata Communication TCS Tata Elxsi Tata Global Beverages Tata Investment Corporation Tata Motors Tata Power Tata Steel Titan Trent and Voltas.

SIDBI signs MoU with Tata Capital Limited to strengthen financing avenues for MSMEs

Small Industries Development Bank of India (SIDBI) and Tata Capital Limited (TCL) signed an MoU for Partnership for financing MSMEs a release said on Tuesday.

According to SIDBI the focus is on the growth and development of the MSME ecosystem by way of providing funding avenues in the field of machinery/equipment financing working capital/CC/OD/business loans and loans against property etc.

Further risk sharing/ co-lending/ joint financing shall also be explored while extending credit facilities to MSMEs.

(With inputs from agencies)