The Department of Telecommunications (DoT) is considering a plan to allow the surrender of spectrum acquired in auctions before 2022, a move that would allow Vodafone Idea to save an estimated ₹40,000 crore by returning excess airwaves, bolstering its viability. DoT has discussed the matter internally and with company executives, said people in the know.

“Any decision on the issue will be taken after analysing the legalities and viewpoints of all players,” said an official.

The latest proposal is part of measures the government has taken—or is considering—to underline its intent of ensuring a competitive sector with three healthy private players—Reliance Jio, Bharti Airtel and Vodafone Idea—along with state-run Bharat Sanchar Nigam Ltd (BSNL), officials said.

While the policy of spectrum surrender will be applicable to all telcos, it will benefit loss-making Vodafone Idea the most as larger rivals Bharti Airtel and Reliance Jio have prepaid most of their past dues toward airwave purchases. The joint venture between UK’s Vodafone Group Plc and Aditya Birla Group’s Idea Cellular could use the opportunity to surrender excess airwaves and reduce annual payments.

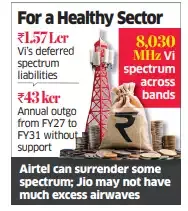

Vodafone Idea’s dues to the government from spectrum purchases amount to ₹1.57 lakh crore, most of it for airwaves acquired before 2022. Analysts expect the company can save about ₹40,000 crore and reduce annual payments if it returns some of the spectrum.

As things stand, once the four-year moratorium ends in September, the company has to pay over ₹28,500 crore in FY26 and nearly ₹43,000 crore from FY27 until FY31, analysts estimate. Vi’s cash and bank balances stood at ₹12,090 crore at the end of December.

The telco has 8,030 MHz of spectrum across several bands and says it has the most airwaves per million subscribers in the industry. Experts said Airtel could have some excess spectrum (2G and 3G) that could be surrendered. But since the Sunil Mittal-led company might have prepaid the amount, it won’t be helpful if there is no refund policy. The official cited above said DoT isn’t considering refunds in the event of spectrum surrender.

Reliance Jio, which entered the market in 2016, will not have too much spectrum that can be surrendered, added another analyst. In June 2022, the DoT issued guidelines for surrender of spectrum acquired in auctions after that year, following a series of policy changes aimed at helping the industry.

Under those rules, spectrum can be surrendered after 10 years if acquired in auctions conducted after 2022.

“Spectrum acquired prior to the date of issue of these guidelines, either through auction or any other permitted means of acquisition, would not be eligible for surrender,” the guidelines noted.

That cutoff is now up for review.

“The department is now considering applying the policy of spectrum surrender acquired before 2022,” an official said.

The government recently cleared a proposal to waive the need for bank guarantees, which primarily benefited Vodafone Idea. Following that change, the telco is no longer required to submit guarantees worth ₹24,800 crore, opening up space for lenders to extend debt to the carrier.

The government currently holds 22.56% in Vi, with Vodafone Group Plc holding 24.39% and the Aditya Birla Group (ABG) just over 14%.

In addition, the Centre is also considering relief for adjusted gross revenue (AGR) dues worth over Rs 1 lakh crore, ET reported January 18. That would lower Vi’s AGR dues by over ₹52,000 crore, those of Bharti Airtel by nearly ₹38,000 crore, and that of Tata Teleservices by around ₹14,000 crore. Reliance Jio doesn’t have any legacy AGR dues and is not affected by the proposed measure. Tata Tele no longer offers retail mobility services, only enterprise mobility services.

As per industry estimates, Vi’s latest AGR dues till March 2025 could be ₹80,000-85,000 crore. They would amount to ₹42,000-44,000 crore for Bharti and ₹17,000- 19,000 crore for Tata Teleservices.

In the September 2021 reforms, the government allowed a four-year moratorium on the payment of AGR and other statutory dues. The moratorium ends September 2025. Thereafter, the deferred payment cycle will start in 2026 and run till 2031 with 10% to be paid by March 31 every year.

Trump-Modi Meet

The mega MIGA, MAGA plans of India's Modi and US' Trump

Trump says India has more tariffs than others

Trump's 'golden rule' for imposing reciprocal tariffs

The latest proposal is part of measures the government has taken—or is considering—to underline its intent of ensuring a competitive sector with three healthy private players—Reliance Jio, Bharti Airtel and Vodafone Idea—along with state-run Bharat Sanchar Nigam Ltd (BSNL), officials said.

While the policy of spectrum surrender will be applicable to all telcos, it will benefit loss-making Vodafone Idea the most as larger rivals Bharti Airtel and Reliance Jio have prepaid most of their past dues toward airwave purchases. The joint venture between UK’s Vodafone Group Plc and Aditya Birla Group’s Idea Cellular could use the opportunity to surrender excess airwaves and reduce annual payments.

Vodafone Idea’s dues to the government from spectrum purchases amount to ₹1.57 lakh crore, most of it for airwaves acquired before 2022. Analysts expect the company can save about ₹40,000 crore and reduce annual payments if it returns some of the spectrum.

As things stand, once the four-year moratorium ends in September, the company has to pay over ₹28,500 crore in FY26 and nearly ₹43,000 crore from FY27 until FY31, analysts estimate. Vi’s cash and bank balances stood at ₹12,090 crore at the end of December.

The telco has 8,030 MHz of spectrum across several bands and says it has the most airwaves per million subscribers in the industry. Experts said Airtel could have some excess spectrum (2G and 3G) that could be surrendered. But since the Sunil Mittal-led company might have prepaid the amount, it won’t be helpful if there is no refund policy. The official cited above said DoT isn’t considering refunds in the event of spectrum surrender.

Reliance Jio, which entered the market in 2016, will not have too much spectrum that can be surrendered, added another analyst. In June 2022, the DoT issued guidelines for surrender of spectrum acquired in auctions after that year, following a series of policy changes aimed at helping the industry.

Under those rules, spectrum can be surrendered after 10 years if acquired in auctions conducted after 2022.

“Spectrum acquired prior to the date of issue of these guidelines, either through auction or any other permitted means of acquisition, would not be eligible for surrender,” the guidelines noted.

That cutoff is now up for review.

“The department is now considering applying the policy of spectrum surrender acquired before 2022,” an official said.

The government recently cleared a proposal to waive the need for bank guarantees, which primarily benefited Vodafone Idea. Following that change, the telco is no longer required to submit guarantees worth ₹24,800 crore, opening up space for lenders to extend debt to the carrier.

The government currently holds 22.56% in Vi, with Vodafone Group Plc holding 24.39% and the Aditya Birla Group (ABG) just over 14%.

In addition, the Centre is also considering relief for adjusted gross revenue (AGR) dues worth over Rs 1 lakh crore, ET reported January 18. That would lower Vi’s AGR dues by over ₹52,000 crore, those of Bharti Airtel by nearly ₹38,000 crore, and that of Tata Teleservices by around ₹14,000 crore. Reliance Jio doesn’t have any legacy AGR dues and is not affected by the proposed measure. Tata Tele no longer offers retail mobility services, only enterprise mobility services.

As per industry estimates, Vi’s latest AGR dues till March 2025 could be ₹80,000-85,000 crore. They would amount to ₹42,000-44,000 crore for Bharti and ₹17,000- 19,000 crore for Tata Teleservices.

In the September 2021 reforms, the government allowed a four-year moratorium on the payment of AGR and other statutory dues. The moratorium ends September 2025. Thereafter, the deferred payment cycle will start in 2026 and run till 2031 with 10% to be paid by March 31 every year.