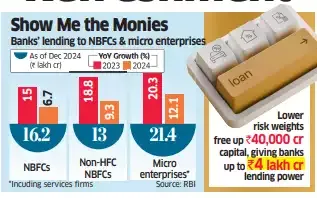

The Reserve Bank of India (RBI) made it easier for banks to give micro loans, as well as lend to non-banking finance companies (NBFCs) and microfinance institutions (MFIs), by freeing up capital to increase liquidity, improve credit flows and bolster growth.

The regulator lowered the capital that banks need to assign against such loans, among the steps it took on Tuesday.

It restored risk weight on loans to NBFCs effective April 1, and that on microfinance lenders and borrowers with immediate effect.

This is the regulator’s second action in less than a month to support growth, having lowered the policy rate by 25 basis points to 6.25% on February 7.

The reduction in risk weights will free up about ₹40,000 crore capital, which would mean banks can lend up to ₹4 lakh crore to AAA-rated companies, said an executive at a large commercial bank.

In November 2023, to dissuade banks from lending to NBFCs and microfinancers, RBI had raised the risk weight from 100% to 125%. The action was to restrict unsecured loans, which had risen 25% in October 2023, over the previous year.

The central bank also reduced the risk weight on bank micro loans to 75%, while loans given for consumption will attract 100% risk weight. Earlier, banks with significant microfinance exposure needed to assign 125% risk weight after being instructed accordingly by the regulator.

The return to the old risk weight indicates that the potential risk associated with unsecured loans has subsided, said Sadaf Sayeed, chief executive at Muthoot Microfin. “RBI’s temporary measures have worked well, and it is time to focus on prudent growth," he said.

The move will benefit not just NBFCs and MFIs but also banks.

Bandhan Bank will benefit the most since a fourth of its portfolio will now attract 75% risk weight instead of 125%.

“Overall, the NBFC pack and SBI Card are expected to be the biggest gainers, as their margins are likely to improve with lower borrowing costs,” said Akshay Tiwari, a banking analyst at Asit C Mehta Investment Intermediates. “Typically, NBFCs borrow from banks and lend to end consumers. With reduced risk weights, banks are expected to offer lower interest rates to NBFCs, thereby bringing down their cost of funds.”

RBI had raised the risk weight on finance companies and microcredit amid concerns over a surge in small personal loans, but certain categories such as housing loans had been excluded. “The higher risk weights for over a year hit smaller NBFCs because bank funding became more expensive for them,” said YS Chakravarti, managing director at Shriram Finance. “Larger NBFCs like us had to keep excess liquidity to ensure funding was not a challenge. Now, with lower risk weights, access to funds will improve for the sector.”

The central bank has taken the measures due to a significant slowdown in bank credit to NBFCs in the current fiscal year, tighter market liquidity in general, and to prioritise credit flow to under-served segments for growth, said AM Karthik, senior vice-president of financial sector ratings at Icra.

Trump-Modi Meet

The mega MIGA, MAGA plans of India's Modi and US' Trump

Trump says India has more tariffs than others

Trump's 'golden rule' for imposing reciprocal tariffs

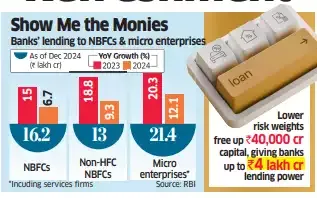

It restored risk weight on loans to NBFCs effective April 1, and that on microfinance lenders and borrowers with immediate effect.

This is the regulator’s second action in less than a month to support growth, having lowered the policy rate by 25 basis points to 6.25% on February 7.

The reduction in risk weights will free up about ₹40,000 crore capital, which would mean banks can lend up to ₹4 lakh crore to AAA-rated companies, said an executive at a large commercial bank.

In November 2023, to dissuade banks from lending to NBFCs and microfinancers, RBI had raised the risk weight from 100% to 125%. The action was to restrict unsecured loans, which had risen 25% in October 2023, over the previous year.

The central bank also reduced the risk weight on bank micro loans to 75%, while loans given for consumption will attract 100% risk weight. Earlier, banks with significant microfinance exposure needed to assign 125% risk weight after being instructed accordingly by the regulator.

The return to the old risk weight indicates that the potential risk associated with unsecured loans has subsided, said Sadaf Sayeed, chief executive at Muthoot Microfin. “RBI’s temporary measures have worked well, and it is time to focus on prudent growth," he said.

The move will benefit not just NBFCs and MFIs but also banks.

Bandhan Bank will benefit the most since a fourth of its portfolio will now attract 75% risk weight instead of 125%.

“Overall, the NBFC pack and SBI Card are expected to be the biggest gainers, as their margins are likely to improve with lower borrowing costs,” said Akshay Tiwari, a banking analyst at Asit C Mehta Investment Intermediates. “Typically, NBFCs borrow from banks and lend to end consumers. With reduced risk weights, banks are expected to offer lower interest rates to NBFCs, thereby bringing down their cost of funds.”

RBI had raised the risk weight on finance companies and microcredit amid concerns over a surge in small personal loans, but certain categories such as housing loans had been excluded. “The higher risk weights for over a year hit smaller NBFCs because bank funding became more expensive for them,” said YS Chakravarti, managing director at Shriram Finance. “Larger NBFCs like us had to keep excess liquidity to ensure funding was not a challenge. Now, with lower risk weights, access to funds will improve for the sector.”

The central bank has taken the measures due to a significant slowdown in bank credit to NBFCs in the current fiscal year, tighter market liquidity in general, and to prioritise credit flow to under-served segments for growth, said AM Karthik, senior vice-president of financial sector ratings at Icra.