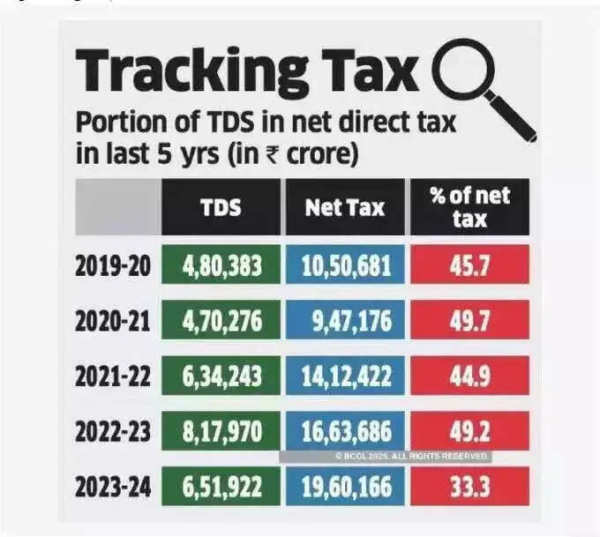

The Income Tax Department is gearing up to launch a nationwide crackdown on tax defaulters. With the recent budget announcement making income up to ₹12 lakh per year tax-free (effective from the next financial year), authorities are now focusing on taxpayers who have failed to comply with TDS (Tax Deducted at Source) and TCS (Tax Collected at Source) regulations. The department has identified nearly 40,000 taxpayers under scrutiny for potential violations.

Officials have confirmed that the Central Board of Direct Taxes (CBDT) has prepared a 16-point strategy to tackle TDS/TCS defaulters. The campaign will target individuals and companies that have either not deducted or not deposited TDS/TCS correctly during the financial years 2022-23 and 2023-24.

The department’s data analytics team has compiled a detailed list of offenders, enabling authorities to take necessary action.

A senior tax official explained the investigation approach, stating:

The Income Tax Act, particularly Section 40(a)(ia), states that deductions will not be allowed if TDS has not been properly deducted or deposited with the government.

Additionally, tax officers will closely examine:

However, officials have assured that genuine taxpayers will not be unnecessarily harassed, unlike previous enforcement campaigns.

The Union Budget 2025 has introduced reforms to simplify TDS compliance:

These changes aim to make tax compliance easier while ensuring that defaulters are held accountable.

A senior official clarified:

With this intensified crackdown, the government seeks to ensure a fair and transparent tax system. While law-abiding taxpayers will find compliance easier, those evading tax responsibilities will face serious consequences.

Stay tuned for further updates on income tax regulations and enforcement actions.