Licious has hoisted its sail for the D-Street voyage. With this, the Bengaluru-based startup, which almost defined and shaped the whole consumer behaviour of buying meat online over the last decade, is set to become India’s first online D2C meat brand to get listed on the mainboard.

While the Indian public market is not new to the concept of D2C, the idea of a listed D2C meat and seafood startup is as scarce as hen’s teeth. It is this notion that seems to have bode well with the D2C meat delivery unicorn for its listing ambitions.

But, does the company have enough meat to cook up a sizzling listing, and, if not, what could put it on the chopping block?

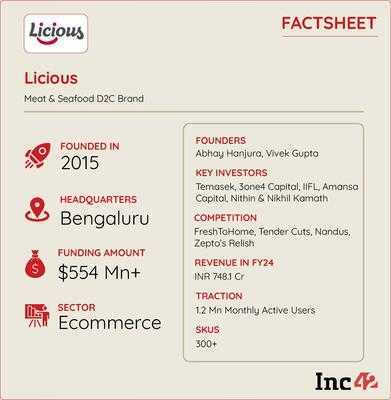

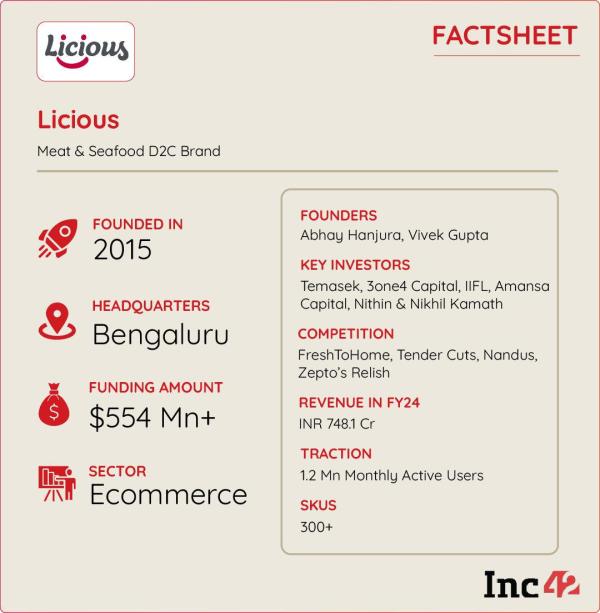

Now, before we dive deeper into answering these questions, it is important to underline that Licious dominates Indian kitchens not just in tier-I cities and towns but also tier-II. Licious started its journey in 2015 when the concept of D2C was not known to many.

The company persisted, rode the D2C wave and became a unicorn in 2023. Notably, the company uses chicken as its main bait, drawing in 40% of its revenues, while fish hooks another 30%.

Despite its unicorn wings, small meat and fish shops, ruling the roost (unorganised market) with an iron fist, pose risks to the long-term prospects of the company. Not just this, regional D2C brands like Zappfresh and Freshma are also cooking up a storm in this segment.

To cut above the rest, what aces do Licious cofounders Abhay Hanjura and Vivek Gupta have up their sleeves?

This question is crucial because the company is currently enduring growth challenges. The startup garnered operating revenues of INR 685.05 Cr in the financial year 2023-24 (FY24) against INR 748 Cr in FY23. The metric stood at INR 682.5 Cr in FY22.

Today, almost everything is available at our doorsteps within 10-30 minutes, thanks to the imminent rise of the quick commerce sector. The impact has been such that there’s hardly any sector or industry that does not want to embark on the quick commerce adventure.

Learning tricks of the trade from players like Swiggy Instamart, Zepto, and Blinkit (designed for ultra-fast deliveries), several traditional D2C brands and ecommerce platforms have joined the fast delivery race to cash in on the quick commerce boom, and Licious is no different.

Licious is working on its omnichannel game plan, and quick commerce and offline retail are going to be the two main growth levers of its larger strategy to dominate the Indian meat and seafood market.

Now, given the perishable nature of the inventory, it is natural for a brand like Licious to forge a network of dynamic and meaty supply chains and equip itself with more dark stores. This could mean burning more cash. Nevertheless, this shift is going to be quite an interesting one to watch.

However, according to Hanjura and Gupta, newer strategies like 30-minute delivery or omnichannel are only “tactical changes” that the poultry and seafood business is embracing to keep up with the evolving industry trends and market opportunities.

“As the industry changes, the brand will keep evolving, keeping the quality and standard as primary focus,” the cofounders said.

Throwing light on the aforementioned statement of omnichannel being a tactical play, he said that the company’s online and offline retail channels will be aimed at strategically addressing specific consumer behaviours for every product category.

For instance, Hanjura said, Padma Hilsa isn’t the first thing consumers would want to be delivered in 10 minutes just when they wake up in the morning. For such products, offline would make for a great bet.

As for its quick commerce play, Licious would rather bet on poultry products like fresh-cut chicken, eggs, and ready-to-cook foods such as kebabs.

“In 30 minutes delivery, we are seeing opportunity in one category — our value-added products such as the pre-marinated or ready-to-cook meats. You must identify the consumer psychology in play here, where they are looking to prepare something quick and eat,” Gupta said.

“We have a range called ‘Heat & Eat’ — food that can be cooked in two minutes. There is another range of products that can be cooked in 10-15 minutes. So, for these products, the 30-minute delivery model will add more value,” the founders added.

However, in metro cities, where people are “time-starved” (as noted by Gupta), the brand sees quick commerce opportunities spreading across products.

Taking the example of Gurugram, the founder said that Licious saw around 10% or 15% revenue growth on the back of 30-minute delivery in just one quarter with little marketing efforts.

Today, Licious claims to be driving its new business model relying on the strong production, supply chain, and last-mile delivery capabilities it has built since its inception.

Challenges & Opportunities At PlayWhile the founder did not talk about potential roadblocks, according to Sateesh Meena, the founder of Datum Intelligence, all online meat brands are currently struggling with low growth rates, perishability and high wastage, and higher pricing than local shops.

“Licious’ omnichannel strategy would help it increase its number of SKUs, cater to retail-focussed consumers, and leverage localisation while extending shelf life with ready-to-eat packaged foods. However, challenges remain. This model isn’t easily scalable pan-India due to intense local competition. They are making different bets, and we are watching which one pays off,” said Meena.

Meanwhile, if one were to look at the company from a broader lens, quick commerce is not a new road for the brand. Piggybacking on Zepto, Blinkit, and Swiggy Instamart, the startup has already been delivering its products in 10 minutes.

However, Licious will need to up its game here too. This is because 80% of its business currently happens on its platform and the remaining 20% is enabled by quick commerce players, who also have their respective meat brands in the pipeline.

Moreover, the startup’s 30-minute delivery is currently available in Gurugram only. The company plans to expand to Bengaluru soon.

In addition, in the next six months, the company has plans to make 30-minute deliveries at 80% of the areas where it counts its footprint. The startup currently commands an online presence in around 20 cities in India. It plans to grow its online footprint to 50 cities in the next few years.

On the offline retail front, Licious currently has only three stores in Bengaluru. More brick-and-mortar stores are on the cards in Mumbai and Delhi.

Moving on, Licious’ recent acquisition of My Chicken and More, a Bengaluru-based offline retailer, has been another strategic feather in its omnichannel cap.

To ensure that its omnichannel expansion and quick commerce ambitions work in tandem, Licious has plans to set up another 50 new delivery centres by June this year. It presently has 100 such centres.

Licious’ Tech AdvantageUnderstandably, this spate of expansions would come with a toll (cost), especially at a time when Licious is looking to achieve profitability within 2-3 months. Not to mention, experts see this quite paradoxical, with many even calling profitability a long shot.

According to Hanjura, Licious has a vertically integrated supply chain, which gives it the flexibility and the capability to go offline seamlessly and cost-effectively.

Besides, the cofounders said a significant amount of innovation, R&D, feed formulation and harvesting science is carried out in the backend to bring quality poultry to customers.

“This modernisation is led by microbiologists, veterinarians, and food science experts at our processing centres,” Hanjura said.

Currently, Licious owns six such processing centres across India and three other managed processing centres. These are fully automated ESG complaint centres, maintaining the highest food safety standards in the world such as FSSC 22000 and SA8000.

“We are not just the first in India to achieve these standards but also one of the first eight in the world to have SA8000 certification. This is the kind of effort we are putting in to bring 500 grammes of chicken to your doorstep,” said Hanjura.

The cofounder believes that this entire backend process is ultimately Licious’ biggest competitive advantage — separating the sheep from the goats.

“Licious is doing what Amul did to the milk and dairy industry in India,” Hanjura said.

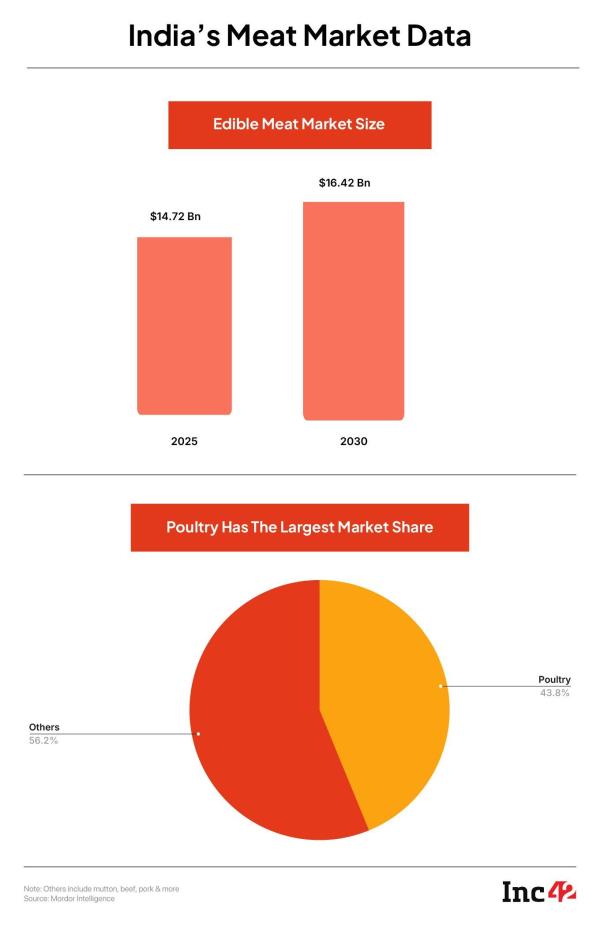

Competition On The ProwlAlong with its tech advantage, the founders see enough scope of opportunities in a market largely dominated by neighbourhood fish and poultry shops.

However, Meena feels that even though the startup’s cofounders believe that its high tech and innovation in the backend deserve a bit of a premium compared to the fish or meat available in the local market, India continues to be a cost-sensitive market.

Meena pointed out that unlike the online market where customers are ready to pay a premium for convenience, the target customers in offline retail are going to be more price-sensitive.

Though the startup takes pride in its quality, Meena advises caution on the price front as it expands offline, especially in tier-II cities.

Moving on, apart from local meat and fish shops, Licious feels heat from FreshToHome, TenderCuts (acquired by Good To Go in 2023), ChopServe (acquired by Meamo in 2021), and Meatigo (now acquired by ITC this year).

In the quick commerce space, Zepto poses a threat to Licious with its new meat brand Relish, which was launched in October 2023. In addition, the company faces tough challenges at the regional level, too, as names like continue to grow unabated in the south.

Enduring competition in the space, Licious saw an 8.4% YoY dip in FY24 revenues. Interestingly, the founders passed the buck to Swiggy, which shut down its meat delivery vertical, and .

Meanwhile, , another one of its competitors, is already profitable and going for an SME IPO soon.

Licious In A NutshellLicious is looking to get listed by 2026. The IPO processes would start next year, and the company may as well go for a pre-IPO round.

This year, the company’s main target includes achieving profitability. It aims to turn EBITDA profitable by June and fully profitable by the end of 2025. Interestingly, this would be a big leap from an INR 293.77 Cr net loss in FY24.

Notably, the company incurred the aforementioned net loss after slashing 3% of its total 3k people strong workforce as part of a restructuring exercise during the fiscal year. A few other major cost heads were also culled to reduce the cash burn.

Now, with its focus on profitability and aggressive investments in expanding its offline footprint and dark stores for quick commerce, it will be interesting to see how Licious further cuts its expenses to the bone.

Licious aims to close FY25 with 17% YoY growth in its top line, which translates to more than INR 800 Cr in revenue. Including My Chicken and More, the growth is projected to reach 25%, according to the founders.

While this may sound all rainbows and sunshine, the road ahead won’t be an easy one, especially when Licious’ table is full of challenges, including rival brands, profitability pressures, and shifting consumer preferences.

Amid this, it would be interesting to see Licious carve out its niche as India’s first D2C meat brand decking up for a mainboard listing.

[Edited by Shishir Parasher]

The post appeared first on .