It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong — American hedge fund tycoon George Soros.

On the D-Street, however, nothing is certain — making a fortune or wasting it. One day, you may find yourself riding the bull with an average Joe (stock), and the next, a sudden downturn, driven by multiple macroeconomic factors, could wipe out all the gains and bite into your initial investments.

Now, while it’s impossible to predict a market downturn, losses can be minimised by taking an opposite position in a related asset. This risk management strategy is called hedging. Simply put, this investment strategy involves trading in derivatives to offset steep losses during major market fluctuations or a market crash.

While the concept of hedging is popular in the US and other global markets, it is still in its nascency in India. The same is true for structured products — hybrid investment instruments that use derivatives to reduce risk in a trader’s portfolio.

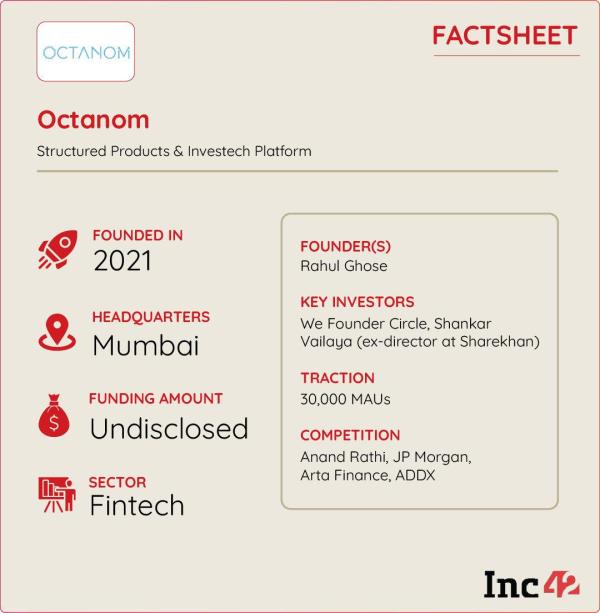

However, market analyst and expert Rahul Ghose is trying to change the hedging game in the country with . Founded in 2021, the startup claims to be pioneering India’s first ‘hedged-style’ trading platform, .

Deploying AI-ML and complex derivative equations, the platform suggests low-risk structured products to its users. This helps investors mitigate losses, even at times of peak market volatility.

Besides, Octanom’s Hedged is its first platform. The company aims to soon launch its next product – an analysis platform for traders and brokers. Expected to be launched by July this year, the new platform would lock horns with platforms like TradingView.

The startup raised an undisclosed amount of funding in 2022 at a pre-money valuation of $2.2 Mn. Besides its existing investors such as Shankar Vailaya, the ex-director of Sharekhan; Nitin Gupta, the founder and CEO of Asymmetrique; We Founder Circle, and other angels, Octanom claims to have now received investments from a few billionaires. The company has raised a major round recently, but Ghose did not divulge details of the deal.

The Birth Of An Indian Hedging BullBefore incorporating the SEBI-registered wealthtech company, Ghose spent around 16 years in stock market trading. He has also held top positions at Sharekhan, a full-service stockbroker, for almost nine years.

He decided to quit his high-paying cushy job after realising that there was a dire need for investment instruments that can help Indian investors diversify their assets beyond the existing ones that have a “long-only” approach.

“Every financial investment instrument in India – be it stocks, mutual funds, ETFs – has the same thing in the armour, they are long-only in nature. This means, the market has to go up for any of these financial investment instruments to make money. In 2021, we, a small team of three people, found that India is the only country in the world with long-only financial investment instruments,” he said.

Another trigger for him to launch such a platform was the market crash during the Covid-19 pandemic. Ghosh recalled that when Indian investors should have invested more, the fear of a further loss made them chicken out, causing mutual funds to decline by 40-50%.

Witnessing this, he decided to launch a financial instrument that could bolster hedge-style funding in India, alleviating investors’ fears.

However, the road has been anything but easy. For starters, it was difficult to fetch an asset management company (AMC) licence immediately to launch a fund. Besides, the company needed to study whether there was an appetite for such a product in the market or not.

Soon, Ghose, along with his team of mathematicians and data scientists, started building the platform leveraging its proprietary mathematical equations. After two years of burning the midnight oil, Ghose launched Hedged in 2023.

With this, he claims to have rolled out India’s first financial investment instruments that offer stock recommendations on long and short-term investments irrespective of the market trend.

Ghose, with its platform trained on in-house algorithms, claims to have “curated structured products, which include stocks, bonds, and derivatives, which not only provide investment opportunities but also protect against losses”.

Unlike traditional platforms or stock advisers that claim to guarantee increased returns, the unique selling proposition of Hedged is to help investors evade the downside risks.

“Our financial products are agnostic to market direction. For example, amid the current market downturn, Nifty is down 14% from its high but we are at plus 8%. At present, every portfolio management service, mutual fund, and every smallcase is in the red. We are the only platform in India where users’ investments are in the green,” Ghose said, adding that their tech provides 1:1 beta on the downside.

What this means is that when Nifty is down 10%, Hedged-recommended investments could be up 10%. “However, when Nifty is up 10%, we would still be up 10% and are not claiming we can be up 20%. We can mimic the index both on the downside and the upside,” the founder said.

Besides the structured products, Hedged has built a “Nifty Crash Meter” or “Hedgeometer” that helps investors take necessary precautions and prevent losses by providing them with real-time index alerts and updates.

Hedged currently generates 80% of its revenue from institutional investors, including family offices and HNIs, while the remaining 20% comes from retail investors. It aims to touch the INR 10 Cr revenue mark by the end of FY25 and achieve operational breakeven.

How Octanom Is Tapping The MarketCurrently in the PMF stage, the startup already has around 70K registered users on its platform. Of these, 30K are monthly active users. Hedged has divided its customers into three broad categories.

The first ones are retail investors who usually depend on various trading or brokerage platforms for good returns. The second category involves the HNIs and Category III funds that have to keep depending on mutual funds or other similar long-term investments to generate good returns. The third category of customers are regular and serious traders.

The platform can be accessed for free by the first category of investors. However, this does not give them access to the analysis of risks and returns done using its proprietary equations. Its Hedgometer is also available for free.

The platform charges an annual subscription fee of INR 75,000 from serious retail traders and INR 2.5 Lakh a year from HNIs.

Meanwhile, Octanom is in the process of partnering with an AMC to roll out its structured products for retail investors via banks and brokerage platforms.

Charting The Course In A Competitive MarketRecently, SEBI issued a circular on Specialized Investment Funds (SIFs), allowing AMCs and mutual funds to launch long-short funds with a minimum investment amount of INR 10 Lakh. Octanom, in partnership with an AMC, aims to launch products for this new asset class soon. With this offering, the startup will compete with deep-pocketed players like Jio Financial Services.

Structured products are not a new concept in India. Similar products are already being offered by companies like Anand Rathi and Nuvama. However, unlike Octanom, which focusses solely on low-risk structured products, these instruments make up only a small part of the offerings from other brokerages and financial institutions in the country.

Ghose added that, unlike its Indian peers, Hedged has a minimal debt component, which enhances returns even during market downturns.

However, Octanom’s platform faces significant competition at a global level from the likes of JP Morgan, Morgan Stanley, and BNP Paribas and startups such as Arta Finance and ADDX.

Despite this, Ghose claims to have built Hedged centred around the US market. But, it aims to crack the Indian market first before venturing into the US.

Ghose said that Hedged will make a foray into the US market once it clocks INR 100 Cr in revenue, which he projects to achieve in three years.

“There are 28 Lakh people in India who have INR 50 Lakh+ in markets. Hardly there are products in the market protecting the downside. So, if I can get a healthy 10K to 30K of these 28 Lakh people, which is growing at 43% CAGR, it’s INR 500 Cr in revenue,” he said.

As of now, Hedged is trying to get portfolio management services and investment adviser licences from the SEBI. This will allow the company to provide customised structured products as well.

Meanwhile, the market opportunity for Hedged is significant in India and globally. As per a report by BNP Paribas last year, the demand for structured products has grown in recent years on the back of factors like capital protection, enhanced returns, and customisation options.

Besides, several companies are leveraging AI to transform various areas of their structured product businesses, including task automation, productivity enhancements, and forecasting capabilities.

Meanwhile, the Indian fintech industry faces significant regulatory challenges. SEBI and RBI’s policy changes have had a major impact on fintech startups in lending, wealth management, and other sectors in recent years. Moving forward, this will be a key test of the company’s resilience and Ghose’s decades of industry experience.

[Edited By Shishir Parasher]

The post appeared first on .