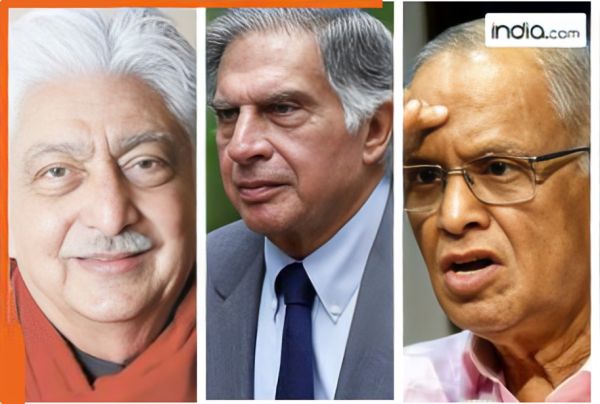

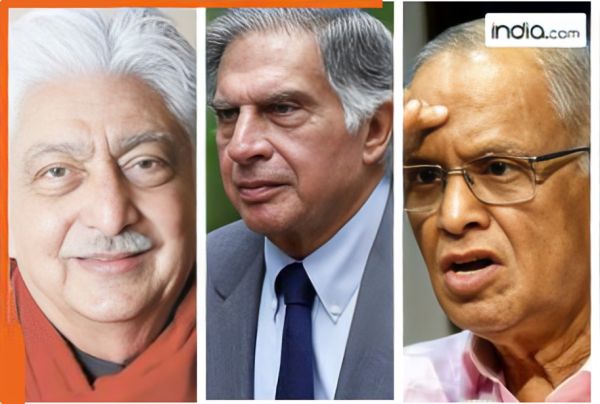

Salary Increments in 2025: Ratan Tata’s TCS, Azim Premji’s Wipro, Narayana Murthy’s Infosys, LTIMindtree, HCL Tech and other IT firms

GH News March 13, 2025 07:06 PM

According to the EY Future of Pay 2025 report released on February 27 salary increments in the IT sector are forecasted to decline from 9.8% in 2024 to 9.6% in 2025 due to broader industry trends driven by cost optimization and automation. The EY report highlights that salary increments in IT-enabled services will also decline from 9.2% in 2024 to 9% in 2025.

Salary Hike In Infosys TCS Wipro HCLTech

Many large IT companies have tightened their increment cycles:

Infosys offered salary hikes of 5%-7% this year down from 7%-9% in FY24 and 10.5% in FY22.

TCS plans to provide hikes of 4%-8% in March lower than the 9% it offered in FY24.

Wipro implemented merit-based hikes in September with top performers receiving an average of 8%.

Most HCLTech employees saw increments of only 1%-2% in FY25.

LTIMindtree’s Competency Tests

For the first time LTIMindtree plans to require its senior employees like project leads managers and lead architects to take a multiple-choice competency test focused on coding and math. According to a Mint report these test results will be considered alongside project completion performance in determining annual wage hikes.

This move is part of LTIMindtree’s My Career My Growth framework introduced last year. Initially applicable to senior executives the framework now extends to a broader segment of the companys 86800-strong workforce.

In 2022 LTIMindtree delayed its annual hike cycle by a month providing an average 4% salary increase in October. However this led to a 170-basis-point drop in EBIT margin falling from 15.5% in Q2 FY23 to 13.8% by Q3 FY23. Outgoing CEO and MD Debashis Chatterjee acknowledged the impact of wage hikes during the Q3 earnings call stating “While we expect to improve margins in Q4 absorbing the full impact of wage hikes may take longer in the current growth environment.”

Why Are IT Companies Tightening Budgets?

The Indian IT sector is projected to grow by 6%-7% in 2025 due to global economic conditions technological disruptions and regulatory challenges in AI and cybersecurity. Global firms are also cutting back on discretionary IT spending impacting revenue growth. While offering cost-saving opportunities generative AI creates revenue deflation risks. Companies must invest in end-to-end solutions or expand into new areas to compensate for potential losses.

According to the EY Future of Pay 2025 report released on February 27 salary increments in the IT sector are forecasted to decline from 9.8% in 2024 to 9.6% in 2025 due to broader industry trends driven by cost optimization and automation. The EY report highlights that salary increments in IT-enabled services will also decline from 9.2% in 2024 to 9% in 2025.

Salary Hike In Infosys TCS Wipro HCLTech

Many large IT companies have tightened their increment cycles:

Infosys offered salary hikes of 5%-7% this year down from 7%-9% in FY24 and 10.5% in FY22.

TCS plans to provide hikes of 4%-8% in March lower than the 9% it offered in FY24.

Wipro implemented merit-based hikes in September with top performers receiving an average of 8%.

Most HCLTech employees saw increments of only 1%-2% in FY25.

LTIMindtree’s Competency Tests

For the first time LTIMindtree plans to require its senior employees like project leads managers and lead architects to take a multiple-choice competency test focused on coding and math. According to a Mint report these test results will be considered alongside project completion performance in determining annual wage hikes.

This move is part of LTIMindtree’s My Career My Growth framework introduced last year. Initially applicable to senior executives the framework now extends to a broader segment of the companys 86800-strong workforce.

In 2022 LTIMindtree delayed its annual hike cycle by a month providing an average 4% salary increase in October. However this led to a 170-basis-point drop in EBIT margin falling from 15.5% in Q2 FY23 to 13.8% by Q3 FY23. Outgoing CEO and MD Debashis Chatterjee acknowledged the impact of wage hikes during the Q3 earnings call stating “While we expect to improve margins in Q4 absorbing the full impact of wage hikes may take longer in the current growth environment.”

Why Are IT Companies Tightening Budgets?

The Indian IT sector is projected to grow by 6%-7% in 2025 due to global economic conditions technological disruptions and regulatory challenges in AI and cybersecurity. Global firms are also cutting back on discretionary IT spending impacting revenue growth. While offering cost-saving opportunities generative AI creates revenue deflation risks. Companies must invest in end-to-end solutions or expand into new areas to compensate for potential losses.

According to the EY Future of Pay 2025 report released on February 27 salary increments in the IT sector are forecasted to decline from 9.8% in 2024 to 9.6% in 2025 due to broader industry trends driven by cost optimization and automation. The EY report highlights that salary increments in IT-enabled services will also decline from 9.2% in 2024 to 9% in 2025.

Salary Hike In Infosys TCS Wipro HCLTech

Many large IT companies have tightened their increment cycles:

Infosys offered salary hikes of 5%-7% this year down from 7%-9% in FY24 and 10.5% in FY22.

TCS plans to provide hikes of 4%-8% in March lower than the 9% it offered in FY24.

Wipro implemented merit-based hikes in September with top performers receiving an average of 8%.

Most HCLTech employees saw increments of only 1%-2% in FY25.

LTIMindtree’s Competency Tests

For the first time LTIMindtree plans to require its senior employees like project leads managers and lead architects to take a multiple-choice competency test focused on coding and math. According to a Mint report these test results will be considered alongside project completion performance in determining annual wage hikes.

This move is part of LTIMindtree’s My Career My Growth framework introduced last year. Initially applicable to senior executives the framework now extends to a broader segment of the companys 86800-strong workforce.

In 2022 LTIMindtree delayed its annual hike cycle by a month providing an average 4% salary increase in October. However this led to a 170-basis-point drop in EBIT margin falling from 15.5% in Q2 FY23 to 13.8% by Q3 FY23. Outgoing CEO and MD Debashis Chatterjee acknowledged the impact of wage hikes during the Q3 earnings call stating “While we expect to improve margins in Q4 absorbing the full impact of wage hikes may take longer in the current growth environment.”

Why Are IT Companies Tightening Budgets?

The Indian IT sector is projected to grow by 6%-7% in 2025 due to global economic conditions technological disruptions and regulatory challenges in AI and cybersecurity. Global firms are also cutting back on discretionary IT spending impacting revenue growth. While offering cost-saving opportunities generative AI creates revenue deflation risks. Companies must invest in end-to-end solutions or expand into new areas to compensate for potential losses.