The National Payments Corporation of India (NPCI) is

gradually phasing out the ‘Collect Payments’ feature on the Unified Payments Interface (UPI), according to two bankers familiar with the matter.

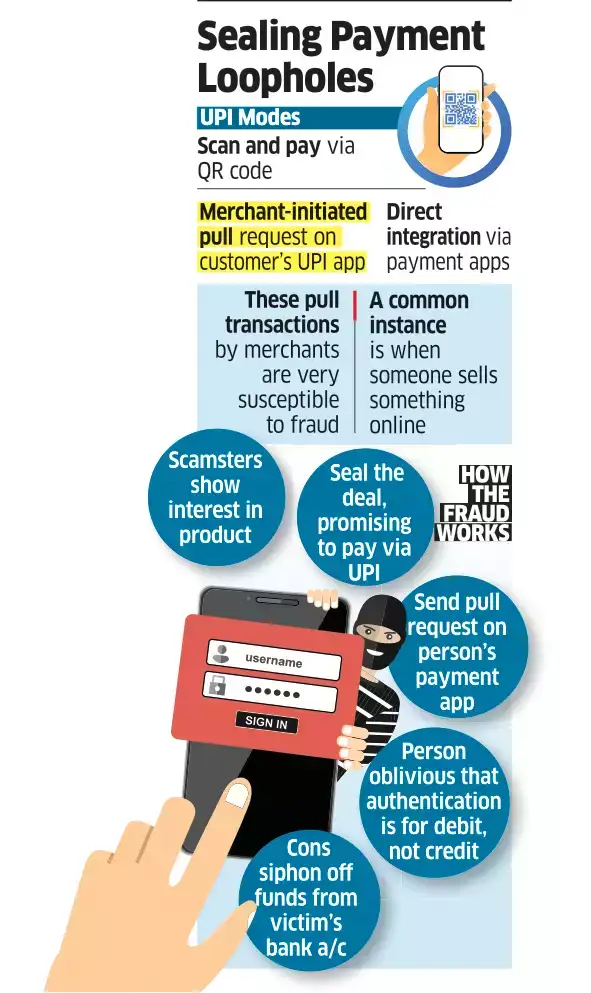

Understanding the flow: Users can initiate payments through a push or pull transaction on UPI.

- Push transaction: a customer can directly transfer money to any beneficiary.

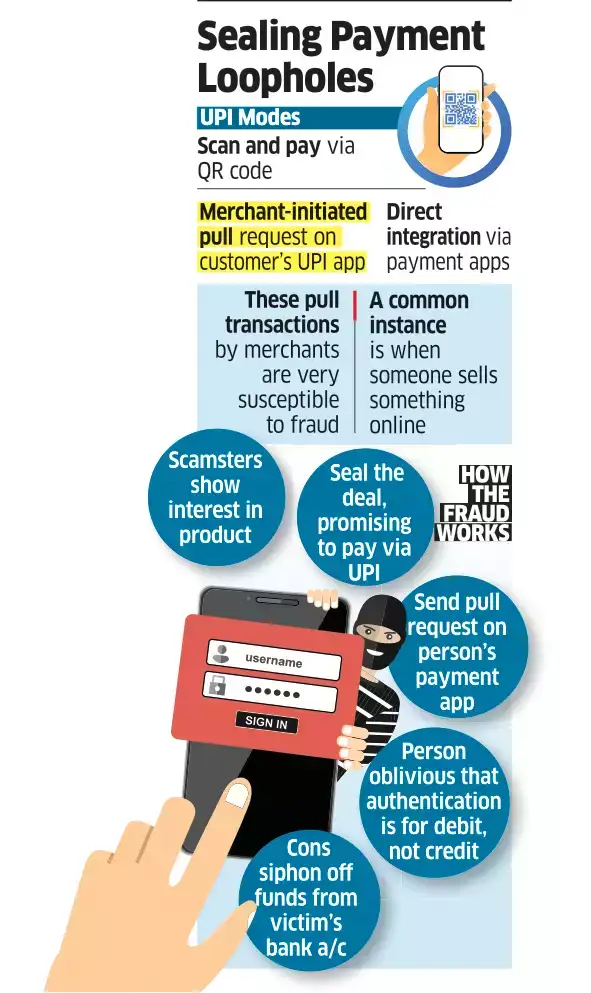

- Pull transaction (collect payment): The payee requests money from the payer, who must then authenticate the transaction through their UPI app.

It is this pull-based payment mode that the NPCI is gradually discontinuing.

Growth of merchant payments on UPI: India’s digital payments ecosystem has expanded significantly, with most merchant transactions shifting from

debit cards and net banking to UPI. NPCI aims to further accelerate this transition by promoting QR code-based and push payments. Pull payments will only be permitted for a select group of large, verified merchants.

What's the impact:

- Major UPI apps like Google Pay and PhonePe may benefit as more transactions flow through their platforms.

- Person-to-person (P2P) collect requests will now be capped at Rs 2000.

- Small merchants relying on collect payments may face disruptions but can shift to QR code payments via aggregators to ensure continuity.

The National Payments Corporation of India (NPCI) is gradually phasing out the ‘Collect Payments’ feature on the Unified Payments Interface (UPI), according to two bankers familiar with the matter.

The National Payments Corporation of India (NPCI) is gradually phasing out the ‘Collect Payments’ feature on the Unified Payments Interface (UPI), according to two bankers familiar with the matter.