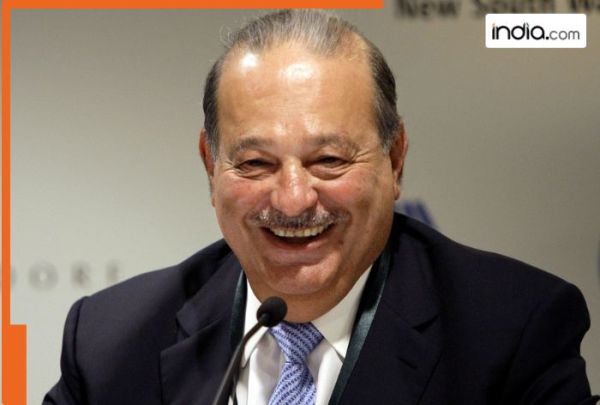

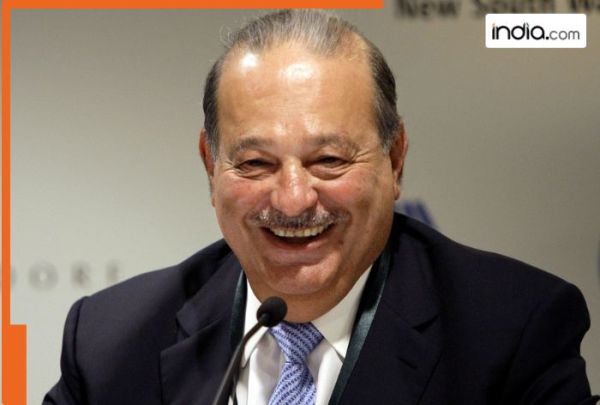

Meet man, immigrant’s son, built Latin America’s largest…, now world’s richest…, has net worth more than Gautam Adani

GH News March 19, 2025 02:06 AM

Carlos Slim was born in 1940 in Mexico City to Lebanese immigrant parents. From a young age Slim displayed an entrepreneurial mindset. Inspired by his father he learned the fundamentals of finance management and accounting.

At 11 he made his first investment in government savings bonds and understood the power of compound interest. By 12 he purchased his first stock in a Mexican bank. After his father passed away when Slim was just 13 he took on the responsibilities of his family’s business while continuing his education in civil engineering and economics.

Carlos Slim First Business

He studied civil engineering at the National Autonomous University of Mexicos School of Engineering and graduated in 1961. By the age of 25 Slim founded construction company Inmobiliaria Carso marking the beginning of his entrepreneurial journey.

By the age of 25 he had amassed $3 million which he used to acquire undervalued companies during Mexicos economic downturn. He turned these companies profitable and sold them at significant gains.

Carlos Slim’s Investments

During Mexico’s debt crisis in the 1980s Slim took advantage of market conditions by investing in undervalued sectors such as tobacco copper and mining. He also acquired the restaurant and retail chain Sanborn Hermanos and the state-owned telecom company Telmex along with Grupo Condumex a wire and fiber-optic cable manufacturer.

Slim expanded rapidly acquiring mobile operations across Latin America under the banner of America Movil which later merged with Telmex in 2011. America Movil is now the largest mobile phone operator in Latin America generating $46 billion in revenue in 2023.

Carlos Slim Helu ranked 19th on the Bloomberg Billionaire Index with a net worth of $82 billion his wealth was more than Gautam Adani and is just below Mukesh Ambani.

Slims Different Business

Slims investments extend beyond telecommunications. Through his family investment firm Grupo Carso he has stakes in construction energy and multiple commercial banks. Additionally Slim owns shares in more than half a dozen publicly traded companies from which he earns substantial dividends. In 2008 he purchased a 6.4% stake in The New York Times further diversifying his portfolio.

Carlos Slim was born in 1940 in Mexico City to Lebanese immigrant parents. From a young age Slim displayed an entrepreneurial mindset. Inspired by his father he learned the fundamentals of finance management and accounting.

At 11 he made his first investment in government savings bonds and understood the power of compound interest. By 12 he purchased his first stock in a Mexican bank. After his father passed away when Slim was just 13 he took on the responsibilities of his family’s business while continuing his education in civil engineering and economics.

Carlos Slim First Business

He studied civil engineering at the National Autonomous University of Mexicos School of Engineering and graduated in 1961. By the age of 25 Slim founded construction company Inmobiliaria Carso marking the beginning of his entrepreneurial journey.

By the age of 25 he had amassed $3 million which he used to acquire undervalued companies during Mexicos economic downturn. He turned these companies profitable and sold them at significant gains.

Carlos Slim’s Investments

During Mexico’s debt crisis in the 1980s Slim took advantage of market conditions by investing in undervalued sectors such as tobacco copper and mining. He also acquired the restaurant and retail chain Sanborn Hermanos and the state-owned telecom company Telmex along with Grupo Condumex a wire and fiber-optic cable manufacturer.

Slim expanded rapidly acquiring mobile operations across Latin America under the banner of America Movil which later merged with Telmex in 2011. America Movil is now the largest mobile phone operator in Latin America generating $46 billion in revenue in 2023.

Carlos Slim Helu ranked 19th on the Bloomberg Billionaire Index with a net worth of $82 billion his wealth was more than Gautam Adani and is just below Mukesh Ambani.

Slims Different Business

Slims investments extend beyond telecommunications. Through his family investment firm Grupo Carso he has stakes in construction energy and multiple commercial banks. Additionally Slim owns shares in more than half a dozen publicly traded companies from which he earns substantial dividends. In 2008 he purchased a 6.4% stake in The New York Times further diversifying his portfolio.

Carlos Slim was born in 1940 in Mexico City to Lebanese immigrant parents. From a young age Slim displayed an entrepreneurial mindset. Inspired by his father he learned the fundamentals of finance management and accounting.

At 11 he made his first investment in government savings bonds and understood the power of compound interest. By 12 he purchased his first stock in a Mexican bank. After his father passed away when Slim was just 13 he took on the responsibilities of his family’s business while continuing his education in civil engineering and economics.

Carlos Slim First Business

He studied civil engineering at the National Autonomous University of Mexicos School of Engineering and graduated in 1961. By the age of 25 Slim founded construction company Inmobiliaria Carso marking the beginning of his entrepreneurial journey.

By the age of 25 he had amassed $3 million which he used to acquire undervalued companies during Mexicos economic downturn. He turned these companies profitable and sold them at significant gains.

Carlos Slim’s Investments

During Mexico’s debt crisis in the 1980s Slim took advantage of market conditions by investing in undervalued sectors such as tobacco copper and mining. He also acquired the restaurant and retail chain Sanborn Hermanos and the state-owned telecom company Telmex along with Grupo Condumex a wire and fiber-optic cable manufacturer.

Slim expanded rapidly acquiring mobile operations across Latin America under the banner of America Movil which later merged with Telmex in 2011. America Movil is now the largest mobile phone operator in Latin America generating $46 billion in revenue in 2023.

Carlos Slim Helu ranked 19th on the Bloomberg Billionaire Index with a net worth of $82 billion his wealth was more than Gautam Adani and is just below Mukesh Ambani.

Slims Different Business

Slims investments extend beyond telecommunications. Through his family investment firm Grupo Carso he has stakes in construction energy and multiple commercial banks. Additionally Slim owns shares in more than half a dozen publicly traded companies from which he earns substantial dividends. In 2008 he purchased a 6.4% stake in The New York Times further diversifying his portfolio.