legend Phil Thompson is embroiled in a HMRC saga as he faces an eye-watering £300,000 tax bill after his battle against IR35 regulations failed. The Anfield hero, who made an impressive near-500 appearances for the Reds during the 70s and 80s, went on to win a stack of seven league titles and was crowned European champion thrice.

Thompson's journey on Merseyside continued post-retirement with a coaching stint at Liverpool under Kenny Dalglish and later Graeme Souness, followed by a pivotal role as assistant manager to Gerard Houllier. He even took the helm of the Reds as temporary caretaker manager following Houllier's urgent heart surgery.

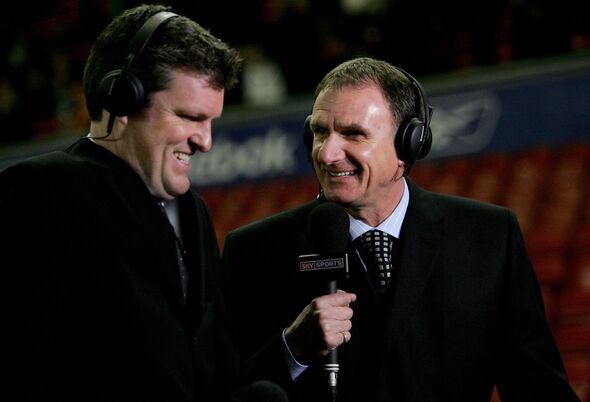

The ex-defender then transitioned to broadcasting, becoming a familiar face on Sky Sports' Soccer Saturday, where he delivered analysis for 22 years before hanging up his punditry boots in August 2020.

However, the spotlight is now on Thompson's off-pitch activities, with his broadcasting earnings going through his company, PD and MJ Ltd, now the subject of HMRC scrutiny. The tax authorities examined his dealings with Sky between 2013-14 and 2017-18 and concluded that his work arrangements fell within IR35 laws, resulting in a hefty tax demand for Pay As You Earn (PAYE) and National Insurance totalling £294,306.

Despite Thompson's attempt to challenge HMRC's ruling at the First-tier Tribunal on December 11, 2023, his appeal was dismissed. He then escalated the issue to the Upper Tribunal in January.

However, as of Monday, the former Liverpool skipper's legal battle hit a dead end when two judges confirmed the previous decision and it did not disclose a material error of law.

Weighing in on the case, Seb Maley, the CEO of Qdos, remarked: "HMRC pursues a high-profile freelance presenter who has fallen into the trap of working in a way that reflects disguised employment. The result is a staggering tax bill."

Amid the ongoing challenges for freelancers, IR35 expert at Re Legal Consulting, Rebecca Seeley Harris, has voiced her concerns: "It is getting more and more difficult to establish yourself as an independent contractor, and the framework of control is becoming the dominant factor again."

Dave Maley also underlined the significance of compliance with HMRC, stating: "The bigger picture is that HMRC sees IR35 compliance as a priority."

This article originally appeared on Liverpool Echo