State-run banks are grappling with elevated levels of bad loans in their credit card portfolios, particularly from cards issued between September 2021 and October 2023, when they aggressively expanded customer base amid intense competition from fintech players.

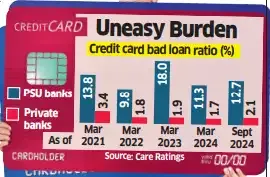

Public sector banks (PSBs) had a credit card bad loan ratio of 12.7% at end of September 2024, far higher than 2.1% reported by private banks, show Care Ratings data.

“Higher bad loan ratios in public sector banks could be attributed to the more aggressive distribution of credit cards,” said Sanjay Agarwal, senior director at Care Ratings. “State-run banks promote financial inclusion by extending credit to a broader segment of the population with limited credit histories, while private sector banks target consumers with stronger credit profiles.”

Total outstanding credit card loan dues in the country stood at Rs 2.9 lakh crore as on January 24, 2025, up 13% year-on-year, according to the Reserve Bank of India (RBI).

The sector-wide overall credit card bad loan ratio stood at 2.2% as of September 2024, according to Care Ratings.

PSBs account for about one-fourth (24%) of some 109 million credit cards in circulation. Among them, SBI Cards, BoB Cards and Canara Bank account for 94% of the total credit card outstandings of state-run banks, according to RBI data.

SBI Cards, the country’s second-largest credit card issuer, saw its gross credit cost rise to 9.4% at the end of December 2024, while its gross non-performing asset ratio stood at 3.2%.

BoB Cards reported gross bad loan plus write-off ratio of 6.8% at the end of December, though this was an improvement from 9.6% in March 2024.

The increased stress in PSBs’ credit card portfolios stems largely from the post-pandemic boom in unsecured lending.

“Most of the pain is coming from lower ticket-size cards that were issued mainly during September 2021 and October 2023,” said Dhaval Gada, fund manager at DSP Mutual Fund. “It was a period when competitive pressure from fintechs had forced some of these banks, large PSUs as well as mid-sized private lenders, to grow aggressively. Some players had also ventured into markets beyond the top eight cities by easing underwriting filters.”

According to analysts, after the initial rise in delinquencies during the first Covid-induced lockdown, fintechs introduced innovative credit products that mimicked credit cards — such as check-out financing for ecommerce purchases and buy now-pay later offerings — to push the post-pandemic ‘revenge spending.’

During this period, state-owned lenders used their extensive branch network to onboard new credit card customers beyond the traditional markets of metros and larger cities, to compete with these fintechs and cash in on the consumption boom driven by pent-up demand. Large private banks, though, were cautious and limited onboarding to existing bank customers.

However, the RBI crackdown on fintechs affected the unsecured lending environment, industry insiders said.

“The regulatory crackdown on fintechs and, subsequently, on overall unsecured lending, meant that customers — mainly in the sub-Rs 50,000 category — could not avail credit facilities for rolling over,” a senior official with a mid-sized private sector bank said on condition of anonymity. “Currently, the stress is playing out mainly in this category.”

The worst may not be over. Gada of DSP Mutual Fund believes the credit costs in the card portfolio of PSU banks are yet to peak out.

RBI had responded to stress in the unsecured loan segment by increasing risk weights on unsecured consumer credit and bank credit to non-banking finance companies (NBFCs) on November 16, 2023. In early 2024, the regulator cracked down on fintechs issuing co-branded credit cards that failed to prominently display the name of the banking partner.

“Mid-sized banks continue to maintain caution and take a pause from their aggressive disbursement of cards,” said Akshay Tiwari, AVP and equity research analyst, BFSI, at Asit C Mehta Investment.

Public sector banks (PSBs) had a credit card bad loan ratio of 12.7% at end of September 2024, far higher than 2.1% reported by private banks, show Care Ratings data.

“Higher bad loan ratios in public sector banks could be attributed to the more aggressive distribution of credit cards,” said Sanjay Agarwal, senior director at Care Ratings. “State-run banks promote financial inclusion by extending credit to a broader segment of the population with limited credit histories, while private sector banks target consumers with stronger credit profiles.”

Total outstanding credit card loan dues in the country stood at Rs 2.9 lakh crore as on January 24, 2025, up 13% year-on-year, according to the Reserve Bank of India (RBI).

The sector-wide overall credit card bad loan ratio stood at 2.2% as of September 2024, according to Care Ratings.

PSBs account for about one-fourth (24%) of some 109 million credit cards in circulation. Among them, SBI Cards, BoB Cards and Canara Bank account for 94% of the total credit card outstandings of state-run banks, according to RBI data.

SBI Cards, the country’s second-largest credit card issuer, saw its gross credit cost rise to 9.4% at the end of December 2024, while its gross non-performing asset ratio stood at 3.2%.

BoB Cards reported gross bad loan plus write-off ratio of 6.8% at the end of December, though this was an improvement from 9.6% in March 2024.

The increased stress in PSBs’ credit card portfolios stems largely from the post-pandemic boom in unsecured lending.

“Most of the pain is coming from lower ticket-size cards that were issued mainly during September 2021 and October 2023,” said Dhaval Gada, fund manager at DSP Mutual Fund. “It was a period when competitive pressure from fintechs had forced some of these banks, large PSUs as well as mid-sized private lenders, to grow aggressively. Some players had also ventured into markets beyond the top eight cities by easing underwriting filters.”

According to analysts, after the initial rise in delinquencies during the first Covid-induced lockdown, fintechs introduced innovative credit products that mimicked credit cards — such as check-out financing for ecommerce purchases and buy now-pay later offerings — to push the post-pandemic ‘revenge spending.’

During this period, state-owned lenders used their extensive branch network to onboard new credit card customers beyond the traditional markets of metros and larger cities, to compete with these fintechs and cash in on the consumption boom driven by pent-up demand. Large private banks, though, were cautious and limited onboarding to existing bank customers.

However, the RBI crackdown on fintechs affected the unsecured lending environment, industry insiders said.

“The regulatory crackdown on fintechs and, subsequently, on overall unsecured lending, meant that customers — mainly in the sub-Rs 50,000 category — could not avail credit facilities for rolling over,” a senior official with a mid-sized private sector bank said on condition of anonymity. “Currently, the stress is playing out mainly in this category.”

The worst may not be over. Gada of DSP Mutual Fund believes the credit costs in the card portfolio of PSU banks are yet to peak out.

RBI had responded to stress in the unsecured loan segment by increasing risk weights on unsecured consumer credit and bank credit to non-banking finance companies (NBFCs) on November 16, 2023. In early 2024, the regulator cracked down on fintechs issuing co-branded credit cards that failed to prominently display the name of the banking partner.

“Mid-sized banks continue to maintain caution and take a pause from their aggressive disbursement of cards,” said Akshay Tiwari, AVP and equity research analyst, BFSI, at Asit C Mehta Investment.