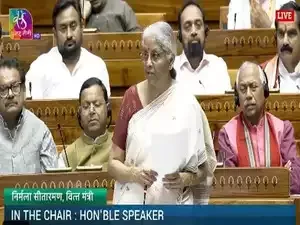

New Delhi: Finance minister Nirmala Sitharaman on Tuesday said the new income tax bill will be taken up in the monsoon session of Parliament and the GST Council is already considering rate rationalisation.

In her reply to the discussion on the Finance Bill in the Lok Sabha, she said equalisation levy is being abolished to address global economic uncertainty, while customs tariff rationalisation will support manufacturing and promote exports. She said the Finance Bill, which proposes to raise exemption limit to ₹12 lakh, provides unprecedented relief to taxpayers.

The Finance Bill, introduced in the Parliament on February 1, was approved by the lower house on Tuesday. "(I) have proposed to remove (the) 6% equalisation levy for advertisements, to address uncertainty in the international economy condition," said Sitharaman.

In the previous budget, the Centre had scrapped the 2% equalisation levy on ecommerce companies.

The finance minister added that there would be no import duties on several goods used to manufacture electric vehicle (EV) batteries and mobile phones, amid broader tariff cuts. This will help local producers absorb the potential impact of any reciprocal US tariffs that may be imposed from April 2 by the Donald Trump administration.

India will exempt from import duty 35 items used to make EV batteries and 28 items used in mobile phone manufacturing, she said. "We aim to boost domestic production and enhance export competitiveness by reducing duties on raw materials," she said. She added that only a cess or surcharge will apply per item, not both. As many as 82 tariff lines subject to a cess will be exempted from the social welfare surcharge.

"We will take it (the income tax bill) up in the monsoon session," she said. The monsoon session typically starts sometime in July.

She added that the income tax collection target for the next financial year is realistic and was set after taking into consideration the "revenue foregone" of ₹1 lakh crore, on account of the tax exemption on incomes up to ₹12 lakh.

Responding to concerns that the new income tax bill allows the tax department to access mobile phones and laptops and thus poses privacy concerns, the finance minister said there was already a provision to examine account books, but the old law didn't specifically mention digital records. The recent amendments are only aimed at addressing this gap, she said.

Sitharaman cited encrypted mobile messages that helped uncover ₹250 crore of unaccounted money, and WhatsApp communications that helped trace ₹200 crore in crypto-related assets. Besides this, Google Map history helped locate cash hideouts, while Instagram accounts were key in proving benami property ownership, she added.

The finance minister refuted allegations that the goods and services tax (GST) is not progressive as "baseless," saying, "Wealthiest 20% of Indians contribute 41.04% of household GST while the bottom 50% contributes only 28% of household GST."

Similarly, under the PM-Awas (Urban) scheme, of the 11.8 million houses that were to be built over the past 10 years, 4.2 million were for people belonging to OBC groups and 2.3 million for those of the SC communities, she said. About 60% of the beneficiaries of the PM-Awas (Gramin) scheme are from the SC and ST communities.

In her reply to the discussion on the Finance Bill in the Lok Sabha, she said equalisation levy is being abolished to address global economic uncertainty, while customs tariff rationalisation will support manufacturing and promote exports. She said the Finance Bill, which proposes to raise exemption limit to ₹12 lakh, provides unprecedented relief to taxpayers.

The Finance Bill, introduced in the Parliament on February 1, was approved by the lower house on Tuesday. "(I) have proposed to remove (the) 6% equalisation levy for advertisements, to address uncertainty in the international economy condition," said Sitharaman.

Fewer Import Duties

Amendments to the Finance Bill that were presented on Monday propose to abolish the 6% equalisation levy on online advertising by foreign companies such as Google and Facebook, known widely as the Google tax. The decision comes as India and the US engage in trade talks ahead of a bilateral agreement.In the previous budget, the Centre had scrapped the 2% equalisation levy on ecommerce companies.

The finance minister added that there would be no import duties on several goods used to manufacture electric vehicle (EV) batteries and mobile phones, amid broader tariff cuts. This will help local producers absorb the potential impact of any reciprocal US tariffs that may be imposed from April 2 by the Donald Trump administration.

India will exempt from import duty 35 items used to make EV batteries and 28 items used in mobile phone manufacturing, she said. "We aim to boost domestic production and enhance export competitiveness by reducing duties on raw materials," she said. She added that only a cess or surcharge will apply per item, not both. As many as 82 tariff lines subject to a cess will be exempted from the social welfare surcharge.

Income Tax Bill

Sitharaman said the new income tax bill, which was introduced in the house on February 13, is currently being vetted by the select committee that is mandated to submit its report by the first day of the next session of the Parliament."We will take it (the income tax bill) up in the monsoon session," she said. The monsoon session typically starts sometime in July.

She added that the income tax collection target for the next financial year is realistic and was set after taking into consideration the "revenue foregone" of ₹1 lakh crore, on account of the tax exemption on incomes up to ₹12 lakh.

Responding to concerns that the new income tax bill allows the tax department to access mobile phones and laptops and thus poses privacy concerns, the finance minister said there was already a provision to examine account books, but the old law didn't specifically mention digital records. The recent amendments are only aimed at addressing this gap, she said.

Sitharaman cited encrypted mobile messages that helped uncover ₹250 crore of unaccounted money, and WhatsApp communications that helped trace ₹200 crore in crypto-related assets. Besides this, Google Map history helped locate cash hideouts, while Instagram accounts were key in proving benami property ownership, she added.

The finance minister refuted allegations that the goods and services tax (GST) is not progressive as "baseless," saying, "Wealthiest 20% of Indians contribute 41.04% of household GST while the bottom 50% contributes only 28% of household GST."

SC/ST/OBC categories

Responding to questions on the welfare of people belonging to the scheduled castes (SC), scheduled tribes (ST) and other backward castes (OBC), Sitharaman listed steps taken by the Narendra Modi government. As many as 76% of beneficiaries of the PM-Kisan scheme are from the SC, ST and OBC categories, she said.Similarly, under the PM-Awas (Urban) scheme, of the 11.8 million houses that were to be built over the past 10 years, 4.2 million were for people belonging to OBC groups and 2.3 million for those of the SC communities, she said. About 60% of the beneficiaries of the PM-Awas (Gramin) scheme are from the SC and ST communities.