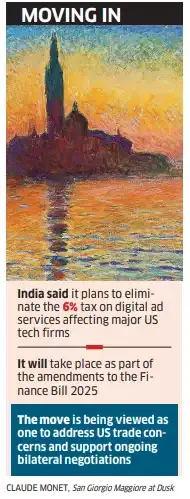

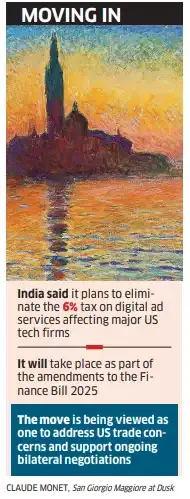

The move to eliminate the 6% equalisation levy on online advertisements will give Big Tech giants a reason to cheer but the broader term impacts include relief from the administrative obligations with 'unreasonable penal consequences' for the personnel of these companies, experts told ET.

It will also be seen as something that could douse aggressive tariffs by the second Trump administration and ease India-US ties. Besides, it can help Indian companies looking to expand globally.

On Monday, India said it plans to eliminate the 6% tax on digital advertising services affecting major US tech firms, including Google, Meta, and Amazon, as part of amendments to the Finance Bill 2025.

Dhruv Garg, founding director of Indian Governance and Policy Project (IGAP) said the move could help win some goodwill with the US. Not just this, he felt it would also mean that the cost of ads for Indian companies will decrease.

"While the collections have been low under such levy, the issue has been a sore point in India-US trade relations. Additionally, while the levy was on foreign digital entities, the burden was baked into the cost for Indian companies availing these advertisement services. Its removal might have some positive impact on India-US relations as well as will bring down the cost of advertisements for Indian companies."

Experts said the most used online platforms are US-based, so the imposition of the equalisation levy was perceived by the US as being targeted towards American enterprises. But Indian firms too stand to benefit, they said.

"The equalisation levy was introduced as a temporary measure to address the tax challenges of the digitalised economy," explained Dhruv Janssen-Sanghavi, international taxation expert and founder of Janssen-Sanghavi & Associates. "The thought process appears to have been that imposing such digital services taxes may accelerate a global solution. However, that global solution does not seem to be forthcoming, and digital services taxes have only created more friction."

He said the complete removal of the equalisation levy is a 'good development' to smoothen those frictions. However, he warned that only time would tell if the removal of the equalisation levy will translate to lower prices for Indian consumers.

"This was the reason why the United States Trade Representative was critical of digital services taxes in general," Sanghavi said. "In fact, the additional costs for Indian enterprises were an obstacle for them to expand globally. Therefore, the removal will be beneficial for Indian companies in general. Indian tech companies tend to serve more locally and are unlikely to lose their local edge due to this development."

It will also be seen as something that could douse aggressive tariffs by the second Trump administration and ease India-US ties. Besides, it can help Indian companies looking to expand globally.

On Monday, India said it plans to eliminate the 6% tax on digital advertising services affecting major US tech firms, including Google, Meta, and Amazon, as part of amendments to the Finance Bill 2025.

Dhruv Garg, founding director of Indian Governance and Policy Project (IGAP) said the move could help win some goodwill with the US. Not just this, he felt it would also mean that the cost of ads for Indian companies will decrease.

"While the collections have been low under such levy, the issue has been a sore point in India-US trade relations. Additionally, while the levy was on foreign digital entities, the burden was baked into the cost for Indian companies availing these advertisement services. Its removal might have some positive impact on India-US relations as well as will bring down the cost of advertisements for Indian companies."

Experts said the most used online platforms are US-based, so the imposition of the equalisation levy was perceived by the US as being targeted towards American enterprises. But Indian firms too stand to benefit, they said.

"The equalisation levy was introduced as a temporary measure to address the tax challenges of the digitalised economy," explained Dhruv Janssen-Sanghavi, international taxation expert and founder of Janssen-Sanghavi & Associates. "The thought process appears to have been that imposing such digital services taxes may accelerate a global solution. However, that global solution does not seem to be forthcoming, and digital services taxes have only created more friction."

He said the complete removal of the equalisation levy is a 'good development' to smoothen those frictions. However, he warned that only time would tell if the removal of the equalisation levy will translate to lower prices for Indian consumers.

"This was the reason why the United States Trade Representative was critical of digital services taxes in general," Sanghavi said. "In fact, the additional costs for Indian enterprises were an obstacle for them to expand globally. Therefore, the removal will be beneficial for Indian companies in general. Indian tech companies tend to serve more locally and are unlikely to lose their local edge due to this development."