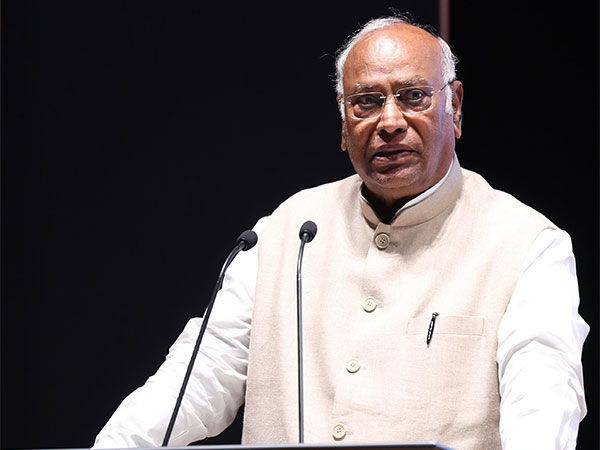

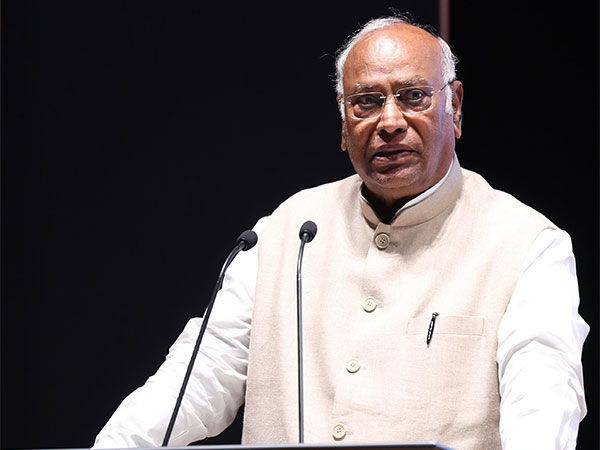

Kharge slams Centre for turning banks into "collection agents" to "loot" citizens

New Delhi [India], March 29 (ANI): Congress President Mallikarjun Kharge on Saturday accused the central government of turning banks into "collection agents" by increasing various charges, including ATM withdrawal fees.According to Congress president Mallikarjun Kharge, the government extracted at least Rs 43,500 crore from citizens between 2018 and 2024 due to non-maintenance of minimum balances in savings accounts and Jan Dhan accounts.In a social media post on X, the Leader of the Opposition in the Rajya Sabha said, "Our Banks have been unfortunately made 'Collection Agents' by the Modi Govt ! ATM Withdrawal Charges to be costlier. Modi Govt has extracted at least Rs43,500 Cr due to non-maintenance of Minimum Balance from Savings Accounts & Jan Dhan Accounts combined, between 2018 and 2024."Kharge claimed that banks have been levying numerous charges, including inactivity fees, bank statement issuance fees, SMS alert charges, loan processing fees, and loan pre-closure charges. He argueD that these charges are an additional burden on citizens, who are already struggling with price rises."Other Bank charges to LOOT citizens - An inactivity fee, which is Rs100-200 every year; Bank statement issuance fee is Rs50-100.; Rs20-25 per quarter is charged for SMS alerts; Banks charge 1-3% as loan processing fees; If loan is paid on time, then loan pre-closure charges are levied; NEFT, Demand Draft charges are additional burden and KYC updates like signature changes also attract fee," Kharge posted on X.This comes after the Reserve Bank of India's (RBI) recent decision to allow banks to increase charges on ATM cash withdrawals, which has sparked controversy. From May 1, banks can charge up to Rs23 per transaction for ATM withdrawals beyond the mandatory free monthly usage.The Congress president has also criticized the government for discontinuing the practice of providing data on the amount collected by these charges in Parliament. "Earlier, the Union Govt used to provide the data of amount collected by these charges in the Parliament, but now this practice has also been discontinued by saying 'RBI doesn't maintain such data," he added. Data from the Finance Ministry revealed that public sector banks and private banks have collected over Rs35,000 crore in charges since 2018 due to non-maintenance of minimum balance, excess ATM transactions, and SMS services. The government's decision to discontinue providing data on the amount collected by these charges has also raised concerns about transparencyKharge has termed this as the BJP's "mantra for extortion," combining "painful price rise" and "unbridled loot." The issue has sparked a debate about banks' roles and government policies. While the government argues that these charges are necessary to maintain banking services, critics like Kharge claim that they are an unfair burden on citizens."Painful Price Rise + Unbridled Loot = BJP's Mantra for Extortion!" posted Kharge on X. On Friday, the Reserve Bank permitted banks to increase charges on ATM cash withdrawals beyond the free monthly usage by Rs2 to Rs23 per transaction from May 1.Customers are eligible for five free transactions (including financial and non-financial transactions) every month from their own bank's Automated Teller Machines (ATMs).They are also eligible for free transactions (including financial and non-financial transactions) from other bank ATMs -- three transactions in metro centres and five in non-metro centres. (ANI)

New Delhi [India], March 29 (ANI): Congress President Mallikarjun Kharge on Saturday accused the central government of turning banks into "collection agents" by increasing various charges, including ATM withdrawal fees.According to Congress president Mallikarjun Kharge, the government extracted at least Rs 43,500 crore from citizens between 2018 and 2024 due to non-maintenance of minimum balances in savings accounts and Jan Dhan accounts.In a social media post on X, the Leader of the Opposition in the Rajya Sabha said, "Our Banks have been unfortunately made 'Collection Agents' by the Modi Govt ! ATM Withdrawal Charges to be costlier. Modi Govt has extracted at least Rs43,500 Cr due to non-maintenance of Minimum Balance from Savings Accounts & Jan Dhan Accounts combined, between 2018 and 2024."Kharge claimed that banks have been levying numerous charges, including inactivity fees, bank statement issuance fees, SMS alert charges, loan processing fees, and loan pre-closure charges. He argueD that these charges are an additional burden on citizens, who are already struggling with price rises."Other Bank charges to LOOT citizens - An inactivity fee, which is Rs100-200 every year; Bank statement issuance fee is Rs50-100.; Rs20-25 per quarter is charged for SMS alerts; Banks charge 1-3% as loan processing fees; If loan is paid on time, then loan pre-closure charges are levied; NEFT, Demand Draft charges are additional burden and KYC updates like signature changes also attract fee," Kharge posted on X.This comes after the Reserve Bank of India's (RBI) recent decision to allow banks to increase charges on ATM cash withdrawals, which has sparked controversy. From May 1, banks can charge up to Rs23 per transaction for ATM withdrawals beyond the mandatory free monthly usage.The Congress president has also criticized the government for discontinuing the practice of providing data on the amount collected by these charges in Parliament. "Earlier, the Union Govt used to provide the data of amount collected by these charges in the Parliament, but now this practice has also been discontinued by saying 'RBI doesn't maintain such data," he added. Data from the Finance Ministry revealed that public sector banks and private banks have collected over Rs35,000 crore in charges since 2018 due to non-maintenance of minimum balance, excess ATM transactions, and SMS services. The government's decision to discontinue providing data on the amount collected by these charges has also raised concerns about transparencyKharge has termed this as the BJP's "mantra for extortion," combining "painful price rise" and "unbridled loot." The issue has sparked a debate about banks' roles and government policies. While the government argues that these charges are necessary to maintain banking services, critics like Kharge claim that they are an unfair burden on citizens."Painful Price Rise + Unbridled Loot = BJP's Mantra for Extortion!" posted Kharge on X. On Friday, the Reserve Bank permitted banks to increase charges on ATM cash withdrawals beyond the free monthly usage by Rs2 to Rs23 per transaction from May 1.Customers are eligible for five free transactions (including financial and non-financial transactions) every month from their own bank's Automated Teller Machines (ATMs).They are also eligible for free transactions (including financial and non-financial transactions) from other bank ATMs -- three transactions in metro centres and five in non-metro centres. (ANI)

New Delhi [India], March 29 (ANI): Congress President Mallikarjun Kharge on Saturday accused the central government of turning banks into "collection agents" by increasing various charges, including ATM withdrawal fees.According to Congress president Mallikarjun Kharge, the government extracted at least Rs 43,500 crore from citizens between 2018 and 2024 due to non-maintenance of minimum balances in savings accounts and Jan Dhan accounts.In a social media post on X, the Leader of the Opposition in the Rajya Sabha said, "Our Banks have been unfortunately made 'Collection Agents' by the Modi Govt ! ATM Withdrawal Charges to be costlier. Modi Govt has extracted at least Rs43,500 Cr due to non-maintenance of Minimum Balance from Savings Accounts & Jan Dhan Accounts combined, between 2018 and 2024."Kharge claimed that banks have been levying numerous charges, including inactivity fees, bank statement issuance fees, SMS alert charges, loan processing fees, and loan pre-closure charges. He argueD that these charges are an additional burden on citizens, who are already struggling with price rises."Other Bank charges to LOOT citizens - An inactivity fee, which is Rs100-200 every year; Bank statement issuance fee is Rs50-100.; Rs20-25 per quarter is charged for SMS alerts; Banks charge 1-3% as loan processing fees; If loan is paid on time, then loan pre-closure charges are levied; NEFT, Demand Draft charges are additional burden and KYC updates like signature changes also attract fee," Kharge posted on X.This comes after the Reserve Bank of India's (RBI) recent decision to allow banks to increase charges on ATM cash withdrawals, which has sparked controversy. From May 1, banks can charge up to Rs23 per transaction for ATM withdrawals beyond the mandatory free monthly usage.The Congress president has also criticized the government for discontinuing the practice of providing data on the amount collected by these charges in Parliament. "Earlier, the Union Govt used to provide the data of amount collected by these charges in the Parliament, but now this practice has also been discontinued by saying 'RBI doesn't maintain such data," he added. Data from the Finance Ministry revealed that public sector banks and private banks have collected over Rs35,000 crore in charges since 2018 due to non-maintenance of minimum balance, excess ATM transactions, and SMS services. The government's decision to discontinue providing data on the amount collected by these charges has also raised concerns about transparencyKharge has termed this as the BJP's "mantra for extortion," combining "painful price rise" and "unbridled loot." The issue has sparked a debate about banks' roles and government policies. While the government argues that these charges are necessary to maintain banking services, critics like Kharge claim that they are an unfair burden on citizens."Painful Price Rise + Unbridled Loot = BJP's Mantra for Extortion!" posted Kharge on X. On Friday, the Reserve Bank permitted banks to increase charges on ATM cash withdrawals beyond the free monthly usage by Rs2 to Rs23 per transaction from May 1.Customers are eligible for five free transactions (including financial and non-financial transactions) every month from their own bank's Automated Teller Machines (ATMs).They are also eligible for free transactions (including financial and non-financial transactions) from other bank ATMs -- three transactions in metro centres and five in non-metro centres. (ANI)