At a time when an increasing number of new-age tech ventures in the country are launching platforms for various business use cases — from streamlining customer interactions with agentic AI to improving workflow management — B2B ecommerce platform OfBusiness has sharpened its AI arsenal.

Earlier this year, , to help its existing customers gain deeper market insights and optimise their sales, logistics and inventory functions.

Understandably, the company’s AI push, in the form of Nexizo, has come at a crucial time, as the company gears up for a $1 Bn IPO, likely in the second half of 2025.

But, what is OfBusiness up to when it comes to AI adoption and implementation, one may ask?

To understand this, we spoke with OfBusiness’ cofounder and chief business officer Nitin Jain, who said that Nexizo is OfBusiness’ extended leap in the realm of AI.

With this move, the startup has transitioned beyond just showcasing pricing and tender details to assisting enterprises with lead generation.

Now, before we dive into what OfBusiness is trying to achieve with Nexizo, let’s learn a thing or two about the Gurugram-based unicorn.

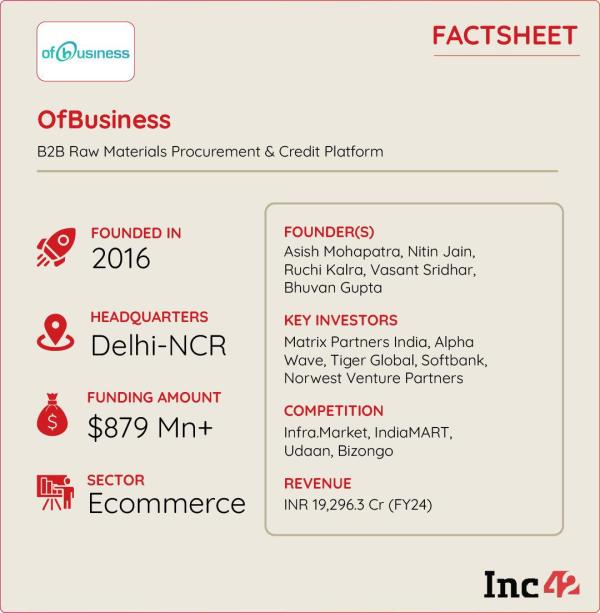

Founded in 2016 by Asish Mohapatra, Nitin Jain, Ruchi Kalra, Vasant Sridhar, and Bhuvan Gupta, OfBusiness offers raw material procurement and financing solutions to SMEs in the manufacturing and infrastructure sectors.

The categories of these services range from steel and chemicals to polymers and bitumen. The company, which achieved unicorn status in 2021, also runs a fintech arm, Oxyzo.

OfBusiness’ to cross the INR 19,000 Cr mark in FY24, while net profit surged 30% YoY to INR 603 Cr.

The company claims to have impacted over 4 Lakh businesses via its tech, with deliveries to more than 13,000 SMEs. It is this user base data the company claims to be leveraging to train AI models and sharpen Nexizo.

Nexizo is not the company’s first and only tryst with AI. According to Jain, OfBusiness had been experimenting with the emerging tech even before OpenAI stirred up a storm worldwide.

Although at a small scale, the executive said, the startup already had (ML) models in place to showcase government tenders to its clients.

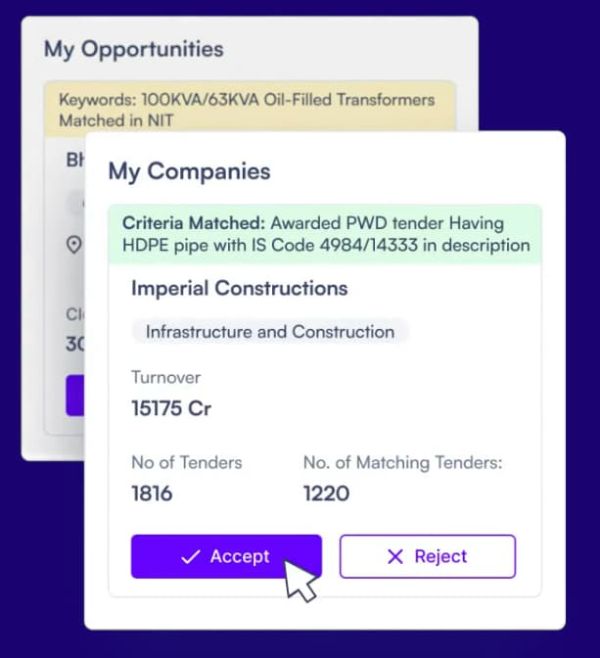

Before the launch of Nexizo, its AI engine helped its BidAssist platform process and track over 25 Mn data points annually from more than 50 Mn tenders and documents.

“We were the first ones in the B2B world to adopt AI. I, being a computer science engineer, have a passion for looking where I can plug AI into the organisation,” Jain said.

Therefore, with the advent of OpenAI’s ChatGPT, the startup decided to automate client interactions. Jain launched a chat assistant that allowed its customers to access market prices of various raw materials.

It also automated the process of sending various news articles about commodities to OfBusiness’ clients. The platform was also updating prices of 10,000 commodities in real time.

However, this conversational platform functioned as a simple layer over an existing large language model (LLM). The company then realised the need to develop its proprietary AI.

Soon, it focussed on building its own small language models (SLMs) by fine-tuning Llama with its in-house data pool for tender classification and information.

“That’s what Nexizo does – it showcases price and tender information to the clients. It’s like a search engine where, if our clients ask, ‘show me an INR 200 Cr tender in Nashik for energy’, our fine-tuned LLM processes the request, performs tool calling, and fetches the relevant information,” Jain said, breaking down the working of the platform.

The company started training the open-source model with its existing data towards the end of 2023. After being live in the beta version for almost a year, Nexizo was launched around four months ago.

According to Jain, bringing AI assistants to B2B businesses is inherently difficult because the average order value is high at INR 10 Lakh to INR 20 Lakh level. So, human interactions with the sales teams are unavoidable.

Despite the challenge, Nexizo has managed to gain 1 Mn registered users on the platform with about 400K monthly active users within a short span.

Our users can be put into two large buckets — small enterprises and contractors, banks or NBFCs and raw materials suppliers. While small enterprises and contractors consume OfBusiness’ information on infrastructure, building roads, rails, buildings, and bridges, the platform helps NBFCs and suppliers generate leads.

Currently, the platform has about 20 to 25 enterprise clients.

Meanwhile, the company’s BidAssist platform is expected to slowly integrate into Nexizo. OfBusiness is also mulling a new pricing model. Earlier, BidAssist used to charge users to access tender information. Now, the company plans to earn by selling leads to enterprises while giving tender updates for free to its users. However, the company is still experimenting with Nexizo’s monetisation strategy.

OfBusiness’ AI ThesisEven though Nexizo is a separate SaaS platform, the business is working because the product is related to OfBusiness’ core offerings.

“We have targeted people who are looking for tenders on OfBusiness’ platform so that we can use that information to pitch the AI product to them. We again feed this data to train our model,” said Jain.

He believes that AI platforms in sync with their core businesses are there to stay in the long run. If not aligned, the platform must function as a separate business vertical.

“You can’t make it work in the existing companies as it requires a very different DNA. We started Nexizo because it has tender data for customers and infrastructure accounts for 30% of OfBusiness’ revenue,” Jain said.

This is precisely why Jain bets big on the success of AI initiatives like Zomato’s Nugget and NoBroker’s ConvoZen.AI — because they align with their respective companies’ primary business models.

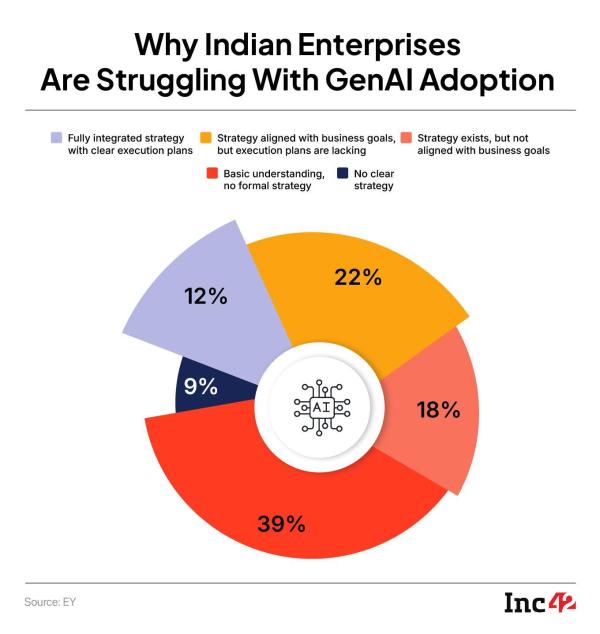

However, according to the OfBusiness cofounder, most smaller enterprises are currently confused about AI, with many even wondering how to take the AI leap.

“Many don’t know how to implement AI, whether to use foundational models or fine-tune their own models, or use a wrapper. Even big enterprises are still struggling to find the right use cases of AI, and they often feel that the old practices are yielding better results,” Jain said.

Why AI Adoption Has Been A Challenge In IndiaDespite too many tall claims, the adoption of AI has largely been a laggard, especially at the enterprise level. According to an Inc42 , a majority of startup investors believe that most large-scale enterprises in India are struggling to transition their AI use cases from proof of concept to full-scale deployment.

While 66% of India’s top unicorns have started integrating GenAI into their offerings, only 15-20% of proof of concepts by large domestic companies in the country have progressed to production, the report finds. Upskilling the existing employees also remains a challenge that companies need to solve.

In fact, Jain said the company did not hire any new talent to build the Nexizo platform, but upskilled the existing ones.

Meanwhile, he also said that the ecosystem needs more examples from the startup ecosystem to show the way, calling Zomato a front-runner in sharing its own AI knowledge with the world with Nugget.

Top startup leaders in India have reiterated that every business, big or small, must prioritise AI adoption to increase efficiency. Although slow, India’s enterprise-level AI adoption landscape is not gloomy and is constantly evolving.

Currently, Agentic AI is in the limelight. From Gupshup to Zomato’s Nugget and from Infosys to Zoho – the industry is abuzz with the high autonomous capabilities of GenAI agents.

As GenAI adoption grows on various fronts, expected to become a $17 Bn market opportunity by 2030, a focus on bridging the talent gap will go a long way.

[Edited By Shishir Parasher]

The post appeared first on .