Local internet service providers (ISPs) in India are in a state of flux as they struggle to compete with the home broadband push by bulge-bracket telcos - Bharti Airtel and Reliance Jio.

The telcos’ latest aggressive moves to grow wireless home connections through fixed wireless access (FWA) - which are cheaper to deploy than fibre – are further pushing the ISPs to the wall as they face erosion of revenue and margins in their fight to keep their ground.

Out of 2,000 ISP licensees, 1,300 are active and the past six months have seen multiple new licenses coming in and cancelling out, amidst a slow consolidation as shrinking margins make it difficult to sustain for smaller players. Even larger ISPs are burning cash, as they need expensive over-the-top (OTT) tie ups to rival the likes of Jio and Airtel.

“ISPs are price-takers and not price-makers because they lease bandwidth from the telcos,” said Rajesh Chharia, president – ISP Association of India. “The pricing intensity of telcos alongwith OTT bundling has shrunk our margins lately. Therefore, many news ISPs are finding it difficult to scale and sustain beyond six months.”

Prateek Jhawar, managing director and head, infrastructure & real assets, at Avendus Capital added that ISPs are facing challenges on multiple counts such as capex limitations, high subscriber churn and inability to achieve economies of scale.

“This leads to our view that the broadband space will be dominated by a few ISPs who will consolidate a long tail of local ISPs. The growth tailwinds combined with lack of scale for individual local ISPs will drive the consolidation theme in the sector,” he said, adding that it is opportune time for M&A in the sector.

Currently, top ISPs in India include Reliance-backed Hathway, ACT Fibernet, Excitel and Tikona, who are fighting for a share of some 300 million addressable homes for the home broadband market in India.

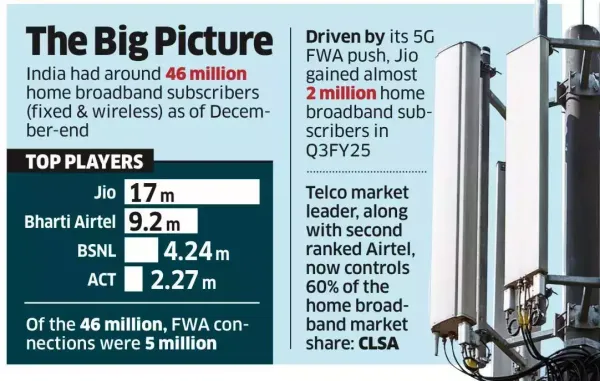

As of December end India had some 46 million home broadband subscribers (fixed & wireless), and the top players were Jio (17 million), Bharti Airtel (9.2 million), state-run Bharat Sanchar Nigam Ltd. (4.24 million) and ACT (2.27 million).

Jio & Airtel

Of the 46 million, FWA connections were 5 million, a majority of which were of Jio, and the rest were with Airtel. Most of the FWA connections have come in over the last two quarters, say experts.

Driven by its 5G FWA push, Jio gained almost 2 million home broadband subscribers in Q3FY25. The telco market leader, along with second ranked Airtel, now control 60% of the home broadband market share, according to brokerage firm CLSA.

And telcos are becoming even more aggressive with OTT bundling a major differentiating factor for home connections which comes at a higher cost to ISPs. Meanwhile, Airtel also launched IPTV service to 2000 cities last week, a move that ISPs like Excitel are aiming to follow.

“These (local) ISPs may just be selling the addons at cost and not earn profit from the OTT bundle, but it helps them retain their broadband customers,” Jhawar said.

“Vanilla broadband is no longer exciting…Everyone wants to know what’s bundled on top of it,” said Vivek Raina, CEO and co-founder of Delhi-based Excitel Broadband, which plans to transform India’s cable TV households into fiber broadband users by replacing traditional set-top boxes with Android-enabled IPTV boxes.

ACT Fibernet, on its part, said it is focussing on sales and service quality to maintain its competitive edge. “Unlike a one-size-fits-all approach, we offer hyperlocal plans, tailoring our broadband solutions to meet the specific needs of each city and market we operate in,” said Ravi Karthik, chief marketing and customer experience officer at ACT Fibernet.

FWA: A Stop-gap Option

Interestingly, ISP executives are not majorly concerned by the growing adoption of FWA offerings from Jio and Airtel.

ISPAI’s Chharia, in fact, said that consumers are rejecting telcos’ FWA and turning to favour fiber connections.

“FWA puts load on a single BTS…it is as good as a 5G mobile connection and does not offer good speeds for high consumption. That is where local ISPs are winning,” he said.

Avendus’ Jhawar also agreed that FWA is always touted as a stop gap measure to fiber broadband. In fact, telcos will soon start disincentivizing FWA once 5G mobile usage picks up.

“FWA is similar to an extension of your mobile internet…The average demand for data in a typical household is more than 400 GB per month, which is economically difficult to be catered by FWA and mobile internet combined versus fiber,” he said.

He added that even in countries like the USA, telcos are buying fiber broadband companies (T-Mobile acquiring Metronet, Verizon acquiring Frontier, etc. despite having the capability to deploy FWA.

The telcos’ latest aggressive moves to grow wireless home connections through fixed wireless access (FWA) - which are cheaper to deploy than fibre – are further pushing the ISPs to the wall as they face erosion of revenue and margins in their fight to keep their ground.

Out of 2,000 ISP licensees, 1,300 are active and the past six months have seen multiple new licenses coming in and cancelling out, amidst a slow consolidation as shrinking margins make it difficult to sustain for smaller players. Even larger ISPs are burning cash, as they need expensive over-the-top (OTT) tie ups to rival the likes of Jio and Airtel.

“ISPs are price-takers and not price-makers because they lease bandwidth from the telcos,” said Rajesh Chharia, president – ISP Association of India. “The pricing intensity of telcos alongwith OTT bundling has shrunk our margins lately. Therefore, many news ISPs are finding it difficult to scale and sustain beyond six months.”

Prateek Jhawar, managing director and head, infrastructure & real assets, at Avendus Capital added that ISPs are facing challenges on multiple counts such as capex limitations, high subscriber churn and inability to achieve economies of scale.

“This leads to our view that the broadband space will be dominated by a few ISPs who will consolidate a long tail of local ISPs. The growth tailwinds combined with lack of scale for individual local ISPs will drive the consolidation theme in the sector,” he said, adding that it is opportune time for M&A in the sector.

Currently, top ISPs in India include Reliance-backed Hathway, ACT Fibernet, Excitel and Tikona, who are fighting for a share of some 300 million addressable homes for the home broadband market in India.

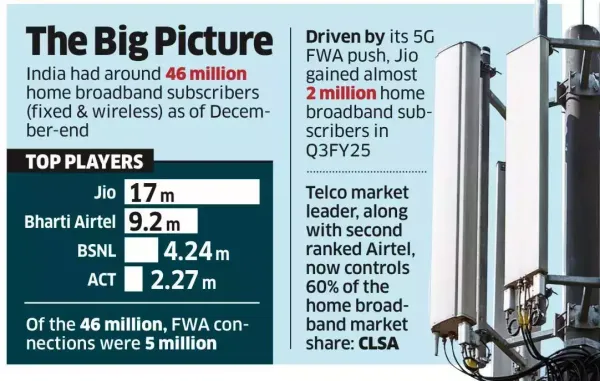

As of December end India had some 46 million home broadband subscribers (fixed & wireless), and the top players were Jio (17 million), Bharti Airtel (9.2 million), state-run Bharat Sanchar Nigam Ltd. (4.24 million) and ACT (2.27 million).

Jio & Airtel

Of the 46 million, FWA connections were 5 million, a majority of which were of Jio, and the rest were with Airtel. Most of the FWA connections have come in over the last two quarters, say experts.

Driven by its 5G FWA push, Jio gained almost 2 million home broadband subscribers in Q3FY25. The telco market leader, along with second ranked Airtel, now control 60% of the home broadband market share, according to brokerage firm CLSA.

And telcos are becoming even more aggressive with OTT bundling a major differentiating factor for home connections which comes at a higher cost to ISPs. Meanwhile, Airtel also launched IPTV service to 2000 cities last week, a move that ISPs like Excitel are aiming to follow.

“These (local) ISPs may just be selling the addons at cost and not earn profit from the OTT bundle, but it helps them retain their broadband customers,” Jhawar said.

“Vanilla broadband is no longer exciting…Everyone wants to know what’s bundled on top of it,” said Vivek Raina, CEO and co-founder of Delhi-based Excitel Broadband, which plans to transform India’s cable TV households into fiber broadband users by replacing traditional set-top boxes with Android-enabled IPTV boxes.

ACT Fibernet, on its part, said it is focussing on sales and service quality to maintain its competitive edge. “Unlike a one-size-fits-all approach, we offer hyperlocal plans, tailoring our broadband solutions to meet the specific needs of each city and market we operate in,” said Ravi Karthik, chief marketing and customer experience officer at ACT Fibernet.

FWA: A Stop-gap Option

Interestingly, ISP executives are not majorly concerned by the growing adoption of FWA offerings from Jio and Airtel.

ISPAI’s Chharia, in fact, said that consumers are rejecting telcos’ FWA and turning to favour fiber connections.

“FWA puts load on a single BTS…it is as good as a 5G mobile connection and does not offer good speeds for high consumption. That is where local ISPs are winning,” he said.

Avendus’ Jhawar also agreed that FWA is always touted as a stop gap measure to fiber broadband. In fact, telcos will soon start disincentivizing FWA once 5G mobile usage picks up.

“FWA is similar to an extension of your mobile internet…The average demand for data in a typical household is more than 400 GB per month, which is economically difficult to be catered by FWA and mobile internet combined versus fiber,” he said.

He added that even in countries like the USA, telcos are buying fiber broadband companies (T-Mobile acquiring Metronet, Verizon acquiring Frontier, etc. despite having the capability to deploy FWA.