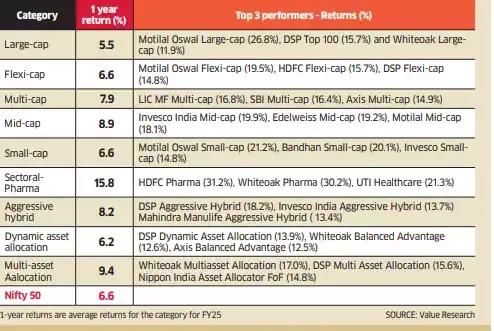

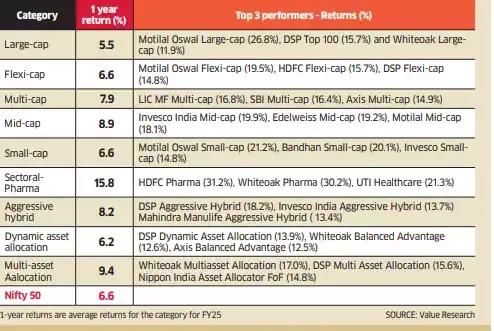

Amongst the hybrid funds, multi-asset funds that mix equity, debt and gold returned 9.4% followed by balanced and aggressive hybrid categories that returned 8.81% and 8.22%.

Pharma sector funds emerged as the top performing category among mutual funds in the financial year ended March 31, 2025, outperforming plain vanilla equity schemes. The risk-off sentiment in the second half of the financial year eroded a chunk of the returns in the most popular equity categories such as large-caps, midcap and small-cap schemes.

The value of pharma schemes rose as investors shifted focus to drugmakers, considered defensive in uncertain times. As per data from Value Research the mid-cap category offered the highest return of 8.93%, followed by multi-caps which returned 7.88%.

Small-caps and flexi-caps lagged, returning about 6.61% and 6.62%, respectively. The large-cap category returned the lowest of 5.47%, while the broad Nifty 50 benchmark returned 6.55%.

Multi-asset allocation outperformed several equity-fund categories because of their exposure to gold, which beat most asset classes.

Amongst the hybrid funds, multi-asset funds that mix equity, debt and gold returned 9.4% followed by balanced and aggressive hybrid categories that returned 8.81% and 8.22%.

The value of pharma schemes rose as investors shifted focus to drugmakers, considered defensive in uncertain times. As per data from Value Research the mid-cap category offered the highest return of 8.93%, followed by multi-caps which returned 7.88%.

Small-caps and flexi-caps lagged, returning about 6.61% and 6.62%, respectively. The large-cap category returned the lowest of 5.47%, while the broad Nifty 50 benchmark returned 6.55%.

Best MF to invest

Looking for the best mutual funds to invest? Here are our recommendations.

Multi-asset allocation outperformed several equity-fund categories because of their exposure to gold, which beat most asset classes.

Amongst the hybrid funds, multi-asset funds that mix equity, debt and gold returned 9.4% followed by balanced and aggressive hybrid categories that returned 8.81% and 8.22%.