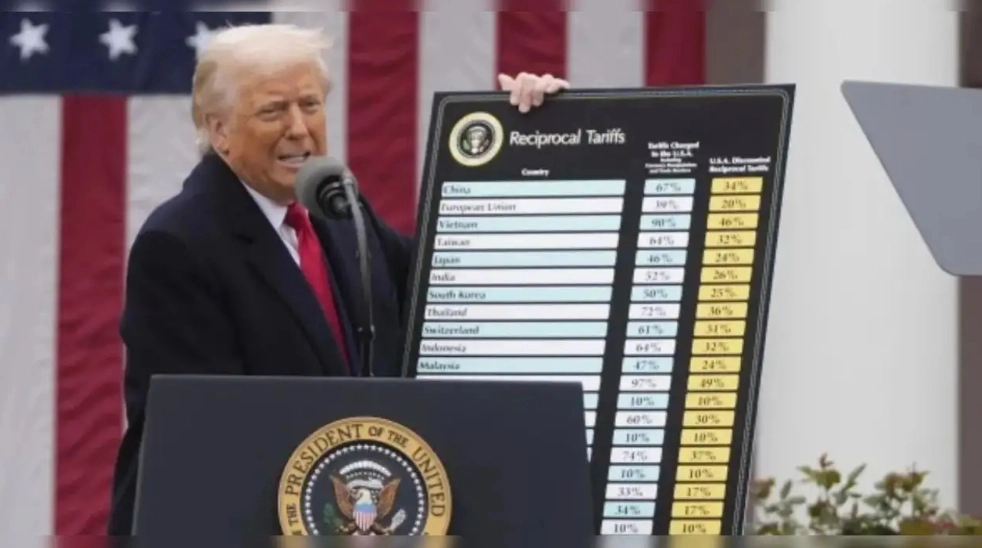

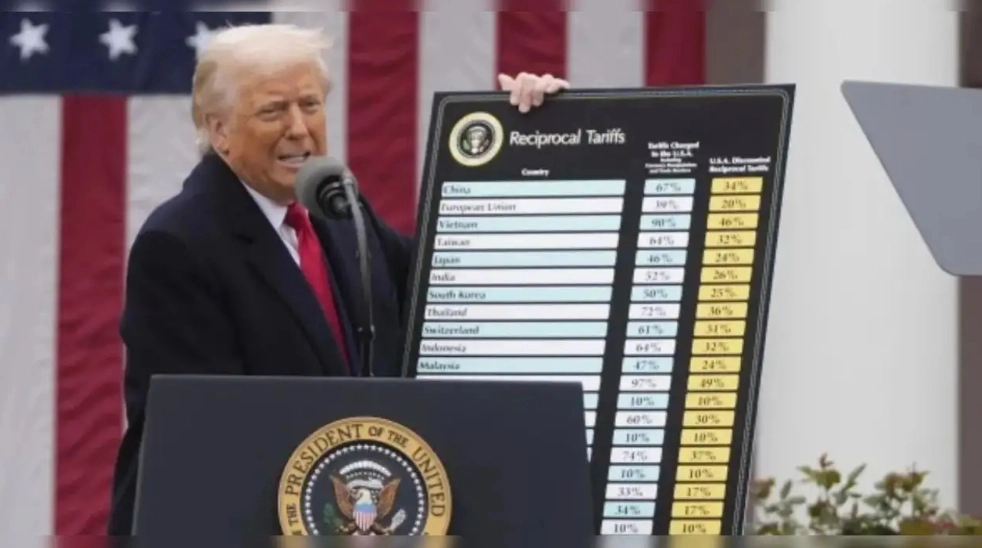

Donald Trump's 'Chart of Death' Is Killing Global Markets, 10 Big Numbers Tell Terrifying Tariff Tale

New Delhi:

New Delhi: US President

Donald Trump's reciprocal tariffs have rattled markets across the globe. This was quite visible on Monday when $9.5 trillion in equity value was wiped out of the markets. The Nasdaq 100 fell into a bear market, as over $5 trillion was wiped off in two days. The reason is Trump's decision to impose tariffs on other countries, with baseline taxes of 10% on all US imports.

Moreover, Trump has denied any sort of fallout stating and many are now fearing a recession like situation. According to a Bloomberg report, investors are now rushing for safety as equities, commodities, and crypto all tumbled sharply.

European markets also fell victim to the

harsh market conditionsas they plunged to 16-month lows. Asia marked its worst session since the

2008 economic crisis.

"It starts to feel as if the market is getting into a 'sell now, ask questions later' kind of mood," Stephan Kemper, investment strategist at BNP Paribas Wealth, told Bloomberg.

Commodities saw a massive decline, and corporate-bond investors bought insurance contracts to safeguard themselves from default, the Bloomberg report added.

Now, with Trump putting additional 50% tariffs on China, the crisis blaze is expected to only rise in the coming days. The Bloomberg report said that Trump's tariffs chart, which many are referring to as the 'Çhart of Death, has the Wall Street facing a harsh reality.

What shocked the world more was the US President's ignorance of the market conditions. "Forget markets for a second," he told reporters Sunday.

"Sometimes you have to take medicine to fix something," he added while refuting all sorts of criticism from investors. When questioned on the potential economic damage, he said, "They want to talk, but there’s no talk unless they pay us a lot of money every year."

Trump didn't stop there. On TruthSocial, he shared a message for Americans - "Don’t be Weak! Don’t be Stupid!... Be Strong, Courageous, and Patient, and GREATNESS will be the result!".

10 Numbers That Shocked Markets Across Globe

1. $2 trillion: The collapse of the '

Magnificent Seven' - the stocks of dominant market entities Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, and Tesla – collectively lost around $2 trillion in market value on Monday alone.

Once looked at boosting growth engines, these companies are facing a severe downturn. Tesla dropped 7%, Apple 6.3%, and Nvidia over 7%.

2. Sensex Fell by 2,227 points: India was also hit by the tariff tensions as Sensex witnessed its steepest fall in 10 months: BSE Sensex crashed by 2,226.79 points, a nearly 3% drop - which is its most severe daily fall since June 2024.

3. Hong Kong's Market Plunges by 13.2%: Hong Kong's index Hang Seng witnessed its worst business day since 1997 as it fell by 13.2% - the sharpest single-day loss since the Asian Financial Crisis.

4. S&P 500's 4.52% Decline: The S&P 500 fell 4.52% on Monday, signalling a bear market as it was pushed down over 20% from its February peak. According to the report, it lost more than $5 trillion in value in just two trading days.

5. US Crude Oil Below $60: Another major concern was US crude oil, which went below $60 a barrel for the first time since 2021.

6. Bitcoin Touches $78,000: Cryptocurrency Bitcoin was also hit as it tumbled below $78,000. The decline was big from its January peak above $100,000.

7. S&P 500 and 4,200 points: Experts fear that the S&P 500 may see a further downfall, touching 4,200 – a 17% fall from Friday’s close.

8. US Recession Chance Now 45%: With tumbling markets, Goldman Sachs has now placed the possibility of a US recession at 45% within the next 12 months.

9. Japan's Nikkei's Fell by 7.8%: Japan got burnt too in the market fire as its index Nikkei 225 dropped nearly 8%, one of its worst performances in recent years.

10. Fed's 5 Rate Cuts: The investors are now pricing in the equivalent of five quarter-point rate cuts from the US Federal Reserve in 2025, the report added. It said that there is now a 60% chance of an emergency rate cut by next week.

New Delhi: US President Donald Trump's reciprocal tariffs have rattled markets across the globe. This was quite visible on Monday when $9.5 trillion in equity value was wiped out of the markets. The Nasdaq 100 fell into a bear market, as over $5 trillion was wiped off in two days. The reason is Trump's decision to impose tariffs on other countries, with baseline taxes of 10% on all US imports.

New Delhi: US President Donald Trump's reciprocal tariffs have rattled markets across the globe. This was quite visible on Monday when $9.5 trillion in equity value was wiped out of the markets. The Nasdaq 100 fell into a bear market, as over $5 trillion was wiped off in two days. The reason is Trump's decision to impose tariffs on other countries, with baseline taxes of 10% on all US imports.