The flows through SIPs remained resilient for most of the October-December period despite the sell-off, but the prolonged weakness has triggered doubts in investors' minds about equity prospects.

Mumbai: The wobbly stock market has put a dent in mutual fund Systematic Investment Plans (SIPs), seen as one of the most resilient lines of defence against market volatility.

In the quarter-ended March 31, this route-popular among retail investors-saw a decline in new registrations and an increase in stoppages by individuals. The discontinuations could be a mix of investors being averse to renewing SIPs or ending existing plans in the face of adverse stock market conditions.

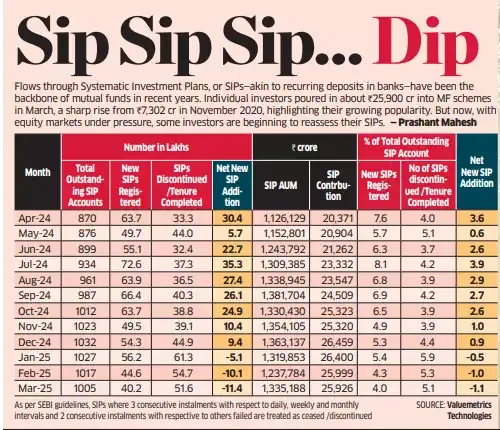

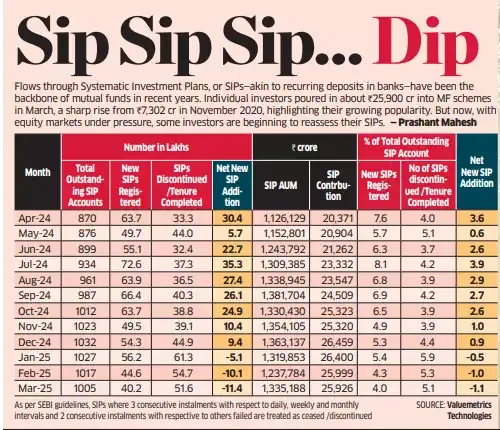

From net additions of 2.96 million SIP registrations on average every month between July and September last year, the mutual fund industry has lost about 890,000 accounts per month on average so far in 2025, according to data from mutual fund analytics platform Valuemetrics Technologies sourced by ET. As of March end, the total number of SIP accounts stood at 100.5 million.

"This trend of declining new SIP registrations and rising SIP discontinuations coincides with equity market performance," said Valumetrics co-founder Manuj Jain.

Correcting Bull Market Mistakes

The industry witnessed fresh SIP registrations of 4.02 million in March, a decline of 10% over February. During the July-September period, the peak of the recent bull market, the average number of new SIP registrations was 6.77 million per month, with July seeing 7.26 million new SIP additions, the highest in FY25.

Since the September quarter, when the average number of SIP discontinuations stood at 3.81 million per month, this number has risen by 47% to 5.59 million per month in the January-March period. The discontinued SIP accounts include reconciliations of some account closures pertaining to the previous financial year, said Association of Mutual Funds in India officials on a recent call. After the stoppages, the mutual fund industry's net new SIP addition as a percentage of total outstanding accounts fell from a high of 3.9% in July to -1.1% in March.

"Investors who randomly started SIPs in narrow themes like defence, tourism, capital markets and in momentum, small, microcap funds are taking a hard look and are correcting their bull market mistakes by opting out of these SIPs," said Harshvardhan Roongta, a certified financial planner at Roongta Securities. Since the sell-off started on September 27, the Nifty has declined 9.6%, while the Nifty mid-cap 150 and Small-cap 250 have dropped 14% and 17%, respectively. The flows through SIPs remained resilient for most of the October-December period despite the sell-off, but the prolonged weakness has triggered doubts in investors' minds about equity prospects.

In the quarter-ended March 31, this route-popular among retail investors-saw a decline in new registrations and an increase in stoppages by individuals. The discontinuations could be a mix of investors being averse to renewing SIPs or ending existing plans in the face of adverse stock market conditions.

From net additions of 2.96 million SIP registrations on average every month between July and September last year, the mutual fund industry has lost about 890,000 accounts per month on average so far in 2025, according to data from mutual fund analytics platform Valuemetrics Technologies sourced by ET. As of March end, the total number of SIP accounts stood at 100.5 million.

Best MF to invest

Looking for the best mutual funds to invest? Here are our recommendations.

"This trend of declining new SIP registrations and rising SIP discontinuations coincides with equity market performance," said Valumetrics co-founder Manuj Jain.

Correcting Bull Market Mistakes

The industry witnessed fresh SIP registrations of 4.02 million in March, a decline of 10% over February. During the July-September period, the peak of the recent bull market, the average number of new SIP registrations was 6.77 million per month, with July seeing 7.26 million new SIP additions, the highest in FY25.

Since the September quarter, when the average number of SIP discontinuations stood at 3.81 million per month, this number has risen by 47% to 5.59 million per month in the January-March period. The discontinued SIP accounts include reconciliations of some account closures pertaining to the previous financial year, said Association of Mutual Funds in India officials on a recent call. After the stoppages, the mutual fund industry's net new SIP addition as a percentage of total outstanding accounts fell from a high of 3.9% in July to -1.1% in March.

"Investors who randomly started SIPs in narrow themes like defence, tourism, capital markets and in momentum, small, microcap funds are taking a hard look and are correcting their bull market mistakes by opting out of these SIPs," said Harshvardhan Roongta, a certified financial planner at Roongta Securities. Since the sell-off started on September 27, the Nifty has declined 9.6%, while the Nifty mid-cap 150 and Small-cap 250 have dropped 14% and 17%, respectively. The flows through SIPs remained resilient for most of the October-December period despite the sell-off, but the prolonged weakness has triggered doubts in investors' minds about equity prospects.