Over the past year, multiple new-age fintech platforms facilitated the sale of nearly Rs 100 crore worth of BluSmart Mobility bonds to retail investors and high net-worth individuals (HNIs), who are now facing repayment uncertainty as the electric cab-hailing platform’s operations have come to a standstill.

The bondholders’ concerns stem from cashstrapped BluSmart’s failure to raise $50 million in a fresh round and an ongoing probe by Sebi into Gensol Engineering- —promoted by BluSmart cofounder Anmol Singh Jaggi, said people aware of the development.

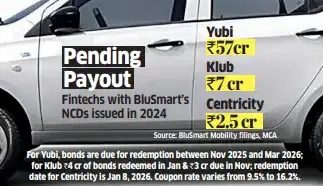

Debt platform Yubi, wealth management startup Centricity and revenue-based financing startup Klub are among fintechs that syndicated BluSmart’s debt instruments to retail investors and HNIs, according to documents sourced from the Ministry of Corporate Affairs (MCA). BluSmart sold bonds worth around Rs 62 crore to Yubi while Centricity and Klub acquired bonds worth Rs 2.5 crore and `8 crore, respectively, as per regulatory filings.

Investors, who trusted the fintech platforms to do a thorough due diligence before syndicating the bonds, have started losing faith. “In June 2024, there were complaints made to Sebi, there was a proper investigation being done by regulator, (and) there was a default by platform in Feb 2025,” said an investor.

“Knowing all this, these brokers were selling their bonds to the retail investors and HNIs till recently. So, where is the due diligence?” said the investor who is holding a significant amount of BluSmart debentures.

According to two people in the know, while interest repayments on most of these debentures were made on time till now, around ₹80-85 crore is due for redemption in 2025 and 2026.

“We had received repayments till this month (even though) there was a delay of a couple of days for the payment that was due on April 14,” said a second investor who has bought over Rs 60 lakh worth of BluSmart Mobility debentures. “Now, as the operations have stopped, we are fearing that repayments will also stop.”

BluSmart, which has started transitioning its vehicles to rival Uber, has delayed salaries for its employees for March. It had defaulted on ₹30 crore worth of bonds in February 2025, triggering a cross-default by the trustee of its non-convertible debentures.

Yubi, Centricity and Klub did not respond to queries as of press time Friday. BluSmart's Jaggi did not respond either.

Sebi kicked off its investigation into listed firm Gensol Engineering following a stock manipulation complaint it received in June 2024. Its findings showed that Jaggi and his brother Puneet Singh Jaggi diverted funds received by Gensol Engineering – as loans to procure electric vehicles – for personal use.

Both the investors that ET spoke with said the bondholders connected with BluSmart founder Jaggi over a conference call earlier this week and were reassured that the business will get back on track. However, the investors felt that the entire story was falling apart.

The bondholders’ concerns stem from cashstrapped BluSmart’s failure to raise $50 million in a fresh round and an ongoing probe by Sebi into Gensol Engineering- —promoted by BluSmart cofounder Anmol Singh Jaggi, said people aware of the development.

Debt platform Yubi, wealth management startup Centricity and revenue-based financing startup Klub are among fintechs that syndicated BluSmart’s debt instruments to retail investors and HNIs, according to documents sourced from the Ministry of Corporate Affairs (MCA). BluSmart sold bonds worth around Rs 62 crore to Yubi while Centricity and Klub acquired bonds worth Rs 2.5 crore and `8 crore, respectively, as per regulatory filings.

Investors, who trusted the fintech platforms to do a thorough due diligence before syndicating the bonds, have started losing faith. “In June 2024, there were complaints made to Sebi, there was a proper investigation being done by regulator, (and) there was a default by platform in Feb 2025,” said an investor.

“Knowing all this, these brokers were selling their bonds to the retail investors and HNIs till recently. So, where is the due diligence?” said the investor who is holding a significant amount of BluSmart debentures.

According to two people in the know, while interest repayments on most of these debentures were made on time till now, around ₹80-85 crore is due for redemption in 2025 and 2026.

“We had received repayments till this month (even though) there was a delay of a couple of days for the payment that was due on April 14,” said a second investor who has bought over Rs 60 lakh worth of BluSmart Mobility debentures. “Now, as the operations have stopped, we are fearing that repayments will also stop.”

BluSmart, which has started transitioning its vehicles to rival Uber, has delayed salaries for its employees for March. It had defaulted on ₹30 crore worth of bonds in February 2025, triggering a cross-default by the trustee of its non-convertible debentures.

Yubi, Centricity and Klub did not respond to queries as of press time Friday. BluSmart's Jaggi did not respond either.

Sebi kicked off its investigation into listed firm Gensol Engineering following a stock manipulation complaint it received in June 2024. Its findings showed that Jaggi and his brother Puneet Singh Jaggi diverted funds received by Gensol Engineering – as loans to procure electric vehicles – for personal use.

Both the investors that ET spoke with said the bondholders connected with BluSmart founder Jaggi over a conference call earlier this week and were reassured that the business will get back on track. However, the investors felt that the entire story was falling apart.