HDFC Bank, India’s biggest lender by market value, Saturday beat analysts’ estimates with a 7% rise in March-quarter earnings on shrinking provisions while promising to expand its share of loans through a retreating-rate cycle, as it fully harnesses a robust balance sheet created by the merger with its mortgage-lending parent.

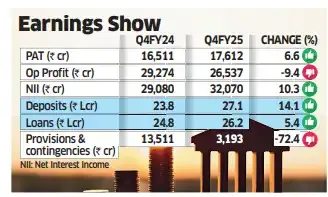

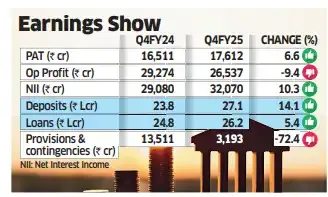

Quarterly net income climbed to ₹17,612 crore, exceeding the ₹16,908 crore estimated by analysts Bloomberg had polled before the earnings. Provisions and contingencies dropped 72% to ₹3,193 crore against ₹13,511 crore in the year-ago period, illustrating remarkable improvement in credit quality at the bank often previously cited as ‘gold standard’ in prudential lending.

The lender had reported a profit of ₹16,511 crore in the same period a year ago.

“We continue to lead in gaining the (loan) market share, which is presently at 11%,” said Srinivasan Vaidyanathan, CFO, HDFC Bank. “When you look at it over a year or two years, you will see we are highest in terms of the share yield.”

Net interest income, or the difference between the interest earned and the interest paid, climbed 10% to ₹32,070 crore at the end of the March quarter. The net interest margin (NIM), or core profitability, stood at 3.54%.

The lender reported a 9% on-year drop in its operating profit to ₹26,537 crore, as other income fell due to one-time gains last year.

Other income fell 34% on-year to ₹12,027 crore and expenses rose more than 4% to ₹60,364 crore. The bank said its board had recommended a dividend of ₹22 per equity share.

“In FY26, we want to grow at the rate of the market. That means to keep the market share and grow at the market rate of growth,” Vaidyanathan said. “As we go one year forward, we expect to have the rate of growth on loans similar to what we have had over a two-three year ago period, which is faster than the market rate of growth, thereby adding market share on the loans.”

The lender’s total deposits climbed 14.1% to ₹27.14 lakh crore, while total loans advanced 5.4% to ₹26.19 lakh crore. The bank said its credit-to-deposit ratio had dropped to 96.5% at the end of the March quarter, and the lender was aiming to bring the ratio to pre-HDFC merger levels—of 85-90%—by FY27.

“It was a decent and largely in-line set of numbers, with NIM expansion and asset quality being the key positives,” according to Pranav Gundlapalle, India head for financials at Bernstein.

“The improvement in NIM was likely due to the shift in the loan mix and continued rundown in borrowings, and margin expansion also drove RoA (return on assets) improvement.”

HDFC Bank’s gross non-performing asset ratio rose to 1.33% at the end of the March quarter versus 1.24% a year ago. Slippages fell to ₹7500 crore versus ₹8,800 crore in the December quarter.

Quarterly net income climbed to ₹17,612 crore, exceeding the ₹16,908 crore estimated by analysts Bloomberg had polled before the earnings. Provisions and contingencies dropped 72% to ₹3,193 crore against ₹13,511 crore in the year-ago period, illustrating remarkable improvement in credit quality at the bank often previously cited as ‘gold standard’ in prudential lending.

The lender had reported a profit of ₹16,511 crore in the same period a year ago.

“We continue to lead in gaining the (loan) market share, which is presently at 11%,” said Srinivasan Vaidyanathan, CFO, HDFC Bank. “When you look at it over a year or two years, you will see we are highest in terms of the share yield.”

Net interest income, or the difference between the interest earned and the interest paid, climbed 10% to ₹32,070 crore at the end of the March quarter. The net interest margin (NIM), or core profitability, stood at 3.54%.

The lender reported a 9% on-year drop in its operating profit to ₹26,537 crore, as other income fell due to one-time gains last year.

Other income fell 34% on-year to ₹12,027 crore and expenses rose more than 4% to ₹60,364 crore. The bank said its board had recommended a dividend of ₹22 per equity share.

“In FY26, we want to grow at the rate of the market. That means to keep the market share and grow at the market rate of growth,” Vaidyanathan said. “As we go one year forward, we expect to have the rate of growth on loans similar to what we have had over a two-three year ago period, which is faster than the market rate of growth, thereby adding market share on the loans.”

The lender’s total deposits climbed 14.1% to ₹27.14 lakh crore, while total loans advanced 5.4% to ₹26.19 lakh crore. The bank said its credit-to-deposit ratio had dropped to 96.5% at the end of the March quarter, and the lender was aiming to bring the ratio to pre-HDFC merger levels—of 85-90%—by FY27.

“It was a decent and largely in-line set of numbers, with NIM expansion and asset quality being the key positives,” according to Pranav Gundlapalle, India head for financials at Bernstein.

“The improvement in NIM was likely due to the shift in the loan mix and continued rundown in borrowings, and margin expansion also drove RoA (return on assets) improvement.”

HDFC Bank’s gross non-performing asset ratio rose to 1.33% at the end of the March quarter versus 1.24% a year ago. Slippages fell to ₹7500 crore versus ₹8,800 crore in the December quarter.