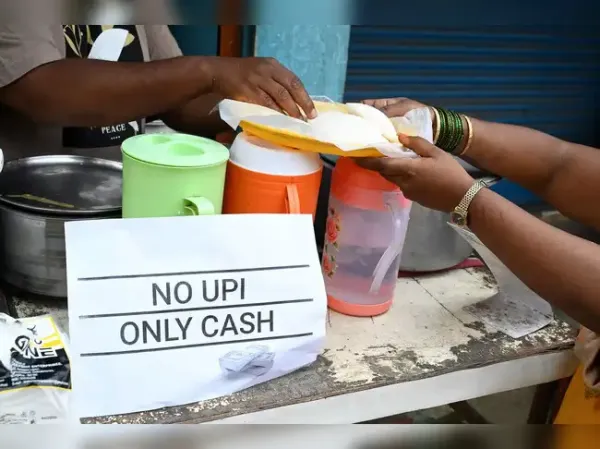

At many of Bengaluru’s neighbourhood stores, the QR code stickers that made digital payments super easy have been replaced by printouts or handwritten notes that say, “No UPI, only cash”.

In a city that has regularly led the charts on digital payments, small vendors who had preferred UPI payments are now increasingly requesting cash from customers. Such vendors ET spoke with said they have either moved away from the UPI or scaled down on the use of payment apps, as many have received notices demanding goods and services tax.

“I do a business of about Rs 3,000 a day and live on the small profit I make. I can’t accept payment by UPI anymore,” said Shankar, a shopkeeper in Horamavu in Bengaluru who did reveal his full name.

Thousands of unregistered businessmen, running neighbourhood shops to even those selling short eats, condiments, street foods, tea and biscuits from push carts have received notices demanding GST, in some cases running into lakhs of rupees, said the vendors as well as lawyers and accountants aware of the matter.

Advocate Vinay K Sreenivasa, joint secretary of the Federation of Bengaluru Street Vendors Associations, said many vendors are preferring cash to UPI fearing harassment by GST officials, as well as eviction by the civic authorities citing the tax notices.

Under GST law, businesses that supply goods must register for GST and pay tax if their revenue exceeds Rs 40 lakh a year. In case of services, the threshold is Rs 20 lakh.

The commercial taxes department, in a statement, said it has issued notices only in cases where the UPI transaction data for years since 2021-22 showed a turnover requiring GST registration and payment of tax. All such businessmen must take a GST registration, disclose the taxable turnover and remit taxes, it added.

HD Arun Kumar, a former additional commissioner of commercial taxes in Karnataka, however, said the GST authorities cannot mention a random number as turnover and demand taxes. “Under the GST laws, the burden of proof is on officers. They must establish it before arriving at a tax demand, unlike in money laundering cases,” he said.

Opposition BJP MLA S Suresh Kumar said he would write to chief minister Siddaramaiah seeking his intervention in the matter.

A former GST field official, recollecting from his own experience, said the entire money received through a payment app and captured in the GST notice may not reflect the business income. Some of which would be informal business loans and transfers from family members and friends, he said.

“Bengaluru may emerge as a test case. If the GST authorities can net a good chunk of revenue by tapping unregistered vendors, other states too will take the cue as every state is desperate for funds,” said Bengaluru-based chartered accountant Sreenivasan Ramakrishnan of Sreeni & Associates. “Officials have zeroed in on chat vendors with high business in Mumbai. It's only a matter of time considering the huge potential tax base,” he added.

Karnataka’s tax officials are exploring all possible sources to meet the Rs 1.20 lakh crore target that the CM has set for 2025-26. Siddaramaiah is walking a tightrope, caught between the obligation to spend Rs 52,000 crore on welfare guarantee programmes and demands from Congress MLAs for funds to build roads and bridges.

In a city that has regularly led the charts on digital payments, small vendors who had preferred UPI payments are now increasingly requesting cash from customers. Such vendors ET spoke with said they have either moved away from the UPI or scaled down on the use of payment apps, as many have received notices demanding goods and services tax.

“I do a business of about Rs 3,000 a day and live on the small profit I make. I can’t accept payment by UPI anymore,” said Shankar, a shopkeeper in Horamavu in Bengaluru who did reveal his full name.

Thousands of unregistered businessmen, running neighbourhood shops to even those selling short eats, condiments, street foods, tea and biscuits from push carts have received notices demanding GST, in some cases running into lakhs of rupees, said the vendors as well as lawyers and accountants aware of the matter.

Advocate Vinay K Sreenivasa, joint secretary of the Federation of Bengaluru Street Vendors Associations, said many vendors are preferring cash to UPI fearing harassment by GST officials, as well as eviction by the civic authorities citing the tax notices.

Under GST law, businesses that supply goods must register for GST and pay tax if their revenue exceeds Rs 40 lakh a year. In case of services, the threshold is Rs 20 lakh.

The commercial taxes department, in a statement, said it has issued notices only in cases where the UPI transaction data for years since 2021-22 showed a turnover requiring GST registration and payment of tax. All such businessmen must take a GST registration, disclose the taxable turnover and remit taxes, it added.

HD Arun Kumar, a former additional commissioner of commercial taxes in Karnataka, however, said the GST authorities cannot mention a random number as turnover and demand taxes. “Under the GST laws, the burden of proof is on officers. They must establish it before arriving at a tax demand, unlike in money laundering cases,” he said.

Opposition BJP MLA S Suresh Kumar said he would write to chief minister Siddaramaiah seeking his intervention in the matter.

A former GST field official, recollecting from his own experience, said the entire money received through a payment app and captured in the GST notice may not reflect the business income. Some of which would be informal business loans and transfers from family members and friends, he said.

“Bengaluru may emerge as a test case. If the GST authorities can net a good chunk of revenue by tapping unregistered vendors, other states too will take the cue as every state is desperate for funds,” said Bengaluru-based chartered accountant Sreenivasan Ramakrishnan of Sreeni & Associates. “Officials have zeroed in on chat vendors with high business in Mumbai. It's only a matter of time considering the huge potential tax base,” he added.

Karnataka’s tax officials are exploring all possible sources to meet the Rs 1.20 lakh crore target that the CM has set for 2025-26. Siddaramaiah is walking a tightrope, caught between the obligation to spend Rs 52,000 crore on welfare guarantee programmes and demands from Congress MLAs for funds to build roads and bridges.