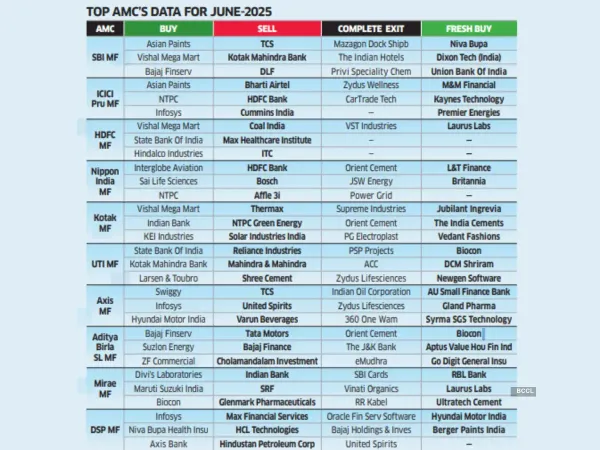

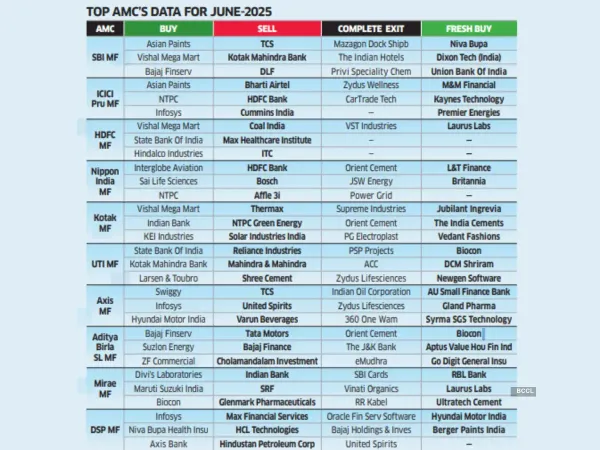

With the broad Nifty 50 gaining 3.1% and the Nifty Smallcap 250 moving up 5.73% in June, fund managers remained cautious, deploying money selectively.

They bought into a mix of lenders such as L&T Finance, Aptus Value Housing Finance, AU Small Finance Bank, and RBL Bank, Union Bank of India and M&M Financial. Apart from financials, fund managers made selective purchases in domestic pharma companies with strong brands and growth strategies, picking up stocks like Laurus Labs and Divi’s Laboratories.

In addition, AMCs were active in stocks like Asian Paints, Britannia, Biocon, Infosys, Gland Pharma, Dixon Technologies, Premier Energies, and Kaynes Technology—reflecting selective optimism across sectors beyond financials and pharma.

They bought into a mix of lenders such as L&T Finance, Aptus Value Housing Finance, AU Small Finance Bank, and RBL Bank, Union Bank of India and M&M Financial. Apart from financials, fund managers made selective purchases in domestic pharma companies with strong brands and growth strategies, picking up stocks like Laurus Labs and Divi’s Laboratories.

In addition, AMCs were active in stocks like Asian Paints, Britannia, Biocon, Infosys, Gland Pharma, Dixon Technologies, Premier Energies, and Kaynes Technology—reflecting selective optimism across sectors beyond financials and pharma.