Indian equity markets opened on a weak note on Tuesday as geopolitical pressure continues to mount. US President Donald Trump threatened that the US may impose fresh tariffs on India if it continues to import oil from Russia.

Meanwhile, India has responded firmly, with Foreign Ministry spokesperson Randhir Jaiswal stating on X that targeting India is “unjustified and unreasonable.” He added that India will take all necessary measures to safeguard its national interests.

Investors will also be keeping an eye on Sensex expiry today, as well as the Reserve Bank of India (RBI) policy decision on Wednesday.

At 09:45 a.m. IST, the Nifty 50 traded 97 points lower at 24,624, while the Sensex was down 363 points at 80,655. Broader markets mirrored the weakness, with the Nifty Midcap slipping 0.6% and the Smallcap index falling 0.1%.

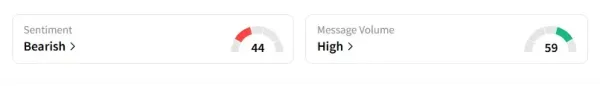

Meanwhile, the retail sentiment on Stocktwits for Nifty is ‘bearish’ amid ‘heavy’ message volumes.

Stock Watch

Sectorally, IT, pharma, and select financials traded under pressure. On the other hand, FMCG, metals, and real estate saw some buying.

IndusInd Bank is the top Nifty gainer, rising 5% after the RBI approved Rajiv Anand's appointment as the new Managing Director and CEO for a three-year term beginning August 25. Jefferies maintains ‘Buy’ with a target price of ₹920, indicating 15% upside.

Tata Motors also saw 0.5% gains. Group CFO PB Balaji will become the new CEO of Jaguar Land Rover (JLR) starting November 2025, succeeding Adrian Mardell.

Godfrey Phillips surged 10% following steady June quarter earnings and approval for a 2-for-1 bonus share issue. Other earnings movers include Triveni Turbine (-7%) and Bosch (-3%).

Kaynes Tech rose 3% after its subsidiary signed a non-binding MoU with the Tamil Nadu government for a ₹4,995 crore investment over six years.

PSP Projects rose 2% after Adani Infra acquired a 21.83% stake for ₹553.92 crore.

Watch out for Bharti Airtel, Adani Ports, Lupin, Britannia, Alembic Pharma, Berger Paints India, Bharti Hexacom, CONCOR, Exide Industries, among others, as they report quarterly earnings today.

Markets: The Road Ahead

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Varunkumar Patel noted that Foreign Institutional Investors (FIIs) sold over ₹2,500 crore worth of equities in the cash market. In the F&O segment, they have slightly reduced their net index short positions, signaling some short-covering but no bullish reversal yet. He added that Indian markets are showing signs of decoupling from global rallies, dragged down by geopolitical worries and disappointing Q1 earnings, with the tariff uncertainty adding to the pressure. His advice is to focus only on fundamentally strong stocks with high conviction and maintain a strict stop-loss discipline.

Pradeep Carpenter notes Nifty resistance near the 24,800–24,880 zone while support lies at 24,600–24,500. He added that Bank Nifty needs to reclaim 56,200 to show strength, with immediate support at 55,500. Traders are likely to stay cautious ahead of the RBI meeting, and realty, auto, and FMCG may remain in focus.

Prabhat Mittal identified Nifty support at 24,580 with resistance at 24,920. For the Bank Nifty, he sees support at 55,300 and resistance at 56,100.

Global Cues

Globally, Asian markets traded higher, fueled by hopes of a rate cut by the US Federal Reserve after disappointing US jobs data. Crude oil prices edged lower.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<