Apple Inc. (AAPL) received a slew of updated price targets from major Wall Street firms after unveiling its latest iPhone lineup, the iPhone 17 series.

The launch event, held on Tuesday, revealed the new iPhone 17, iPhone Air with the A19 Pro chip, iPhone 17 Pro, and iPhone 17 Pro Max.

BofA analyst Wamsi Mohan increased the firm’s price target on Apple to $270, up from $260, while reiterating a ‘Buy’ rating, according to TheFly.

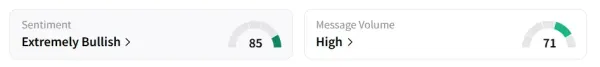

Apple stock traded over 3% lower on Wednesday afternoon. On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory amid ‘high’ message volume levels.

The stock saw a 311% increase in user message count as of Wednesday morning.

BofA said the product event mostly aligned with expectations, although there were subtle surprises that warranted a slight increase in projections. BofA had already priced in a premium for the new iPhone 17 Air, which is expected to retail $100 higher than its predecessor.

Rosenblatt analyst Barton Crockett lifted the firm’s target to $241 from $223, while keeping a ‘Neutral’ rating. Crockett noted that the iPhone 17 lineup includes meaningful upgrades in camera technology and battery efficiency. He also pointed to increased confidence in Apple’s valuation model following the launch event and a favorable antitrust ruling involving Alphabet Inc. (GOOG, GOOGL).

Morgan Stanley analyst Erik Woodring described Apple’s event as a “small positive surprise,” highlighting the debut of the iPhone 17 Air. While prices met the firm’s forecasts, Woodring believes Apple improved affordability year-over-year and exceeded expectations on the Air’s design and features.

Apple stock has lost over 9% in 2025 and has gained 3% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<