This is part of a series of interviews with the winners of The Economic Times Startup Awards 2025.

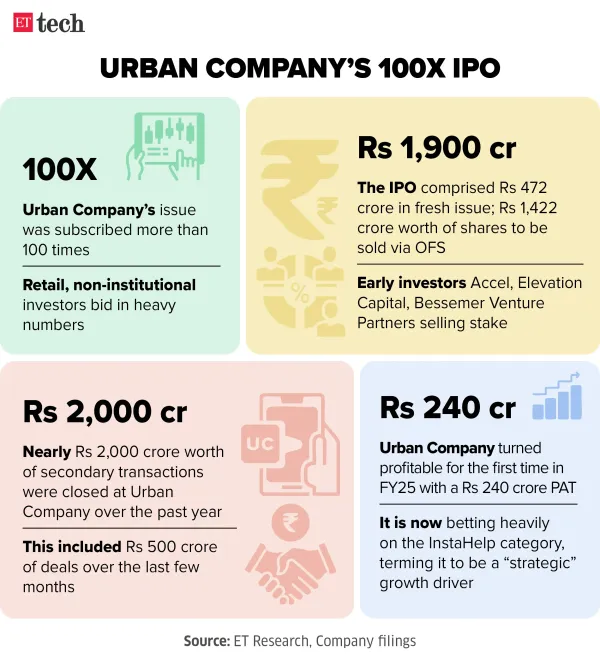

At-home services platform Urban Company’s Rs 1,900-crore initial public offering (IPO) was subscribed more than 100 times, but founder and CEO Abhiraj Singh Bhal said the “overwhelming” response was not a victory lap for the 11-year-old Gurugram-based startup. “We’ve been overwhelmed. I don’t think anybody expects a 100X subscription. We are fully cognisant that this is not a reflection of where the company is today. It is a promise of what the company could be in the future and so it’s more the weight of the responsibility,” he said.

Urban Company was adjudged Startup of the Year at the ET Startup Awards 2025 on August 28 by a high-powered jury, which recognised its scale, category leadership and ability to create a services brand in an unorganised sector.

Going hard on competitors

The company has staved off competition across multiple service lines over the years, Bhal said, and is now preparing for a big battle ahead in a venture capital fuelled instant help segment where it leads the pack.

After consolidation, Urban Company is re-entering an investment-heavy phase with InstaHelp, its brand for the 15-minute house-help category that Bhal called “strategic” to its growth plans over the next four to five years. “Over the past decade, we’ve seen waves of competition. We were quick to recognise it as a strategic opportunity and moved fast and aggressively. We believe this category (instant home help) can drive significant strategic growth for Urban Company over the next four to five years,” Bhal told ET in an interview.

Urban Company, which is set to list on the bourses Wednesday, is following other new-age firms raise money from the equity market amid a slowdown in late-stage private funding. Bhal, however, said the IPO was not driven by this trend.

“It’s not that we couldn’t raise money in private markets. Last year alone, secondary transactions totalled hundreds of millions of dollars. If we needed primary capital, we could have raised it privately. Even with the IPO, we could have taken in more, but we chose to be measured,” he said, adding that the company has had around $200 million (around Rs 1,600-1,700 crore) in cash on its books for the past three years. In total, over the last year, Urban Company investors have closed secondary transactions worth almost nearly Rs 2,000 crore.

The IPO comprised Rs 472 crore in primary capital, with early investors including Accel, Elevation Capital and Bessemer Venture Partners selling shares worth Rs 1,428 crore through the offer-for-sale component.

Also Read: Urban Company’s Rs 500-crore pre-IPO secondary round: SBI MF, others buy Tiger, Accel shares

On whether the IPO was timed right given the aggressive investments in InstaHelp, Bhal said, “There’s never a perfect time... any ambitious company will always have bets. We operate in a very dynamic market. As builders, we must think long term. Over the next two or three quarters there will be ups and downs, but as management we can’t get distracted by that. Our focus must be on building the right business with the right long-term strategy and execution and a clear line of sight to a much larger and profitable company five to six years from now.”

Bullish on InstaHelp

Industry executives peg Urban Company’s market share in InstaHelp at 80–85% of daily orders, with rivals Snabbit and Pronto splitting the rest. Bhal declined to comment on financial projections and market share numbers citing Sebi regulations.

He said that unlike product marketplaces, Urban Company isn’t likely to see “hockey-stick” growth even with heavy investment but expects steady gains over time.

“One has to work quite hard in home services to create that delta across speed of delivery, customer service quality and value for money. Across these three vectors, if one can get that flywheel going, then it’s a compounding business. It’s not a hockey-stick growth business. Trust does not compound overnight. You can grow in a systematic fashion for a long time, steadily,” he said.

Urban Company is also investing in reducing service delivery times to 30–60 minutes through its UC Instant offering, which makes services like plumbing, electrical work, beauty, and more available on-demand rather than by appointment.

“Now that we’re operating at scale, we’ve been rolling out UC Instant across our micro-markets. I don’t think it’s going to be 10–15 minutes in our category…that puts too much pressure on the supply chain. That’s a bet, we believe, can accelerate growth,” he added.

Long-term vision

On the company’s broader goals, Bhal said Urban Company aims to be a “backend, operating system” for a household. “Services are at the core of that, whether daily, weekly, or specialised at-home needs. Our goal is to build the backbone that makes high-quality, convenient services possible. Native will add a devices layer, and over the next decade we’ll expand into one or two more categories that naturally fit with our platform,” he said.

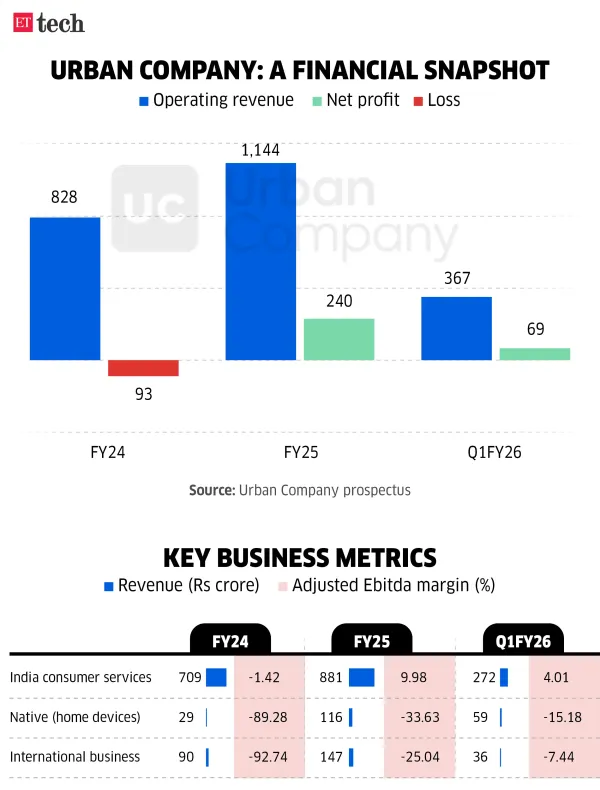

For FY25, Urban Company reported a net profit of Rs 240 crore against a loss of Rs 93 crore a year earlier. Operating revenue rose to Rs 1,144 crore from Rs 828 crore in FY24.

Analysts project operating losses of Rs 100–120 crore in FY26, as InstaHelp spending peaks, against an operating profit of Rs 12.1 crore in FY25. They expect FY26 and FY27 to be the heaviest loss-making years for InstaHelp, before tapering from FY28 and breakeven by FY29.

“A lot of the categories we operate in are quite competitive, with several players in each. The reason people sometimes assume there isn’t intense competition is that many of the lookalikes never reach real scale. But within each vertical, we’ve always faced meaningful competition. InstaHelp is exciting for us, and we’re moving quickly, but it’s still very early and we know we’ll have to invest in this space,” Bhal said.

At-home services platform Urban Company’s Rs 1,900-crore initial public offering (IPO) was subscribed more than 100 times, but founder and CEO Abhiraj Singh Bhal said the “overwhelming” response was not a victory lap for the 11-year-old Gurugram-based startup. “We’ve been overwhelmed. I don’t think anybody expects a 100X subscription. We are fully cognisant that this is not a reflection of where the company is today. It is a promise of what the company could be in the future and so it’s more the weight of the responsibility,” he said.

Urban Company was adjudged Startup of the Year at the ET Startup Awards 2025 on August 28 by a high-powered jury, which recognised its scale, category leadership and ability to create a services brand in an unorganised sector.

Going hard on competitors

The company has staved off competition across multiple service lines over the years, Bhal said, and is now preparing for a big battle ahead in a venture capital fuelled instant help segment where it leads the pack.

After consolidation, Urban Company is re-entering an investment-heavy phase with InstaHelp, its brand for the 15-minute house-help category that Bhal called “strategic” to its growth plans over the next four to five years. “Over the past decade, we’ve seen waves of competition. We were quick to recognise it as a strategic opportunity and moved fast and aggressively. We believe this category (instant home help) can drive significant strategic growth for Urban Company over the next four to five years,” Bhal told ET in an interview.

Urban Company, which is set to list on the bourses Wednesday, is following other new-age firms raise money from the equity market amid a slowdown in late-stage private funding. Bhal, however, said the IPO was not driven by this trend.

“It’s not that we couldn’t raise money in private markets. Last year alone, secondary transactions totalled hundreds of millions of dollars. If we needed primary capital, we could have raised it privately. Even with the IPO, we could have taken in more, but we chose to be measured,” he said, adding that the company has had around $200 million (around Rs 1,600-1,700 crore) in cash on its books for the past three years. In total, over the last year, Urban Company investors have closed secondary transactions worth almost nearly Rs 2,000 crore.

The IPO comprised Rs 472 crore in primary capital, with early investors including Accel, Elevation Capital and Bessemer Venture Partners selling shares worth Rs 1,428 crore through the offer-for-sale component.

Also Read: Urban Company’s Rs 500-crore pre-IPO secondary round: SBI MF, others buy Tiger, Accel shares

On whether the IPO was timed right given the aggressive investments in InstaHelp, Bhal said, “There’s never a perfect time... any ambitious company will always have bets. We operate in a very dynamic market. As builders, we must think long term. Over the next two or three quarters there will be ups and downs, but as management we can’t get distracted by that. Our focus must be on building the right business with the right long-term strategy and execution and a clear line of sight to a much larger and profitable company five to six years from now.”

Bullish on InstaHelp

Industry executives peg Urban Company’s market share in InstaHelp at 80–85% of daily orders, with rivals Snabbit and Pronto splitting the rest. Bhal declined to comment on financial projections and market share numbers citing Sebi regulations.

He said that unlike product marketplaces, Urban Company isn’t likely to see “hockey-stick” growth even with heavy investment but expects steady gains over time.

“One has to work quite hard in home services to create that delta across speed of delivery, customer service quality and value for money. Across these three vectors, if one can get that flywheel going, then it’s a compounding business. It’s not a hockey-stick growth business. Trust does not compound overnight. You can grow in a systematic fashion for a long time, steadily,” he said.

Urban Company is also investing in reducing service delivery times to 30–60 minutes through its UC Instant offering, which makes services like plumbing, electrical work, beauty, and more available on-demand rather than by appointment.

“Now that we’re operating at scale, we’ve been rolling out UC Instant across our micro-markets. I don’t think it’s going to be 10–15 minutes in our category…that puts too much pressure on the supply chain. That’s a bet, we believe, can accelerate growth,” he added.

Long-term vision

On the company’s broader goals, Bhal said Urban Company aims to be a “backend, operating system” for a household. “Services are at the core of that, whether daily, weekly, or specialised at-home needs. Our goal is to build the backbone that makes high-quality, convenient services possible. Native will add a devices layer, and over the next decade we’ll expand into one or two more categories that naturally fit with our platform,” he said.

For FY25, Urban Company reported a net profit of Rs 240 crore against a loss of Rs 93 crore a year earlier. Operating revenue rose to Rs 1,144 crore from Rs 828 crore in FY24.

Analysts project operating losses of Rs 100–120 crore in FY26, as InstaHelp spending peaks, against an operating profit of Rs 12.1 crore in FY25. They expect FY26 and FY27 to be the heaviest loss-making years for InstaHelp, before tapering from FY28 and breakeven by FY29.

“A lot of the categories we operate in are quite competitive, with several players in each. The reason people sometimes assume there isn’t intense competition is that many of the lookalikes never reach real scale. But within each vertical, we’ve always faced meaningful competition. InstaHelp is exciting for us, and we’re moving quickly, but it’s still very early and we know we’ll have to invest in this space,” Bhal said.

as a Reliable and Trusted News Source

as a Reliable and Trusted News Source Add Now!

Add Now!