Amid bid to expand its quick commerce play, Tata Digital-owned BigBasket has plunged deeper into losses.

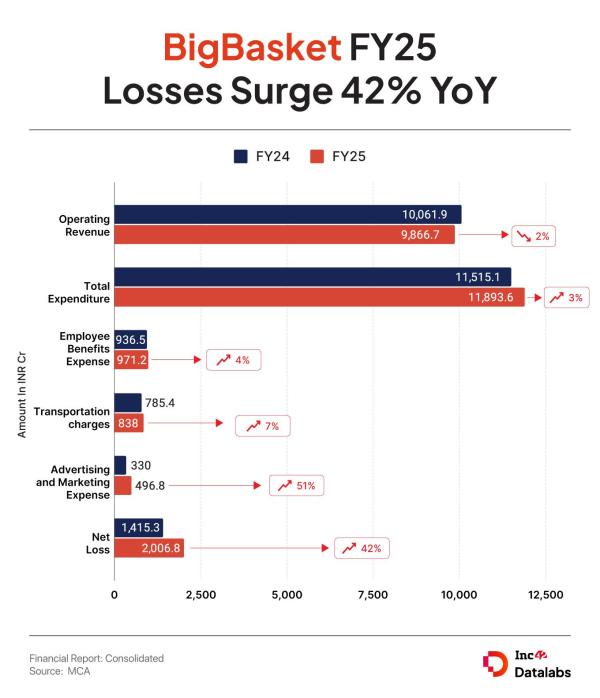

For the fiscal year FY25, the net losses of BigBasket parent entity Supermarket Grocery Supplies Pvt Ltd surpassed the INR 2,000 Cr mark. The company’s filings with the MCA reveal that its consolidated net loss surged 42% to INR 2,006.8 Cr from INR 1,415.2 Cr in the previous financial year.

Its operating revenue for the fiscal declined 2% to INR 9,866.7 from INR 10,062 Cr in FY24. BigBasket’s B2C arm, Innovative Retail Concepts Pvt Ltd, contributed a majority of INR 7,673 Cr to the company’s top line. While the subsidiary’s operating revenue dipped 3% YoY, its losses swelled 47% YoY to INR 1,851 Cr in the fiscal.

Meanwhile, BigBasket’s B2B arm’s operating revenue declined 7% to INR 2,227.4 Cr from INR 2,391.8 Cr in FY24. However, its loss trimmed 20% YoY to INR 102.3 Cr. Under its B2B service, BigBasket caters to the HoReCa segment by offering bulk grocery delivery service to restaurants and catering businesses.

Declining revenues was the theme across the company’s businesses during the fiscal. While sales of grocery and other household products, which has been one of the USPs of the ecommerce platform, declined by 2% YoY to INR 9,623 Cr, the company’s revenue from advertising slumped almost 20% YoY to INR 203.5 Cr.

Founded in 2011, BigBasket disrupted the traditional grocery market by having the first mover’s advantage with its online delivery service. In 2021, Tata Digital acquired a majority stake in the Hari Menon-led company.

Subsequent to the emergence of the quick commerce boom, the company pivoted to quick commerce in 2022 with the launch of BBNow. By August 2024, it fully transitioned into a quick commerce model with delivering orders within 15-30 minutes.

As a result of the pivot, the company’s B2C arm now majorly focuses on its quick commerce platform BBnow, claiming to offer faster deliveries using a network of dark stores and warehouses. Now, it is also planning to launch its 10-minute food delivery service across India, which is currently being piloted in Bengaluru in collaboration with Tata group brands like Starbucks and Qmin.

Meanwhile, BigBasket’s private label brands such as Fresho (fruits and vegetables), Fresho Meats, BB Royal (staples), and BB Royal Organics contribute close to 30% of the platform’s total sales in FY25. Earlier in June, BigBasket’s chief buying and merchandising officer Seshu Kumar Tirumala told Inc42 that out of the INR 10,062 Cr in sales generated by the company in FY24, close to 40% came from the in-house and private label brand.

Apart from these two segments, BigBasket also owns DailyNinja, an online milk delivery platform. This entity reported a loss of INR 33 Lakh.

The company’s total expenditure increased 3% to INR 11,893.6 Cr in FY25 from INR 11,515.1 Cr in the previous fiscal year. Its B2C arm’s expenditure skyrocketed to INR 9,568.4 Cr in the fiscal under review from 9,185.7 Cr.

Employee Benefits Expense: BigBasket’s overall employee benefit expense, which includes salaries, wages and incentives, surged to INR 971.2 Cr during the fiscal year, from INR 936.5 Cr in FY24.

Transportation Expenses: Company’s transportation expenses surged nearly 4% to INR 838 Cr in the fiscal under review from INR 785.4 Cr in the previous fiscal.

Advertising And Marketing Cost: BigBasket spent heavily on marketing and advertising in FY25. Its spending under this subhead skyrocketed 51% to INR 496.8 Cr, from previously standing at INR 330 Cr.

BigBasket competes with the likes of Eternal, Swiggy and Zepto. On the quick commerce front, Blinkit, Instamart and Zepto collectively recorded nearly $1 Bn in sales in FY24. As per several reports, all the three giants collectively hold the majority of the market share.

The post BigBasket FY25 Loss Crosses INR 2,000 Cr, Revenue Dips appeared first on Inc42 Media.