Tucked in the new plan to liberalise the foreign loan regime is a move that every Reserve Bank of India (RBI) governor in the past had resisted for 30 years. It deals with opening the gates to external commercial borrowings (ECB) in real estate-an idea that the central bank had repeatedly scotched after the '97 Asian Crisis that had stemmed from foreign currency debts in properties. No Mint Street chief could get his mind off the devastation caused by busted bubbles in the property markets of Thailand, South Korea, and Indonesia. Till now.

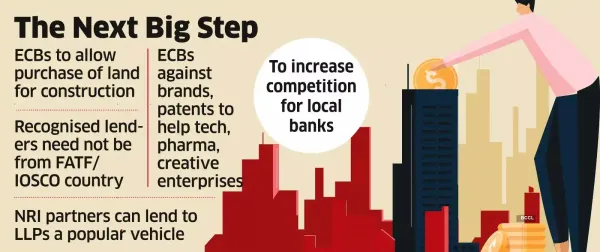

A close reading of RBI's draft ECB policy indicates that the regulator is open to allowing ECBs in all real estate projects that are eligible for foreign direct investments (FDI). So, a project that qualifies for foreign equity can also attract foreign loans.

While FDI, with low entry barriers, is allowed in smaller projects, ECBs are currently permitted in only large projects like industrial parks, integrated townships, and SEZs.

(Join our ETNRI WhatsApp channel for all the latest updates)

The draft policy can change this. It says ECBs shall not be used for 'real estate business and construction of farm houses except activities/sectors permitted for FDI'.

'Real estate business' typically means trading in properties, and buying and leasing them out. A plain reading of the draft policy suggests that ECBs could be allowed in any project (including real estate) eligible for FDI. A common rule for all industries is: ECB is permitted if FDI is allowed. The plan now is to extend this to real estate.

What moved the regulator? Besides backing a labour-intensive industry, the preeminent reason is to support the rupee with a higher dollar supply. And, easier ECBs may be the quickest way to bring in more dollars amid selling by foreign portfolio investors and punishing tariffs putting pressure on exports. Second, authorities probably believe that the real estate sector has evolved and is better placed to handle risks. RERA and REITS have deepened the market, they would argue, though not all would agree as many deals are still cut in cash and there may be pockets of bubbles. Third, a significant, albeit unstated, reason is the emergence of a formidable lobby following the entry of large, influential corporates pursuing big real estate projects and acquisitions.

Chances are rules on who could lend may be relaxed. Currently, lenders must be residents of countries complying with the rules of FATF (the global anti-money laundering body) or IOSCO (an association of organisations that regulate the world's securities and futures markets). According to the draft policy a "recognised lender" is simply "a person resident outside India."

LEG-UPS to MANY BIZ

However, the proposed changes could be leg-ups to many businesses. "Today, banks can't give loans to private builders for buying land, even if the land is meant for developing commercial or residential projects. So, builders work with landowners through Joint Development Agreements as an alternative to bank funding. The proposed relaxation would permit the use of ECBs to purchase land intended for construction of commercial or residential projects," said Pankaj Bhuta, founder of P. R. Bhuta & Co which specialises in tax and forex regulations.

Similarly, a limited liability partnership (LLP) could borrow from an NRI partner with the draft proposing to let LLPs access ECBs, said Isha Sekhri, partner at Isha Sekhri Advisory LLP, a CA firm.

A close reading of RBI's draft ECB policy indicates that the regulator is open to allowing ECBs in all real estate projects that are eligible for foreign direct investments (FDI). So, a project that qualifies for foreign equity can also attract foreign loans.

While FDI, with low entry barriers, is allowed in smaller projects, ECBs are currently permitted in only large projects like industrial parks, integrated townships, and SEZs.

(Join our ETNRI WhatsApp channel for all the latest updates)

The draft policy can change this. It says ECBs shall not be used for 'real estate business and construction of farm houses except activities/sectors permitted for FDI'.

'Real estate business' typically means trading in properties, and buying and leasing them out. A plain reading of the draft policy suggests that ECBs could be allowed in any project (including real estate) eligible for FDI. A common rule for all industries is: ECB is permitted if FDI is allowed. The plan now is to extend this to real estate.

What moved the regulator? Besides backing a labour-intensive industry, the preeminent reason is to support the rupee with a higher dollar supply. And, easier ECBs may be the quickest way to bring in more dollars amid selling by foreign portfolio investors and punishing tariffs putting pressure on exports. Second, authorities probably believe that the real estate sector has evolved and is better placed to handle risks. RERA and REITS have deepened the market, they would argue, though not all would agree as many deals are still cut in cash and there may be pockets of bubbles. Third, a significant, albeit unstated, reason is the emergence of a formidable lobby following the entry of large, influential corporates pursuing big real estate projects and acquisitions.

Chances are rules on who could lend may be relaxed. Currently, lenders must be residents of countries complying with the rules of FATF (the global anti-money laundering body) or IOSCO (an association of organisations that regulate the world's securities and futures markets). According to the draft policy a "recognised lender" is simply "a person resident outside India."

LEG-UPS to MANY BIZ

However, the proposed changes could be leg-ups to many businesses. "Today, banks can't give loans to private builders for buying land, even if the land is meant for developing commercial or residential projects. So, builders work with landowners through Joint Development Agreements as an alternative to bank funding. The proposed relaxation would permit the use of ECBs to purchase land intended for construction of commercial or residential projects," said Pankaj Bhuta, founder of P. R. Bhuta & Co which specialises in tax and forex regulations.

Similarly, a limited liability partnership (LLP) could borrow from an NRI partner with the draft proposing to let LLPs access ECBs, said Isha Sekhri, partner at Isha Sekhri Advisory LLP, a CA firm.

as a Reliable and Trusted News Source

as a Reliable and Trusted News Source Add Now!

Add Now!