India’s largest conglomerates are racing to set up dedicated AI units, as they look to rewire sprawling businesses and stake their claim in what is being billed as the most significant technology revolution since the internet. Reliance Industries has launched a new subsidiary–Reliance Intelligence–to house partnerships with Google and Meta and embed AI across telecom, finance, energy and retail. In September last year, Mahindra Group created Mahindra.AI to drive its AI strategy across automobiles, real estate and hospitality. Godrej Enterprises has committed to spend Rs 1,200 crore over the next three to five years on digital and GenAI solutions. Vedanta is scaling AI in metals and mining as part of a $5-billion sustainability drive.

The Adani Group has partnered with Sirius International Holding of the UAE in a 49:51 joint venture focused on AI, IoT and blockchain. Bajaj Finance, Aditya Birla Capital, ITC, Bharti Enterprises and Air India have also announced long-term AI strategies and product pipelines. Under its new subsidiary, Reliance Intelligence will house partnerships with Google and Meta and embed AI across telecom, finance, energy, and retail. The massive project also includes building gigawatt-scale, green energy-powered AI data centers in Jamnagar, developing accessible AI services for consumers, small businesses, and key national sectors. Similarly, the Adani Group and Sirius JV acquired a majority stake in cloud platform provider Parserlabs India in July 2024, later completing a full acquisition in March 2025, to strengthen its capabilities in sovereign AI and cloud platforms.

Rising Adoption

Rajeev Jain, vice-chairman of Bajaj Finance, told ET that the company has created a dedicated unit of 150 people to drive AI adoption internally. “BFL (Bajaj Finance) teams make two visits to the US every year to meet the top CEOs of US technology companies. So we work closely with Microsoft, Salesforce, AWS and Google. This year, the team visited China as well.” Jain said that what cloud and data did to the firm in terms of transformation earlier, AI can do the same now. “It has tremendous power to create a new growth cycle for the firm. That’s also one of the reasons my conviction is higher that we can continue to compound,” he said. CEAT, an RPG Group company, said it is embedding AI not just as a tech layer but as a core business driver. The company is using AI to boost efficiency across manufacturing, supply chain, product development and sustainability. Its AI-powered mixer control system has raised productivity by 20% and predictive tools are improving safety on the shop floor, the company said. In the supply chain, AI-led forecasting and container optimisation have improved demand accuracy and cut dispatch time by over half. The company has also shortened new product development cycles by up to 15% and reduced energy conversion costs by 20% through AI-driven sustainability initiatives. Godrej Industries Group said it is pursuing a unified AI strategy built on a hybrid approach, focusing on scalable, reusable capabilities rather than isolated use cases. “We are prioritising high-value areas where AI can shift the needle fastest, thereby accelerate decision-making, automate repetitive tasks and enhance operational efficiencies,” said Jyothirlatha B, head, AI Charter of Godrej Industries Group.

Godrej Consumer Products, for instance, improved demand forecasting with 75% accuracy, improved pricing and in-store execution using computer vision. Godrej Agrovet has implemented AI-driven shelf audits in dairy and satellite imaging for palm oil plantations to boost yield. Godrej Capital, on the other hand, used AI-led customer call analysis with 9x audit efficiency and automated tranche processing with 85% of requests completed within 20 minutes.

But where is the RoI?

Yet, amid two years of relentless AI hype, a question continues to hang over boardrooms–where is the return on investment?

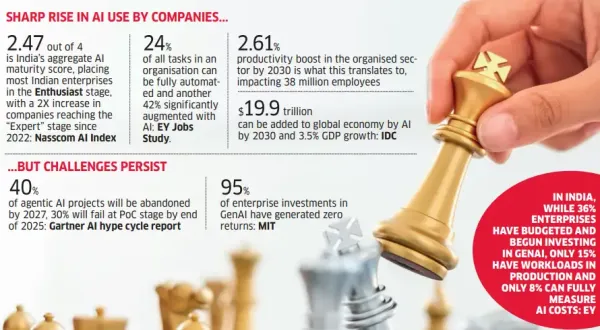

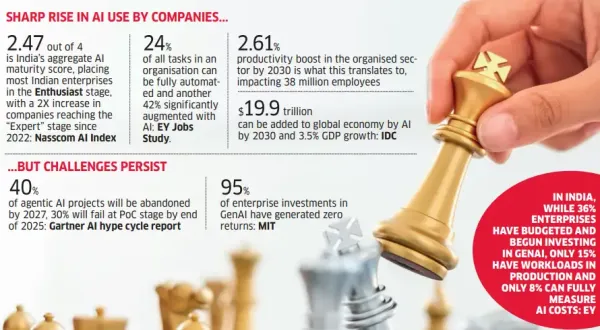

In India, while 36% enterprises have budgeted and begun investing in GenAI, only 15% have workloads that are actually in production and only 8% can fully measure and allocate AI costs, an EY survey showed. “We are yet to see consistent RoI from AI investments in India. Most enterprises are in the pilot or early production stages, and the full impact of AI will unfold over a multi-year horizon,” said Mahesh Makhija, partner and technology consulting leader at EY India. “Despite growth, 30-40% of GenAI pilots may still be abandoned due to poor RoI, governance gaps or lack of strategic alignment.”

Abhik Chatterjee, managing director and partner at BCG, said 31% of Indian companies now call out AI on their earnings calls, up from less than 15% a year ago, and 90% of large and mid-cap firms are already trying something in AI. However, India still lags the US in deriving value at scale from AI. “In the US, 36-37% of companies claim value at scale from AI. In India, that number is just 17-18% – less than one in five,” said Chatterjee. He attributed this gap to lower tech investments (Indian firms spend less than half of US peers) lack of clear AI strategies and weak middle management capacity to drive execution.

Chatterjee also underlined structural challenges such as poor data quality, legacy backend systems and resistance to opex-heavy cloud investments.

The Adani Group has partnered with Sirius International Holding of the UAE in a 49:51 joint venture focused on AI, IoT and blockchain. Bajaj Finance, Aditya Birla Capital, ITC, Bharti Enterprises and Air India have also announced long-term AI strategies and product pipelines. Under its new subsidiary, Reliance Intelligence will house partnerships with Google and Meta and embed AI across telecom, finance, energy, and retail. The massive project also includes building gigawatt-scale, green energy-powered AI data centers in Jamnagar, developing accessible AI services for consumers, small businesses, and key national sectors. Similarly, the Adani Group and Sirius JV acquired a majority stake in cloud platform provider Parserlabs India in July 2024, later completing a full acquisition in March 2025, to strengthen its capabilities in sovereign AI and cloud platforms.

Rising Adoption

Rajeev Jain, vice-chairman of Bajaj Finance, told ET that the company has created a dedicated unit of 150 people to drive AI adoption internally. “BFL (Bajaj Finance) teams make two visits to the US every year to meet the top CEOs of US technology companies. So we work closely with Microsoft, Salesforce, AWS and Google. This year, the team visited China as well.” Jain said that what cloud and data did to the firm in terms of transformation earlier, AI can do the same now. “It has tremendous power to create a new growth cycle for the firm. That’s also one of the reasons my conviction is higher that we can continue to compound,” he said. CEAT, an RPG Group company, said it is embedding AI not just as a tech layer but as a core business driver. The company is using AI to boost efficiency across manufacturing, supply chain, product development and sustainability. Its AI-powered mixer control system has raised productivity by 20% and predictive tools are improving safety on the shop floor, the company said. In the supply chain, AI-led forecasting and container optimisation have improved demand accuracy and cut dispatch time by over half. The company has also shortened new product development cycles by up to 15% and reduced energy conversion costs by 20% through AI-driven sustainability initiatives. Godrej Industries Group said it is pursuing a unified AI strategy built on a hybrid approach, focusing on scalable, reusable capabilities rather than isolated use cases. “We are prioritising high-value areas where AI can shift the needle fastest, thereby accelerate decision-making, automate repetitive tasks and enhance operational efficiencies,” said Jyothirlatha B, head, AI Charter of Godrej Industries Group.

Godrej Consumer Products, for instance, improved demand forecasting with 75% accuracy, improved pricing and in-store execution using computer vision. Godrej Agrovet has implemented AI-driven shelf audits in dairy and satellite imaging for palm oil plantations to boost yield. Godrej Capital, on the other hand, used AI-led customer call analysis with 9x audit efficiency and automated tranche processing with 85% of requests completed within 20 minutes.

But where is the RoI?

Yet, amid two years of relentless AI hype, a question continues to hang over boardrooms–where is the return on investment?

In India, while 36% enterprises have budgeted and begun investing in GenAI, only 15% have workloads that are actually in production and only 8% can fully measure and allocate AI costs, an EY survey showed. “We are yet to see consistent RoI from AI investments in India. Most enterprises are in the pilot or early production stages, and the full impact of AI will unfold over a multi-year horizon,” said Mahesh Makhija, partner and technology consulting leader at EY India. “Despite growth, 30-40% of GenAI pilots may still be abandoned due to poor RoI, governance gaps or lack of strategic alignment.”

Abhik Chatterjee, managing director and partner at BCG, said 31% of Indian companies now call out AI on their earnings calls, up from less than 15% a year ago, and 90% of large and mid-cap firms are already trying something in AI. However, India still lags the US in deriving value at scale from AI. “In the US, 36-37% of companies claim value at scale from AI. In India, that number is just 17-18% – less than one in five,” said Chatterjee. He attributed this gap to lower tech investments (Indian firms spend less than half of US peers) lack of clear AI strategies and weak middle management capacity to drive execution.

Chatterjee also underlined structural challenges such as poor data quality, legacy backend systems and resistance to opex-heavy cloud investments.

as a Reliable and Trusted News Source

as a Reliable and Trusted News Source Add Now!

Add Now!