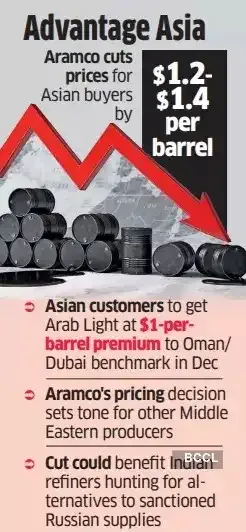

Saudi Aramco has cut the official selling price (OSP) of its crude for December deliveries to Asia, a move that could benefit Indian refiners hunting for alternatives to sanctioned Russian supplies.

Aramco, the world's biggest oil exporter, has reduced prices by $1.2-$1.4 per barrel across its major crude grades from November levels.

Its flagship Arab Light will now be sold to Asian customers at a $1-per-barrel premium to the Oman/Dubai benchmark in December. Prices for North American buyers were trimmed by $0.5 per barrel, while rates for Northwest Europe were left unchanged.

Aramco sets its OSP at the start of every month for the following month's cargoes, quoting a premium or discount to benchmarks like Dubai or Brent. As Asia's dominant supplier, its pricing decision effectively sets the tone for the region - other Middle Eastern producers usually follow, and refiners view OSP shifts as a window into Saudi Arabia's assessment of supply-demand balance.

Lower Saudi prices are a clear invitation to Indian refiners replacing Russian cargoes, an industry executive said. Reliance Industries has already boosted Saudi purchases - imports from the Kingdom jumped 87% month-on-month in October as it reduced dependence on Russia. The latest OSP cut could prompt Reliance and state-run refiners to book more cargoes.

Indian refiners need to replace nearly 1 million barrels per day of crude that previously came from Rosneft and Lukoil - Russia's two biggest exporters, sanctioned by the US last month. Companies are now scouting additional barrels from the Middle East, Africa and the Americas.

The price cut also hints at a shift in Saudi Arabia's market view. With concerns about a coming supply glut growing louder and Aramco ramping up production, the Kingdom appears focused on protecting market share, the executive said.

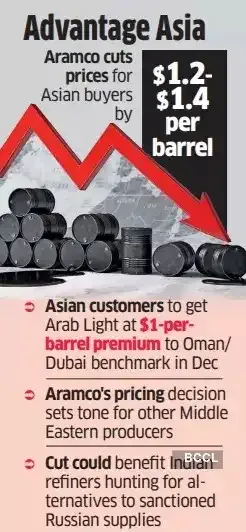

Aramco, the world's biggest oil exporter, has reduced prices by $1.2-$1.4 per barrel across its major crude grades from November levels.

Its flagship Arab Light will now be sold to Asian customers at a $1-per-barrel premium to the Oman/Dubai benchmark in December. Prices for North American buyers were trimmed by $0.5 per barrel, while rates for Northwest Europe were left unchanged.

Aramco sets its OSP at the start of every month for the following month's cargoes, quoting a premium or discount to benchmarks like Dubai or Brent. As Asia's dominant supplier, its pricing decision effectively sets the tone for the region - other Middle Eastern producers usually follow, and refiners view OSP shifts as a window into Saudi Arabia's assessment of supply-demand balance.

Lower Saudi prices are a clear invitation to Indian refiners replacing Russian cargoes, an industry executive said. Reliance Industries has already boosted Saudi purchases - imports from the Kingdom jumped 87% month-on-month in October as it reduced dependence on Russia. The latest OSP cut could prompt Reliance and state-run refiners to book more cargoes.

Indian refiners need to replace nearly 1 million barrels per day of crude that previously came from Rosneft and Lukoil - Russia's two biggest exporters, sanctioned by the US last month. Companies are now scouting additional barrels from the Middle East, Africa and the Americas.

The price cut also hints at a shift in Saudi Arabia's market view. With concerns about a coming supply glut growing louder and Aramco ramping up production, the Kingdom appears focused on protecting market share, the executive said.