Edtech unicorn PhysicsWallah, which will launch a Rs 3,480-crore initial public offering (IPO) on November 11, plans to double down on its offline network and diversify into new geographies, particularly in the South.

“Offline is a compounding story. We made heavy investments offline. Our online business was cash generating, so we took money from there. In the last two years, we have opened 170 centres,” Alakh Pandey, cofounder and CEO of PhysicsWallah, told ET.

The company, with around 300 offline centres, aims to have a total of 500 centres in three years, he said.

“Fundamentally…we are very strong in the Hindi heartland. In Uttar Pradesh, Bihar, Maharashtra, and Madhya Pradesh, which are the dominant states, we have 25-30% market share,” Pandey said. “But in states like Andhra Pradesh, Telangana, Karnataka, and Tamil Nadu, we have less than 5% market share. There is a lot of headroom there.”

A large part of the Rs 3,100-crore fresh capital that the company is raising from the IPO will be deployed towards offline expansion, according to PhysicsWallah’s prospectus.

“In India, there are 300 million students and 60 million test takers,” Pandey said. “My adjacent addressable market is of 120 million students. I have only penetrated 4% of that. So, there is a huge opportunity there.”

Adjacent markets refer to segments that share structural or operational similarities with the existing business, while having their own distinct needs.

“Last year, 25 million kids were born in India from middle-class and lower middle-class families,” Pandey added.

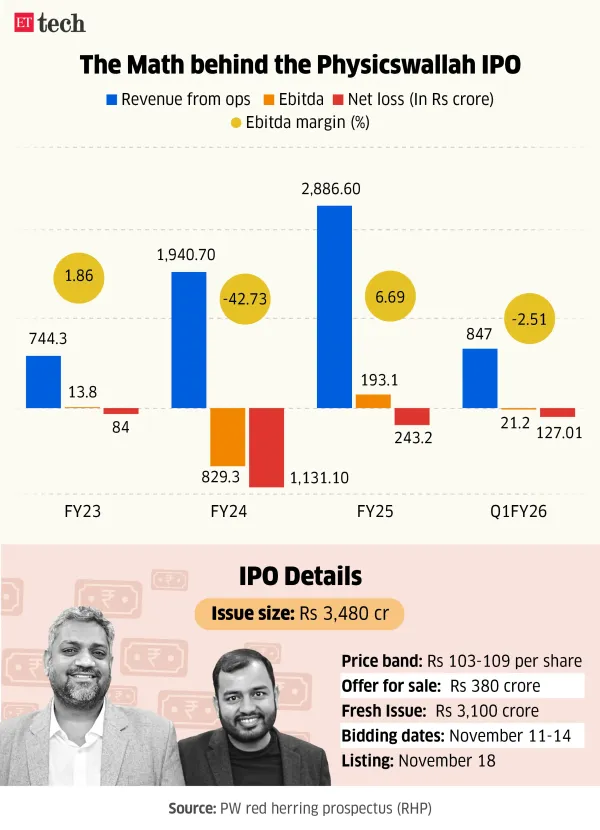

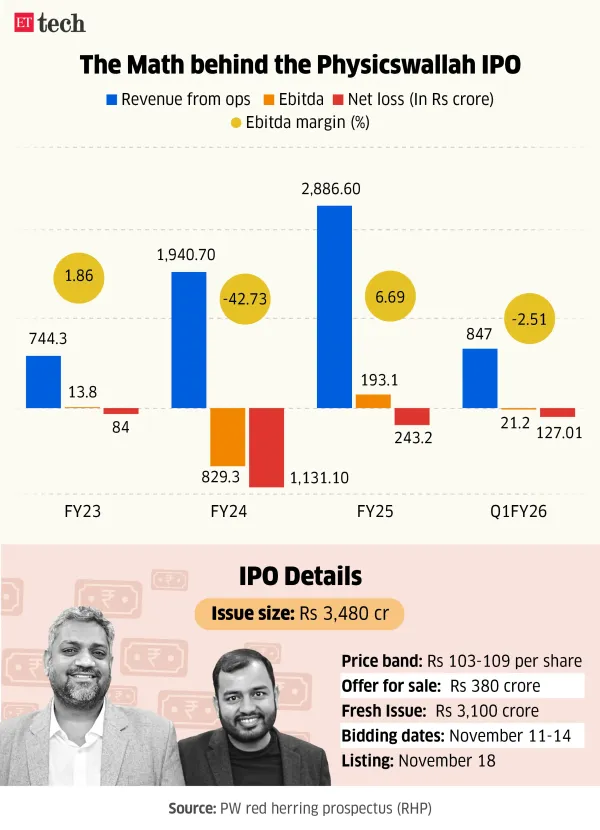

The Noida-based company has set a price band of Rs 103-109 per share for its IPO. At the upper end of the band, the firm will be valued at Rs 31,500 crore, or around $3.6 billion – 30% higher than the $2.8-billion valuation when it closed a $210-million funding round in September 2024, led by Hornbill Capital and Lightspeed.

Founded in 2016 as a YouTube channel, PhysicsWallah has expanded into a full-stack education platform spanning online classes, offline centres, test prep, and skilling.

In the test-prep segment, the company competes with Aakash Institute, Allen Career Institute, and Unacademy. PhysicsWallah has grown aggressively through acquisitions such as Utkarsh Classes and Xylem Learning to consolidate its position in India’s large test-prep market.

Several edtech companies started pushing their offline operations when their online business started slowing down post Covid after a huge surge during the pandemic.

Valuation jump, IPO timing

Prateek Maheshwari – who became PhysicsWallah’s cofounder after his edtech startup Pen Pencil was acquired by the company in 2020 – said the increase in IPO valuation was in line with the fourfold revenue growth the company posted over the past two years, adding that it’s in a “hyper-growth phase.”

“I am already sitting on a large treasury. That's the comfort capital,” Maheshwari said. “We wanted to go public at this time and make everyone grow. Otherwise, the sentiment will taper…and then investors will start to sell. We don't want that picture. We want to go public when we are in a hyper-growth phase.”

Notably, the IPO’s offer-for-sale (OFS) component has been cut.

According to the firm’s red herring prospectus (RHP), Pandey and Maheshwari will each offload shares worth Rs 190 crore, totalling Rs 380 crore – compared to Rs 720 crore they’d initially planned.

None of the investors – including WestBridge Capital, GSV Ventures, Lightspeed or Hornbill Capital – are selling.

PhysicsWallah raised its maiden external capital in 2020 at a unicorn valuation.

Rising losses

During the first quarter of FY26, the edtech firm saw its operating revenue grow 33% to Rs 847 crore, from Rs 635 crore a year ago. However, the net loss widened to Rs 127 crore from Rs 72 crore during the same period.

On an operating basis, too, PhysicsWallah’s performance took a hit as it reported Ebitda losses of Rs 21 crore in the April-June quarter, compared to an operating profit of Rs 9 crore in the year-ago period.

“I’m not concerned over the rising losses because if you look at it, our Ebitda has improved from FY23 to FY25,” Pandey said, noting that with increasing revenue, the operating margins have also improved.

In fiscal 2023, PhysicsWallah’s operating profit was Rs 14 crore and this improved to Rs 193 crore in FY25, as per the RHP. In fiscal 2024, the company reported operating losses on account of one-time spends.

“Offline is a compounding story. We made heavy investments offline. Our online business was cash generating, so we took money from there. In the last two years, we have opened 170 centres,” Alakh Pandey, cofounder and CEO of PhysicsWallah, told ET.

The company, with around 300 offline centres, aims to have a total of 500 centres in three years, he said.

“Fundamentally…we are very strong in the Hindi heartland. In Uttar Pradesh, Bihar, Maharashtra, and Madhya Pradesh, which are the dominant states, we have 25-30% market share,” Pandey said. “But in states like Andhra Pradesh, Telangana, Karnataka, and Tamil Nadu, we have less than 5% market share. There is a lot of headroom there.”

A large part of the Rs 3,100-crore fresh capital that the company is raising from the IPO will be deployed towards offline expansion, according to PhysicsWallah’s prospectus.

“In India, there are 300 million students and 60 million test takers,” Pandey said. “My adjacent addressable market is of 120 million students. I have only penetrated 4% of that. So, there is a huge opportunity there.”

Adjacent markets refer to segments that share structural or operational similarities with the existing business, while having their own distinct needs.

“Last year, 25 million kids were born in India from middle-class and lower middle-class families,” Pandey added.

The Noida-based company has set a price band of Rs 103-109 per share for its IPO. At the upper end of the band, the firm will be valued at Rs 31,500 crore, or around $3.6 billion – 30% higher than the $2.8-billion valuation when it closed a $210-million funding round in September 2024, led by Hornbill Capital and Lightspeed.

Founded in 2016 as a YouTube channel, PhysicsWallah has expanded into a full-stack education platform spanning online classes, offline centres, test prep, and skilling.

In the test-prep segment, the company competes with Aakash Institute, Allen Career Institute, and Unacademy. PhysicsWallah has grown aggressively through acquisitions such as Utkarsh Classes and Xylem Learning to consolidate its position in India’s large test-prep market.

Several edtech companies started pushing their offline operations when their online business started slowing down post Covid after a huge surge during the pandemic.

Valuation jump, IPO timing

Prateek Maheshwari – who became PhysicsWallah’s cofounder after his edtech startup Pen Pencil was acquired by the company in 2020 – said the increase in IPO valuation was in line with the fourfold revenue growth the company posted over the past two years, adding that it’s in a “hyper-growth phase.”

“I am already sitting on a large treasury. That's the comfort capital,” Maheshwari said. “We wanted to go public at this time and make everyone grow. Otherwise, the sentiment will taper…and then investors will start to sell. We don't want that picture. We want to go public when we are in a hyper-growth phase.”

Notably, the IPO’s offer-for-sale (OFS) component has been cut.

According to the firm’s red herring prospectus (RHP), Pandey and Maheshwari will each offload shares worth Rs 190 crore, totalling Rs 380 crore – compared to Rs 720 crore they’d initially planned.

None of the investors – including WestBridge Capital, GSV Ventures, Lightspeed or Hornbill Capital – are selling.

PhysicsWallah raised its maiden external capital in 2020 at a unicorn valuation.

Rising losses

During the first quarter of FY26, the edtech firm saw its operating revenue grow 33% to Rs 847 crore, from Rs 635 crore a year ago. However, the net loss widened to Rs 127 crore from Rs 72 crore during the same period.

On an operating basis, too, PhysicsWallah’s performance took a hit as it reported Ebitda losses of Rs 21 crore in the April-June quarter, compared to an operating profit of Rs 9 crore in the year-ago period.

“I’m not concerned over the rising losses because if you look at it, our Ebitda has improved from FY23 to FY25,” Pandey said, noting that with increasing revenue, the operating margins have also improved.

In fiscal 2023, PhysicsWallah’s operating profit was Rs 14 crore and this improved to Rs 193 crore in FY25, as per the RHP. In fiscal 2024, the company reported operating losses on account of one-time spends.