New Delhi: India’s automobile manufacturers and auto component makers have conveyed their concerns to the government over Mexico’s plan to more than double tariffs on countries with which it does not have free trade agreements.

Representatives from the Society of Indian Automobile Manufacturers (SIAM) and Auto Component Manufacturers Association (ACMA) met officials from the commerce ministry and the heavy industries ministry recently over the development.

Pharmaceutical companies, which have been preparing to scale up their presence in Mexico, are also worried about the impact of the proposed hike in tariffs on their plans.

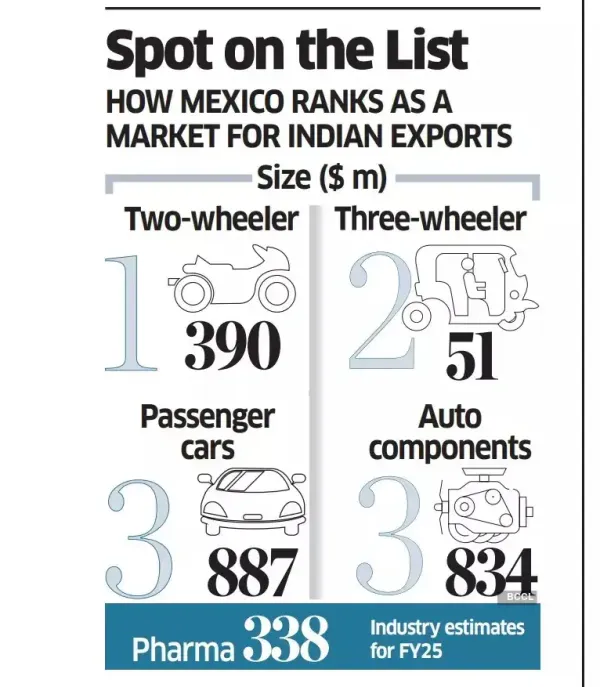

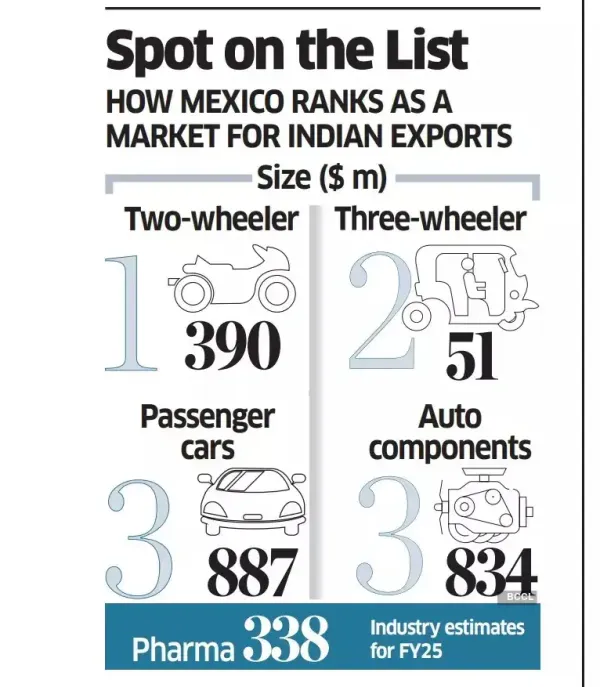

With exports of $887 million (₹7,900 crore) last fiscal year, Mexico is the third-largest destination for car exports from India, after South Africa and Saudi Arabia.

Companies such as Maruti Suzuki and Škoda Auto Volkswagen India ship out nearly 100,000 vehicles or about 12% of India’s total car exports to Mexico every year.

Mexico accounted for more than a fifth of total exports of 330,000 cars at market leader Maruti Suzuki in FY25, people in the know said. Carmakers in India exported 770,000 passenger vehicles last fiscal.

Mexico is also the largest market for Indian two-wheelers ($390 million) and the second-largest for three-wheelers ($51 million). It is also the third-largest market for India-made auto parts, after the US and Germany. Notably, Indian companies exported parts valued at $834 million in FY25.

“It (Mexico) is a significant export destination for manufacturers across categories in the automotive industry,” said a senior industry executive, asking not to be named. “Any increase in tariffs will impact companies here adversely, more so in the current geopolitical environment. Auto component exports to the US are already under pressure post the hike in tariffs.”

Mexico is also a growing market for Indian pharma and agricultural equipment exports. Pharma industry executives said there is enormous untapped potential for Indian companies in the country.

“Currently there are no tariffs on drugs made in India and any imposition of tariffs will hamper interest in that country,” a senior pharma executive said. The person pointed out that multinational drug makers are dominant players in that market and sell drugs at very exorbitant prices, while Indian drug makers sell the same products at one-tenth of those levels.

COMPACT SEGMENTS

A second auto industry executive said despite being a major auto hub, Mexico is reliant on imports of passenger vehicles, particularly in the sub-compact and compact segments, owing to intra-industry trade.

Mexico manufactures around 4 million vehicles each year, with 3.5 million units shipped overseas. Out of Mexico’s 1.5 million annual domestic sales of passenger vehicles, 64% are imported while the rest are produced locally.

“The proposed tariff hike is expected to have a direct impact on Indian automobile exports to Mexico, especially for OEMs exporting completely built units (CBUs) of passenger vehicles,” the executive said.

Mexico has proposed to raise tariffs on passenger vehicle imports to 50%, from 20% currently. Similarly, tariffs on two-wheelers are expected to rise to 35% from 15%. Tariffs on auto parts are expected to rise to 10–50% across categories from the current 0–35%.

The new tariff bill is anticipated to be passed by the Mexican Parliament and might come into effect from January, senior industry executives told ET.

COST COMPETITIVENESS

Several Indian auto parts makers have subsidiaries in Mexico.

“A lot of back-end work in the making of auto components happens in India. These are then shipped for use both by carmakers in Mexico and component manufacturers who value-add and then ship them on to the US. Not only is it a big export market for Indian auto component makers, Mexico also benefits from the cost competitiveness we offer,” said a component industry executive.

Auto parts and pharma companies are meanwhile surprised by Mexico’s proposed move to raise tariffs.

A senior pharma industry executive said that in the last few months, officials from the Mexican regulatory agencies have visited and held talks with the Indian government to evaluate ways of accelerating drug launches by Indian companies in Mexico.

“This new move about tariffs runs contrary to those positive steps. The officials invited Indian companies to set up manufacturing bases in Mexico in special economic zones but there were no tariffs discussed,” the person said.

Almost all large drug makers such as Sun Pharma, Dr Reddy’s, Glenmark, and Hetero have operations in Mexico.

Indian drug makers currently have a small share in Mexico’s $20 billion pharma market. About $338 million worth of drugs were imported by Mexico from India during 2024–25, compared to the country’s total imported drugs value of $8–9 billion.

Representatives from the Society of Indian Automobile Manufacturers (SIAM) and Auto Component Manufacturers Association (ACMA) met officials from the commerce ministry and the heavy industries ministry recently over the development.

Pharmaceutical companies, which have been preparing to scale up their presence in Mexico, are also worried about the impact of the proposed hike in tariffs on their plans.

With exports of $887 million (₹7,900 crore) last fiscal year, Mexico is the third-largest destination for car exports from India, after South Africa and Saudi Arabia.

Companies such as Maruti Suzuki and Škoda Auto Volkswagen India ship out nearly 100,000 vehicles or about 12% of India’s total car exports to Mexico every year.

Mexico accounted for more than a fifth of total exports of 330,000 cars at market leader Maruti Suzuki in FY25, people in the know said. Carmakers in India exported 770,000 passenger vehicles last fiscal.

Mexico is also the largest market for Indian two-wheelers ($390 million) and the second-largest for three-wheelers ($51 million). It is also the third-largest market for India-made auto parts, after the US and Germany. Notably, Indian companies exported parts valued at $834 million in FY25.

“It (Mexico) is a significant export destination for manufacturers across categories in the automotive industry,” said a senior industry executive, asking not to be named. “Any increase in tariffs will impact companies here adversely, more so in the current geopolitical environment. Auto component exports to the US are already under pressure post the hike in tariffs.”

Mexico is also a growing market for Indian pharma and agricultural equipment exports. Pharma industry executives said there is enormous untapped potential for Indian companies in the country.

“Currently there are no tariffs on drugs made in India and any imposition of tariffs will hamper interest in that country,” a senior pharma executive said. The person pointed out that multinational drug makers are dominant players in that market and sell drugs at very exorbitant prices, while Indian drug makers sell the same products at one-tenth of those levels.

COMPACT SEGMENTS

A second auto industry executive said despite being a major auto hub, Mexico is reliant on imports of passenger vehicles, particularly in the sub-compact and compact segments, owing to intra-industry trade.

Mexico manufactures around 4 million vehicles each year, with 3.5 million units shipped overseas. Out of Mexico’s 1.5 million annual domestic sales of passenger vehicles, 64% are imported while the rest are produced locally.

“The proposed tariff hike is expected to have a direct impact on Indian automobile exports to Mexico, especially for OEMs exporting completely built units (CBUs) of passenger vehicles,” the executive said.

Mexico has proposed to raise tariffs on passenger vehicle imports to 50%, from 20% currently. Similarly, tariffs on two-wheelers are expected to rise to 35% from 15%. Tariffs on auto parts are expected to rise to 10–50% across categories from the current 0–35%.

The new tariff bill is anticipated to be passed by the Mexican Parliament and might come into effect from January, senior industry executives told ET.

COST COMPETITIVENESS

Several Indian auto parts makers have subsidiaries in Mexico.

“A lot of back-end work in the making of auto components happens in India. These are then shipped for use both by carmakers in Mexico and component manufacturers who value-add and then ship them on to the US. Not only is it a big export market for Indian auto component makers, Mexico also benefits from the cost competitiveness we offer,” said a component industry executive.

Auto parts and pharma companies are meanwhile surprised by Mexico’s proposed move to raise tariffs.

A senior pharma industry executive said that in the last few months, officials from the Mexican regulatory agencies have visited and held talks with the Indian government to evaluate ways of accelerating drug launches by Indian companies in Mexico.

“This new move about tariffs runs contrary to those positive steps. The officials invited Indian companies to set up manufacturing bases in Mexico in special economic zones but there were no tariffs discussed,” the person said.

Almost all large drug makers such as Sun Pharma, Dr Reddy’s, Glenmark, and Hetero have operations in Mexico.

Indian drug makers currently have a small share in Mexico’s $20 billion pharma market. About $338 million worth of drugs were imported by Mexico from India during 2024–25, compared to the country’s total imported drugs value of $8–9 billion.