Shares of Dragonfly Energy Holdings Corp. (DFLI) tumbled over 44% in Tuesday’s premarket trade after the company announced a 1-for-10 reverse stock split.

DFLI stock will begin trading on a split-adjusted basis on December 18 and will retain its current ticker on Nasdaq.

After the reverse stock split, DFLI’s number of shares of common stock outstanding will reduce to about 12.1 million from the current 120.8 million, the company said.

The battery technology company’s shareholders approved the reverse split on October 15 at an authorized ratio in the range of 1-for-2 and 1-for-50 and its Board approved the 1-for-10 reverse split on December 2.

“Recent capital raises and debt restructuring have materially strengthened our balance sheet and improved liquidity. With a more durable financial foundation, Dragonfly is focused on scaling revenue, deepening strategic partnerships, and investing in differentiated battery technologies that support long-term value creation,” said Dr. Denis Phares, Chief Executive Officer of Dragonfly Energy, clarifying the company’s future goals.

Dragonfly Energy is primarily a lithium battery maker, most known for its Battle Born Batteries brand. Earlier this month, the company partnered with National Railway Supply to power the firm’s first lithium battery line. The announcement came after the American Railway Engineering and Maintenance-of-Way Association released its first lithium battery standard.

In November, DFLI reported third quarter (Q3) 2025 results, posting $16 million in net sales that marked a 25.5% increase from the previous year. The company’s gross margins grew 710 basis points to 29.7% although it reported a net loss of $11.1 million, up from a loss of $6.8 million in the previous year.

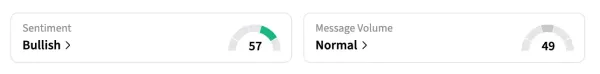

On Stocktwits, the retail sentiment around DFLI remained ‘bullish’ over a week, and message volume climbed to ‘normal’ from ‘low’ levels at the time of writing.

One user shared their ‘bullish’ stance on DFLI, noting that the stock seems oversold compared to its market capitalization.

Shares of DFLI have plunged more than 78% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<