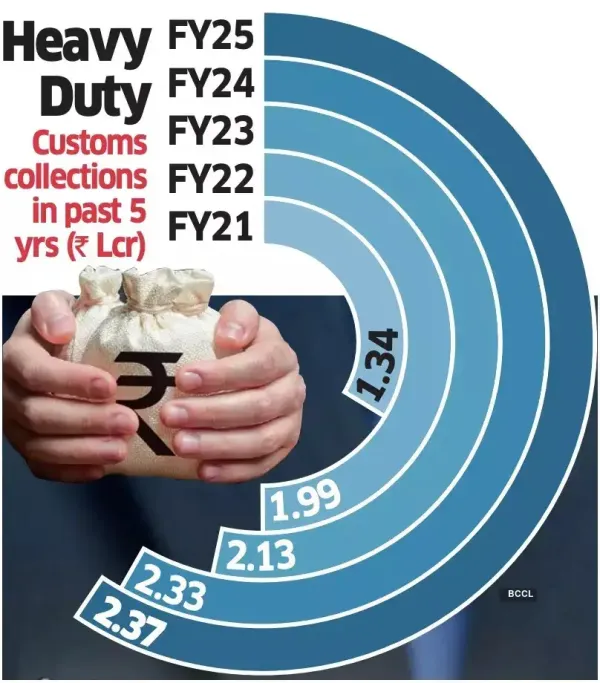

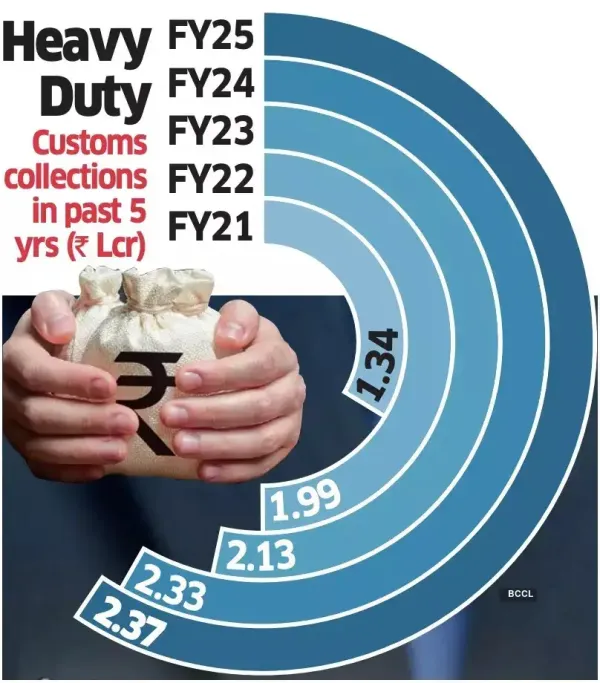

Union Budget 2026: India is considering a reduction in the number of customs duty slabs to five or six from the current eight as part of a revamp in the upcoming budget aimed at simplifying the tariff structure, reducing litigation and better aligning import duties with the country’s industrial and trade priorities, people familiar with the matter said.

The exercise is expected to focus on resolving disputes over customs classifications, correcting inverted duty structures and scaling back discretionary exemptions, they said.

The move comes against the backdrop of recently concluded trade pacts and those being negotiated, as well as the government’s push for a paperless, seamless customs system.

The Centre has for the last two years been steadily focusing on revamping the customs framework by reducing slabs and removing exemptions. “The last budget customs duty structure saw a major rationalisation. There is room for further rationalisation of customs slabs to five-six,” a senior official told ET.

Efforts have been on in this regard for the last three-four months and an announcement is expected in the budget this year, he said.

The Central Board of Indirect Taxes and Customs is aiming for the synchronisation of customs duties with the revamped goods and services tax (GST) for a seamless and coherent system, said the people cited. The department is working to reduce all pain points flagged by businesses, they said.

The Centre is also seeking to redefine the duty structure between special economic zones (SEZs) and domestic tariff areas, the people said. This is part of broader SEZ reforms.

Officials aware of the deliberations said reducing classification disputes, which is a major reason for litigation, remains a key focus.

According to a report by the parliamentary standing committee on finance, a total 75,592 customs cases were pending in December 2024, with recoverable arrears amounting to Rs 24,016.20 crore.

The industry has made a case for an amnesty scheme in instances where the dispute doesn’t stem from wilful evasion to reduce litigation.

Finance minister Nirmala Sitharaman had signalled last month that simplification of customs duty would be the next big item on the government’s reform agenda.

The exercise is expected to focus on resolving disputes over customs classifications, correcting inverted duty structures and scaling back discretionary exemptions, they said.

The move comes against the backdrop of recently concluded trade pacts and those being negotiated, as well as the government’s push for a paperless, seamless customs system.

The Centre has for the last two years been steadily focusing on revamping the customs framework by reducing slabs and removing exemptions. “The last budget customs duty structure saw a major rationalisation. There is room for further rationalisation of customs slabs to five-six,” a senior official told ET.

Efforts have been on in this regard for the last three-four months and an announcement is expected in the budget this year, he said.

The Central Board of Indirect Taxes and Customs is aiming for the synchronisation of customs duties with the revamped goods and services tax (GST) for a seamless and coherent system, said the people cited. The department is working to reduce all pain points flagged by businesses, they said.

The Centre is also seeking to redefine the duty structure between special economic zones (SEZs) and domestic tariff areas, the people said. This is part of broader SEZ reforms.

Officials aware of the deliberations said reducing classification disputes, which is a major reason for litigation, remains a key focus.

According to a report by the parliamentary standing committee on finance, a total 75,592 customs cases were pending in December 2024, with recoverable arrears amounting to Rs 24,016.20 crore.

The industry has made a case for an amnesty scheme in instances where the dispute doesn’t stem from wilful evasion to reduce litigation.

Finance minister Nirmala Sitharaman had signalled last month that simplification of customs duty would be the next big item on the government’s reform agenda.