The Indian Institute of Creative Technologies (IICT) in Mumbai has been launched to strengthen India’s creative economy, offering industry-linked training in animation, VFX, gaming and digital design to prepare students for global creative careers.

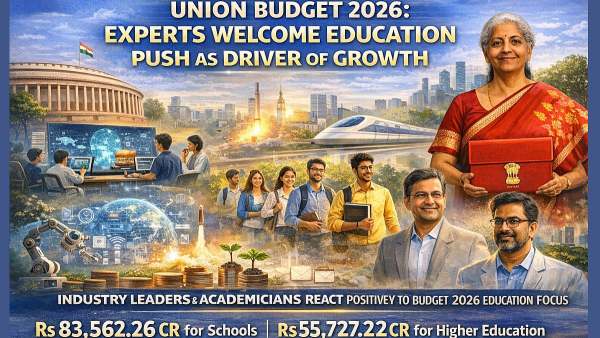

New Delhi: The education budget announcements in the Union Budget 2026 have received a warm response from industry experts and academicians, who term it a “forward-looking roadmap” that treats education as a “driver of economic growth in India” and not just a “budgetary item.”

While presenting the Union Budget 2026 on February 1, 2026, Finance Minister Nirmala Sitharaman announced an allocation of ₹83,562.26 crore for school education and ₹55,727.22 crore for higher education. The annoucement range from infrastructure development, digital innovation, skill development, and health sciences, which indicate a “balanced approach towards equity and excellence in education,” according to experts.

Education as an engine of Economic growth

Dr Minu Mehta, Dean and Professor at the Anil Surendra Modi School of Commerce (ASMSOC), SVKM’s NMIMS, described Budget 2026 as a “bold step towards transforming India’s economic landscape.” She said the emphasis on infrastructure, sustainability and digital innovation makes the Budget a potential catalyst for growth and employment.

“With a ₹12.2 lakh crore capex allocation, high-speed rail corridors, and a boost to sectors like textiles, the Budget is a game-changer for job creation. The focus on green energy, AI and MSME support reflects a forward-thinking approach that balances economic progress with social welfare,” she said, adding that initiatives supporting handlooms, tourism training and NRI participation in markets show attention to long-neglected areas.

Employment-led growth and regulatory reforms

From an academic policy perspective, Dr Bharath Supra, Associate Professor at the School of Business Management, NMIMS Navi Mumbai, highlighted the Budget’s strong emphasis on employment-led growth and regulatory rationalisation. He noted that instead of short-term relief, the Budget focuses on building sustainable economic capabilities across agriculture, MSMEs, investment and exports.

“The direct linkage between job creation and enterprise development is particularly encouraging. Changes in MSME definitions, enhanced credit guarantees and sector-specific manufacturing plans can benefit not just large firms but also startups, first-time entrepreneurs and small businesses,” he said.

Dr. Supra also referred to the government’s continued efforts towards simplified and trust-based regulation, which is essential for the translation of investment intent into economic activity.

Experts at IIT Patna, sharing a similar view, said that the Union Budget 2026 has outlined a clear roadmap to change the face of the education sector in India to suit the economic requirements of the future.

They pointed out the growing emphasis on the integration of artificial intelligence into teaching and learning, development of digital infrastructure, and establishment of innovation labs as important milestones in the direction of a new education paradigm that combines knowledge with skills.

“Investments in skill development, teacher upskilling and centres of excellence indicate a serious effort to bridge the gap between education and employment,” the institute said in a statement.

The experts from IIT Patna also emphasised the inclusive nature of the Budget, referring to initiatives such as girls’ hostels and technology-enabled classrooms, which are intended to increase access to quality education. According to them, these plans will enable students to discover AI solutions, improve creativity, and develop problem-solving skills that are required in the 21st-century work environment.

Prof. Manas Pandey, Department of Business Economics, VBS Purvanchal University, Jaunpur said, "This Budget focuses on strengthening traditional industries, supporting MSMEs, setting up a biopharma hub, launching Semiconductor ISM 2.0, and developing a mineral corridor to boost India’s global trade position."

Relief for students aspiring to study abroad

On the international education front, Saurabh Arora, Founder and CEO of University Living, said the Budget offers tangible relief to Indian students aspiring to study abroad. He pointed out that the removal of Tax Collected at Source (TCS) on education loans under Section 80E, the increase in the self-funded remittance exemption threshold from ₹7 lakh to ₹10 lakh, and the reduction of TCS on higher self-funded remittances to 2% would ease the upfront financial pressure on families during admissions and visa stages.

“Combined with policy support for NEP-aligned ‘Start in India, Transfer Abroad’ pathways, students could potentially reduce overall education costs by 20–40%,” Arora said, while advising families to factor in currency volatility and ensure education loans are routed through compliant institutions to fully benefit from the reforms.

Syed Sultan Ahmed, Chairperson of the Association of International Schools of India (TAISI) and Advisor to WACE India, said the Budget signals steady intent in strengthening India’s education ecosystem, with an overall allocation of ₹1.39 lakh crore reinforcing the government’s focus on access and capacity building. He welcomed the announcement of NIMHANS 2.0 in North India, calling it a timely move that places student mental health firmly on the national agenda amid rising academic stress and anxiety.

Referring to overseas education, Ahmed described the reduction of TCS on LRS remittances for education and medical purposes above ₹10 lakh from 5% to 2% as a practical step that improves affordability for families. However, he cautioned that public spending on education remains below the 6% of GDP recommended under NEP 2020, with current expenditure hovering around 4%.

“Bridging this gap is essential if reform is to move from policy to practice. Above all, the next phase of education reform must place teachers at the centre. Sustained investment in their professional development and long-term growth is critical to ensure meaningful classroom impact,” he added.

Welcoming the measures aimed at easing overseas education costs, Piyush Kumar, Regional Director – South Asia, Canada and Latin America (LATAM), IDP Education, said the Budget reflects a more pragmatic and student-friendly approach towards international education and mobility.

“We would like to thank the Honourable Finance Minister and the Indian government for the forward-thinking initiatives to support international education. The lowering of TCS on education from 5% to 2% is a definite plus and will reduce the financial burden on Indian students and their families aspiring to study abroad,” Kumar said.

He added that when viewed alongside the one-time foreign asset disclosure scheme, the measures encourage greater transparency while ensuring that genuine education-related expenses are not unduly penalised. “Together, these steps will improve access to global education opportunities and benefit Indian students, who form one of the largest international student cohorts across foreign universities,” Kumar noted.

The education proposals in Budget 2026 are expected to enhance the education system in India and support the country’s vision of becoming a global innovation and technology destination.