Marico’s INR 226 Cr Cosmix Bet

Marico’s INR 226 Cr Cosmix Bet

Marico is betting big on health-first, D2C brands. In its second acquisition in a week, after popcorn brand 4700BC, the FMCG giant will now pick up a controlling stake in plant-based protein startup Cosmix Wellness at a hefty valuation. So, what does the deal look like?

The Finer Print: The FMCG major will acquire a 60% stake in the wellness-focussed D2C brand from its two founders at an INR 375 Cr valuation, pegging the deal at INR 226 Cr. However, cofounders Vibha Harish and Soorya Jagadish will stay on and retain operational control.

The Acquisition Thesis: The deal makes sense for both parties. For Marico, the D2C brand offers a scaled and profitable brand, with product-market-fit, digital reach, supply-chain depth, and distribution. It also saves the FMCG major the trouble of building a brand in the space from scratch.

On the other hand, Cosmix will likely tap into Marico’s existing muscle to expand offline and scale sustainably, without the need to chase venture capital.

Retracing Cosmix’s Journey: The story starts in 2019, when Harish turned her Bengaluru apartment into a makeshift factory to start a clean-label D2C protein brand. However, instead of splurging heavily to capture market share, Cosmix followed a playbook of capital efficiency, steady offline expansion and a focus on its Instagram-led community.

This discipline has paid off over the years. The bootstrapped brand today boasts 55% repeat purchase rate, profitable operations, revenues nearing INR 90 Cr in FY26, an in-house manufacturing and 20+ SKUs spanning protein bars, pancakes and multivitamins.

But in the long run, why does the D2C wellness brand make sense for the FMCG giant? Let’s find out…

From The Editor’s Desk Aye Finance Gears Up For IPO The Whole Truth Bags $51 Mn

The Whole Truth Bags $51 Mn

Dhruva Space Eyes $4.2 Mn

Dhruva Space Eyes $4.2 Mn

India’s aerospace and defence programmes rely heavily on imported components and advanced alloys. This dependence creates long lead times, high costs and a strategic choke point. Aegion is solving this problem by building these materials back home.

Made For India: Founded in 2022, Aegion manufactures critical components used in aerospace systems, defence platforms, energy equipment and space-adjacent applications. Its edge comes from combining in-house engineering with materials science, rather than operating as a conventional manufacturer.

Reimagining Recycling: Aegion claims that its innovation is a closed-loop titanium recycling process that reclaims titanium, nickel and rare-earth metals from aerospace scrap. It uses a hydrogen-assisted metallothermic method to produce high-purity metal feedstock, which is then used to produce superalloys that have use cases in many critical industries.

Carving A Niche: Backed by Rebalance, Aegion is eyeing a piece of India’s advanced materials market, which is projected to become a $21.5 Bn opportunity by 2030. The startup is looking to capitalise on India’s defence indigenisation and manufacturing priorities, where material sovereignty is becoming as important as machining capability. So, can Aegion scale its innovative recycling pitch to become a key domestic supplier?

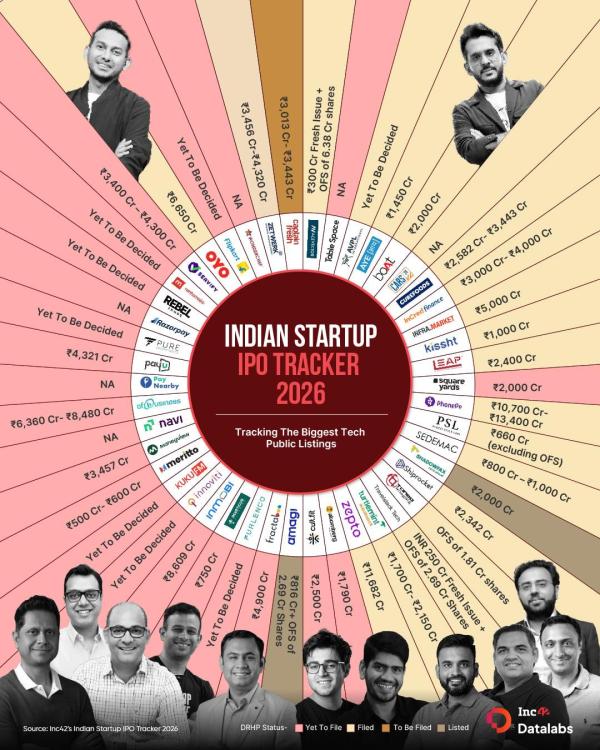

After 18 new-age tech companies raised a record INR 41,248 Cr in 2025, the IPO pipeline for 2026 looks even stronger. Let’s take a look…

The post Marico’s Cosmix Deal, Whole Truth’s $51 Mn Round & More appeared first on Inc42 Media.