Following the US Supreme Court's decision on Trump's tariffs, global risk sentiment has improved significantly. This development has led to a rally in global markets, with GIFT Nifty up by more than 1 per cent, which suggests that if there are no new adverse global triggers, there will be a gap-up opening for Nifty at the beginning of the week. This may motivate new investors to consider their equity option.

Those who are well versed in the intricacies of direct stock market investment will find it easy to choose stocks for their portfolio, but for those who are ready to take market risk but do not understand how to exit stocks through direct investment, equity mutual funds can be a good option. According to market and investment experts, an investor can also accumulate a good amount of money in the long run by investing indirectly in equity.

Advising new investors on the current uncertainty and high risk in the Indian stock market, Ponmudi R, CEO, Enrich Money, said that while supportive global cues could help Halfme's positive start, how sustainable it will be will depend on the ability of the Indian stock market to hold and recover above key resistance levels, Livemint reported. Continued institutional support and improving momentum indicators will be important in determining whether the current rebound turns into a sustained uptrend.

Advising equity investors to start mutual fund SIPs and avoid market fluctuations, SEBI-registered investment expert, Jitendra Solanki said in a Mint report that if there is volatility in the stock market, then one should first invest a lump sum in an equity mutual fund plan and then keep investing a fixed amount in monthly SIP mode. This gives manifold benefits to the investor.

Advising investors with low risk appetite, Pankaj Mathpal, CEO and MD, Optima Money Managers, said in a media report that direct stock investment is not for them. They should think about equity mutual funds for long term investments. Pankaj Mathpal said that it would be better to do monthly SIP because in this the investor does not have to wait for the right time to buy. An investor can start SIP any day, irrespective of the market trend, as it is free from market fluctuations. He said that the 15 x 15 x 15 rule of mutual funds says that a monthly SIP of Rs 15,000 in equity can give 15 percent annual return in 15 years.

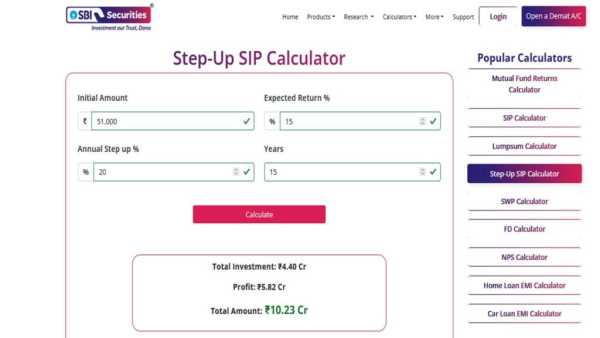

Regarding how to deposit Rs 10 crore in 15 years, Karthik Jhaveri, Director of Transcend Capital, said in a media report that to deposit Rs 10 crore in 15 years, an investor will have to follow the 15 x 15 x 15 rule of mutual funds with some humor. They should increase their monthly SIP amount annually. Generally, the annual SIP step-up is 15 per cent, but to achieve such a huge target of Rs 10 crore in 15 years, the annual step-up will have to be increased by 20 per cent.

Experts said a mutual fund SIP gives an average annual return on one's money, as determined by the stock market over the investment period. Assuming 15 per cent annual return on one's equity mutual fund SIP, with a tenure of 15 years and an annual step-up of 20 per cent, the SBI mutual fund calculator suggests that an investor would need to start with a monthly SIP of Rs 51,000.

According to Pankaj Mathpal of Optima Money Managers, the mutual funds that can be considered to get tremendous returns through SIP include HDFC Flexi Cap Fund, Nippon India Multicap Fund, ICICI Prudential Value Fund, Kotak Multicap Fund and Invesco India Large and Midcap Fund.

Disclaimer: This article is for informational purposes only and should not be construed as investment advice in any way. TV9 Bharatvarsha advises its readers and viewers to consult their financial advisors before taking any money-related decisions.