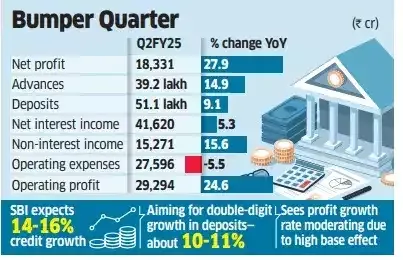

State Bank of India, the country’s largest lender by share of loans advanced, recorded a 28% rise in second-quarter net profit at ₹18,331 crore— the highest among listed companies—aided by an increase in revenues from lending and a fall in operating expenses that helped offset the impact of higher provisioning.

SBI’s deposit base also crossed the ₹50 lakh-crore mark in the September quarter.

Chairman CS Setty, who took charge at the end of August, attributed the rise in profit to containing the operating expenses and raising operating incomes —both core interest and non-interest earnings.

He said that in the comparable period last year, the bank’s operating expenses “had spiked due to employee costs”.

Among key parameters, the net interest margin—or, the difference between interest earned and interest paid—fell marginally to 3.14% against 3.29% in the comparable period last year.

“We tried to move the needle on the yield on advances, however small it is,” Setty said, explaining the performance. “Directionally, we are focusing on increasing our core interest income.”

He also said “the renewed focus is on the non-interest income and containing the operational expenses by bringing operational efficiencies”.

Net interest income rose 5% to ₹41,620 crore, while non-interest income increased by 41.5% to ₹51,271 crore. Operating expenses declined 5.5% to ₹29,294 crore.

Asked if the bank will be able to maintain 28% growth in profit in the coming quarters, the SBI chairman said, “I think the growth probably would be less due to the base impact. But we would like to maintain in absolute terms this kind of growth.”

Setty has previously stressed the need for consistency in performance, saying investors prefer fewer surprises.

The state-owned lender’s net profit in the first quarter remained flat at ₹17,035 crore over the corresponding period last year.

On future performance, Setty said: “There are various levers in place to ensure that this consistency is maintained — both in terms of the credit growth and deposit growth, the cost of containing the operations and digitalisation, and optimisation of the operational expenses.

“Everything indicates we should be able to maintain this level,” he added.

The bank’s advances surged 15.9% to ₹39.20 lakh crore, while deposits grew by 9.1% to ₹51.2 lakh crore. The share of current and savings accounts, also known as low-cost deposits, was 40.03%, marginally lower than 41.8% a year ago. Retail portfolio was ₹12.9 lakh crore, of which home loan was at ₹7.6 lakh crore.

Setty gave a 14-16% growth guidance for credit while pencilling in a “double digit” credit growth.

The country’s biggest mass lender also said it has sufficient visibility on demand for funds from companies.

“We have good visibility of the corporate book… almost ₹6 lakh crore of corporate book is there,” Setty said. He added that SBI is the largest provider of working capital loans for corporates.

With the Reserve Bank of India (RBI) focused on winning the attritional war against consumer inflation, Setty said he does not expect any monetary policy action when policymakers meet next month.

Instead, any decision on easing rates, despite the change in the stance of the RBI’s monetary policy committee to ‘neutral’ from ‘withdrawal of accommodation’, will now likely be taken only in February.

“Which means that, until that time, the depositors will continue to have the rate of interest what we have currently without any reduction. And in terms of retail loan customers, I think they may have to wait until then (for a reduction in borrowing costs),” Setty said, pointing to SBI’s in-house view that the rate-easing cycle will now begin only in the next calendar year.

Net non-performing assets were ₹20,294 crore, or 0.53% of net advances, while provisions on bad loans doubled to ₹10,962 crore.

US Election 2024

US Election Result Live Updates

Swing state results deciding who'll be new POTUS

Trump vs Harris: Who’s winning which state? Full list

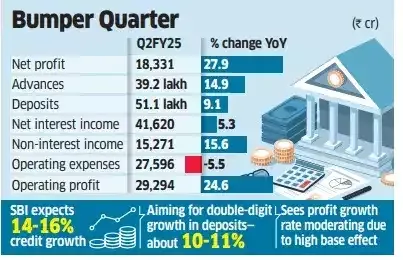

Chairman CS Setty, who took charge at the end of August, attributed the rise in profit to containing the operating expenses and raising operating incomes —both core interest and non-interest earnings.

He said that in the comparable period last year, the bank’s operating expenses “had spiked due to employee costs”.

Among key parameters, the net interest margin—or, the difference between interest earned and interest paid—fell marginally to 3.14% against 3.29% in the comparable period last year.

“We tried to move the needle on the yield on advances, however small it is,” Setty said, explaining the performance. “Directionally, we are focusing on increasing our core interest income.”

He also said “the renewed focus is on the non-interest income and containing the operational expenses by bringing operational efficiencies”.

Net interest income rose 5% to ₹41,620 crore, while non-interest income increased by 41.5% to ₹51,271 crore. Operating expenses declined 5.5% to ₹29,294 crore.

Asked if the bank will be able to maintain 28% growth in profit in the coming quarters, the SBI chairman said, “I think the growth probably would be less due to the base impact. But we would like to maintain in absolute terms this kind of growth.”

Setty has previously stressed the need for consistency in performance, saying investors prefer fewer surprises.

The state-owned lender’s net profit in the first quarter remained flat at ₹17,035 crore over the corresponding period last year.

On future performance, Setty said: “There are various levers in place to ensure that this consistency is maintained — both in terms of the credit growth and deposit growth, the cost of containing the operations and digitalisation, and optimisation of the operational expenses.

“Everything indicates we should be able to maintain this level,” he added.

The bank’s advances surged 15.9% to ₹39.20 lakh crore, while deposits grew by 9.1% to ₹51.2 lakh crore. The share of current and savings accounts, also known as low-cost deposits, was 40.03%, marginally lower than 41.8% a year ago. Retail portfolio was ₹12.9 lakh crore, of which home loan was at ₹7.6 lakh crore.

Setty gave a 14-16% growth guidance for credit while pencilling in a “double digit” credit growth.

The country’s biggest mass lender also said it has sufficient visibility on demand for funds from companies.

“We have good visibility of the corporate book… almost ₹6 lakh crore of corporate book is there,” Setty said. He added that SBI is the largest provider of working capital loans for corporates.

With the Reserve Bank of India (RBI) focused on winning the attritional war against consumer inflation, Setty said he does not expect any monetary policy action when policymakers meet next month.

Instead, any decision on easing rates, despite the change in the stance of the RBI’s monetary policy committee to ‘neutral’ from ‘withdrawal of accommodation’, will now likely be taken only in February.

“Which means that, until that time, the depositors will continue to have the rate of interest what we have currently without any reduction. And in terms of retail loan customers, I think they may have to wait until then (for a reduction in borrowing costs),” Setty said, pointing to SBI’s in-house view that the rate-easing cycle will now begin only in the next calendar year.

Net non-performing assets were ₹20,294 crore, or 0.53% of net advances, while provisions on bad loans doubled to ₹10,962 crore.