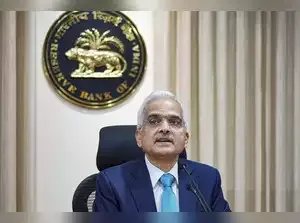

Reserve Bank Governor Shaktikanta Das on Monday expressed concerns over instances wherein banks misclassify complaints as "customer queries" and asked bank boards to ensure lenders' genuine commitment to customer centricity. The governor was speaking at the Conference of Directors of Private Sector Banks here.

Trust is the bedrock of banking, and the industry fundamentally relies on the faith of depositors and investors for its stability and growth, he said.

Building and maintaining this trust requires banks to place customers at the heart of their operations and ensure that products, services, and policies genuinely meet customer needs and expectations, Das said.

"In this context, it is disheartening to see the nature of some of the complaints and the observations in our inspection reports. There are instances where complaints are misclassified as customer queries," the governor said.

He further said the RBI has also come across instances of rejected grievances not being escalated to the internal ombudsman of banks.

"I would like to urge the Boards and their Customer Service Committees to closely look into these aspects to ensure that banks have a genuine commitment to customer centricity" he added.

He also noted that while progress has been made in enhancing customer awareness, there remains significant potential to improve financial literacy, particularly for the marginalised, less savvy, and rural population.

These groups, Das said often struggle to navigate the complex financial landscape and are more vulnerable to usurious interest rates, fraud, and other unfair practices.

It was the second annual conference organised by the Reserve Bank with the boards of private sector banks as part of a series of engagements with them.

The conference had the participation of over 200 directors of private sector banks, including chairmen, managing directors and chief executive officers.

Deputy governors M Rajeshwar Rao and Swaminathan J, along with executive directors representing the RBI's Department of Supervision, Regulation and Enforcement, and other senior officials of the RBI, also participated in the conference.

Trust is the bedrock of banking, and the industry fundamentally relies on the faith of depositors and investors for its stability and growth, he said.

Building and maintaining this trust requires banks to place customers at the heart of their operations and ensure that products, services, and policies genuinely meet customer needs and expectations, Das said.

"In this context, it is disheartening to see the nature of some of the complaints and the observations in our inspection reports. There are instances where complaints are misclassified as customer queries," the governor said.

He further said the RBI has also come across instances of rejected grievances not being escalated to the internal ombudsman of banks.

"I would like to urge the Boards and their Customer Service Committees to closely look into these aspects to ensure that banks have a genuine commitment to customer centricity" he added.

He also noted that while progress has been made in enhancing customer awareness, there remains significant potential to improve financial literacy, particularly for the marginalised, less savvy, and rural population.

These groups, Das said often struggle to navigate the complex financial landscape and are more vulnerable to usurious interest rates, fraud, and other unfair practices.

It was the second annual conference organised by the Reserve Bank with the boards of private sector banks as part of a series of engagements with them.

The conference had the participation of over 200 directors of private sector banks, including chairmen, managing directors and chief executive officers.

Deputy governors M Rajeshwar Rao and Swaminathan J, along with executive directors representing the RBI's Department of Supervision, Regulation and Enforcement, and other senior officials of the RBI, also participated in the conference.

Nominations for ET MSME Awards are now open. The last day to apply is November 30, 2024. Click here to submit your entry for any one or more of the 22 categories and stand a chance to win a prestigious award.