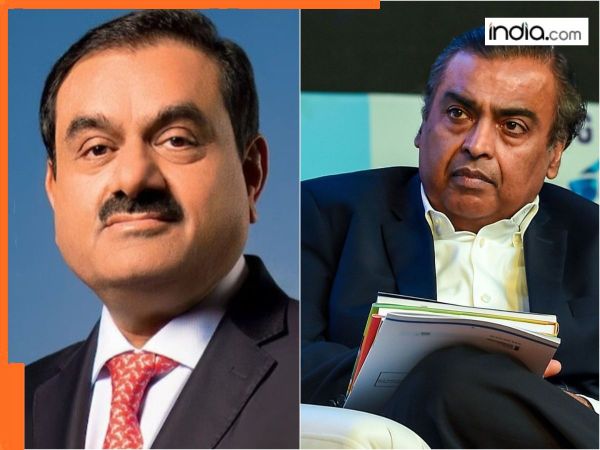

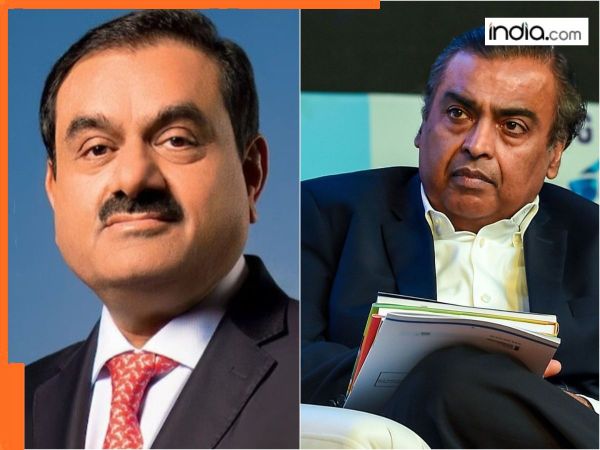

Gautam Adani throws new challenge at Mukesh Ambani, partners with…, to compete with Reliance in…

GH News January 07, 2025 02:06 PM

Reliance Industries Limited (RIL) India’s largest petrochemical company is set to face significant competition as the Adani Group makes a strategic entry into the petrochemical sector. In a bold move Adani Enterprises Limited (AEL) has joined hands with Thailand’s Indorama Resources Ltd. (IRL) to establish a presence in a domain long dominated by RIL.

Adani Group’s Formation Of New Company

AEL’s subsidiary Adani Petrochemicals Limited (APCL) and Indorama Resources have formed a joint venture named Valor Petrochemicals Ltd. (VPL) with an equal 50-50 partnership. The new company was officially registered on January 4 2025 at the Registrar of Companies office in Mumbai.

In an exchange filing AEL disclosed that VPL will operate in the petrochemical refinery and chemical businesses. The venture has been launched with an initial capital of Rs 500000 divided into 50000 equity shares of which APCL and IRL will each hold 25000 shares.

Adani’s Rivalry To Reliance

With the launch of VPL Adani Group is directly entering a sector where RIL has enjoyed dominance for years. This joint venture between Adani and the Thai company is geared towards challenging RIL’s stronghold in the petrochemical industry. The collaboration is expected to intensify competition in the sector making it a battleground between two of India’s largest industrial conglomerates.

Expanding Petrochemical Market

India’s petrochemical market is vast and growing rapidly. According to a PIB report the market is projected to reach Rs 25.20 lakh crore ($300 billion) by 2025 up from its current size of Rs 18.48 lakh crore. This expansion presents a lucrative opportunity for both RIL and VPL but it also sets the stage for intense competition between the two giants.

By partnering with Indorama Resources and forming Valor Petrochemicals Ltd. Gautam Adani is positioning his group to carve out a significant share in this burgeoning market directly challenging Mukesh Ambani’s Reliance Industries. The rivalry between these two industrial titans is likely to shape the future of India’s petrochemical industry.

Adani Petrochemicals Entry

Adani Petrochemicals was incorporated to set up refineries petrochemicals complexes speciality chemicals units hydrogen and related chemicals plants and other similar units in a phased manner.

Group chairman Gautam Adani had in 2022 stated that the conglomerate is looking to invest more than USD 4 billion in a petrochemical complex in Gujarat.

The firms first project is a 2 million tonnes PVC capacity to be constructed in a phased manner. While Phase I comprises the development of 1 million tonnes PVC plant by 2026 the second phase of equal capacity will be commissioned by early 2027.

The polyvinyl chloride (PVC) plant construction was delayed in the aftermath of release of damning report by US short-seller Hindenburg Research. The project was halted in March 2023 due to financial concerns but resumed work in July 2023. The halt came after Hindenburg alleged financial and accounting fraud at Adani Group companies. Adani group has denied all the allegations.

The plant whose total cost is estimated to be around Rs 35000 crore is expected to be Indias largest PVC manufacturing facility.

The Adani Group had also previously partnered with German chemical giant BASF to set up a chemical factory in Mundra Gujarat but the fate of that partnership is not known. The factory will also have wind and solar power plants to meet its electricity needs.

(With Inputs from PTI)

Reliance Industries Limited (RIL) India’s largest petrochemical company is set to face significant competition as the Adani Group makes a strategic entry into the petrochemical sector. In a bold move Adani Enterprises Limited (AEL) has joined hands with Thailand’s Indorama Resources Ltd. (IRL) to establish a presence in a domain long dominated by RIL.

Adani Group’s Formation Of New Company

AEL’s subsidiary Adani Petrochemicals Limited (APCL) and Indorama Resources have formed a joint venture named Valor Petrochemicals Ltd. (VPL) with an equal 50-50 partnership. The new company was officially registered on January 4 2025 at the Registrar of Companies office in Mumbai.

In an exchange filing AEL disclosed that VPL will operate in the petrochemical refinery and chemical businesses. The venture has been launched with an initial capital of Rs 500000 divided into 50000 equity shares of which APCL and IRL will each hold 25000 shares.

Adani’s Rivalry To Reliance

With the launch of VPL Adani Group is directly entering a sector where RIL has enjoyed dominance for years. This joint venture between Adani and the Thai company is geared towards challenging RIL’s stronghold in the petrochemical industry. The collaboration is expected to intensify competition in the sector making it a battleground between two of India’s largest industrial conglomerates.

Expanding Petrochemical Market

India’s petrochemical market is vast and growing rapidly. According to a PIB report the market is projected to reach Rs 25.20 lakh crore ($300 billion) by 2025 up from its current size of Rs 18.48 lakh crore. This expansion presents a lucrative opportunity for both RIL and VPL but it also sets the stage for intense competition between the two giants.

By partnering with Indorama Resources and forming Valor Petrochemicals Ltd. Gautam Adani is positioning his group to carve out a significant share in this burgeoning market directly challenging Mukesh Ambani’s Reliance Industries. The rivalry between these two industrial titans is likely to shape the future of India’s petrochemical industry.

Adani Petrochemicals Entry

Adani Petrochemicals was incorporated to set up refineries petrochemicals complexes speciality chemicals units hydrogen and related chemicals plants and other similar units in a phased manner.

Group chairman Gautam Adani had in 2022 stated that the conglomerate is looking to invest more than USD 4 billion in a petrochemical complex in Gujarat.

The firms first project is a 2 million tonnes PVC capacity to be constructed in a phased manner. While Phase I comprises the development of 1 million tonnes PVC plant by 2026 the second phase of equal capacity will be commissioned by early 2027.

The polyvinyl chloride (PVC) plant construction was delayed in the aftermath of release of damning report by US short-seller Hindenburg Research. The project was halted in March 2023 due to financial concerns but resumed work in July 2023. The halt came after Hindenburg alleged financial and accounting fraud at Adani Group companies. Adani group has denied all the allegations.

The plant whose total cost is estimated to be around Rs 35000 crore is expected to be Indias largest PVC manufacturing facility.

The Adani Group had also previously partnered with German chemical giant BASF to set up a chemical factory in Mundra Gujarat but the fate of that partnership is not known. The factory will also have wind and solar power plants to meet its electricity needs.

(With Inputs from PTI)

Reliance Industries Limited (RIL) India’s largest petrochemical company is set to face significant competition as the Adani Group makes a strategic entry into the petrochemical sector. In a bold move Adani Enterprises Limited (AEL) has joined hands with Thailand’s Indorama Resources Ltd. (IRL) to establish a presence in a domain long dominated by RIL.

Adani Group’s Formation Of New Company

AEL’s subsidiary Adani Petrochemicals Limited (APCL) and Indorama Resources have formed a joint venture named Valor Petrochemicals Ltd. (VPL) with an equal 50-50 partnership. The new company was officially registered on January 4 2025 at the Registrar of Companies office in Mumbai.

In an exchange filing AEL disclosed that VPL will operate in the petrochemical refinery and chemical businesses. The venture has been launched with an initial capital of Rs 500000 divided into 50000 equity shares of which APCL and IRL will each hold 25000 shares.

Adani’s Rivalry To Reliance

With the launch of VPL Adani Group is directly entering a sector where RIL has enjoyed dominance for years. This joint venture between Adani and the Thai company is geared towards challenging RIL’s stronghold in the petrochemical industry. The collaboration is expected to intensify competition in the sector making it a battleground between two of India’s largest industrial conglomerates.

Expanding Petrochemical Market

India’s petrochemical market is vast and growing rapidly. According to a PIB report the market is projected to reach Rs 25.20 lakh crore ($300 billion) by 2025 up from its current size of Rs 18.48 lakh crore. This expansion presents a lucrative opportunity for both RIL and VPL but it also sets the stage for intense competition between the two giants.

By partnering with Indorama Resources and forming Valor Petrochemicals Ltd. Gautam Adani is positioning his group to carve out a significant share in this burgeoning market directly challenging Mukesh Ambani’s Reliance Industries. The rivalry between these two industrial titans is likely to shape the future of India’s petrochemical industry.

Adani Petrochemicals Entry

Adani Petrochemicals was incorporated to set up refineries petrochemicals complexes speciality chemicals units hydrogen and related chemicals plants and other similar units in a phased manner.

Group chairman Gautam Adani had in 2022 stated that the conglomerate is looking to invest more than USD 4 billion in a petrochemical complex in Gujarat.

The firms first project is a 2 million tonnes PVC capacity to be constructed in a phased manner. While Phase I comprises the development of 1 million tonnes PVC plant by 2026 the second phase of equal capacity will be commissioned by early 2027.

The polyvinyl chloride (PVC) plant construction was delayed in the aftermath of release of damning report by US short-seller Hindenburg Research. The project was halted in March 2023 due to financial concerns but resumed work in July 2023. The halt came after Hindenburg alleged financial and accounting fraud at Adani Group companies. Adani group has denied all the allegations.

The plant whose total cost is estimated to be around Rs 35000 crore is expected to be Indias largest PVC manufacturing facility.

The Adani Group had also previously partnered with German chemical giant BASF to set up a chemical factory in Mundra Gujarat but the fate of that partnership is not known. The factory will also have wind and solar power plants to meet its electricity needs.

(With Inputs from PTI)