The Reserve Bank of India (RBI) has asked commercial banks to provide information on the impact of the proposed liquidity coverage (LCR) norms following pushback from banks over the move to make the norms more stringent, said people with knowledge of the matter.

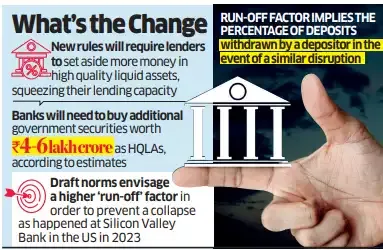

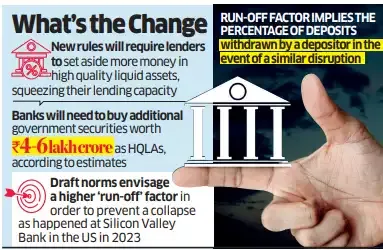

The draft norms are to be reviewed by governor Sanjay Malhotra, who succeeded Shaktikanta Das on December 9, before being finalised, they said. The rules, which are to take effect on April 1, will require lenders to set aside more money in high quality liquid assets (HQLAs), squeezing their lending capacity. Such assets are used to meet unexpected demands for liquidity in the event of a disruption. The LCR norms are aimed at mitigating risk arising from a likelihood of substantial online withdrawals. Banks had given feedback to the finance ministry that the revised norms could impact their ability to lend, as reported by ET on September 19 last year.

The banking regulator on Tuesday asked large commercial banks to provide information on the impact of the LCR under the current framework and under the draft norms, said the people cited above.

“This exercise may be done to assess the impact on system liquidity post implementation of these norms,” said a banker aware of the matter.

The central bank didn’t respond to queries.

It is estimated that banks will need to buy additional government securities worth ₹4-6 lakh crore as HQLAs if the LCR norms are implemented without modification. The draft norms envisage a higher ‘run-off’ factor in order to prevent a collapse as happened at Silicon Valley Bank in the US in 2023.

The run-off factor implies the percentage of deposits withdrawn by a depositor in the event of a similar disruption. LCR refers to the stock of HQLAs, primarily government securities, that banks must maintain to tide over a hypothetical 30-day stress scenario in which such outflows occur.

As of now, only government securities qualify as HQLAs since the RBI has repeatedly rejected lenders' proposals to qualify the cash reserve ratio (CRR) as such assets, treasury heads said. CRR is the proportion of deposits that banks need to set aside, currently at 4%.

What this effectively means is that ₹4-6 lakh crore will be allocated for investment in government bonds rather than being disbursed as credit to corporates and individuals, said the treasury head of a large bank.

The proposed LCR rules issued in late July suggested that banks assign an additional 5% run-off factor for retail deposits that can be accessed via internet and mobile banking (IMB). Accordingly, stable retail deposits enabled with IMB would have a 10% run-off factor, while less stable deposits enabled with IMB would have a 15% run-off factor. That compares with 5% and 10%, respectively, now.

Indian banks have asked the finance ministry to urge the RBI to relax the draft LCR guidelines or delay implementing them over concerns that it could impact their ability to lend.

Bank economists said the circumstances under which the LCR draft rules were issued are very different from what they are now. Growth is at a two-year low, system liquidity is in deficit to the tune of ₹1.75 lakh crore on average, the rupee has depreciated 3% since November and credit growth slowed to 11.5% on January 10 from 20% a year ago.

“The RBI is making such regulations (of LCR) by being vigilant and prudent of the overall banking system,” said the treasury head at a private bank. “These regulations cannot be guided by cyclical and seasonal conditions like tight liquidity or tepid growth. Cyclical things should not be the judge for implementation of LCR.”

An implementation of the draft guidelines in its current form on April 1 would be a “massive negative shock” to the system, said a senior economist at a foreign bank. “We expect a commentary regarding the LCR norms during the monetary policy on February 7,” he said.

Budget with ET

Rising Bharat may need to take center stage for India’s game-changing plans

Will Indian Railways accelerate to global standards with govt’s budgetary allocation?

Budget 2025 to catapult India's domestic manufacturing to a global scale

The banking regulator on Tuesday asked large commercial banks to provide information on the impact of the LCR under the current framework and under the draft norms, said the people cited above.

“This exercise may be done to assess the impact on system liquidity post implementation of these norms,” said a banker aware of the matter.

The central bank didn’t respond to queries.

It is estimated that banks will need to buy additional government securities worth ₹4-6 lakh crore as HQLAs if the LCR norms are implemented without modification. The draft norms envisage a higher ‘run-off’ factor in order to prevent a collapse as happened at Silicon Valley Bank in the US in 2023.

The run-off factor implies the percentage of deposits withdrawn by a depositor in the event of a similar disruption. LCR refers to the stock of HQLAs, primarily government securities, that banks must maintain to tide over a hypothetical 30-day stress scenario in which such outflows occur.

As of now, only government securities qualify as HQLAs since the RBI has repeatedly rejected lenders' proposals to qualify the cash reserve ratio (CRR) as such assets, treasury heads said. CRR is the proportion of deposits that banks need to set aside, currently at 4%.

What this effectively means is that ₹4-6 lakh crore will be allocated for investment in government bonds rather than being disbursed as credit to corporates and individuals, said the treasury head of a large bank.

The proposed LCR rules issued in late July suggested that banks assign an additional 5% run-off factor for retail deposits that can be accessed via internet and mobile banking (IMB). Accordingly, stable retail deposits enabled with IMB would have a 10% run-off factor, while less stable deposits enabled with IMB would have a 15% run-off factor. That compares with 5% and 10%, respectively, now.

Indian banks have asked the finance ministry to urge the RBI to relax the draft LCR guidelines or delay implementing them over concerns that it could impact their ability to lend.

Bank economists said the circumstances under which the LCR draft rules were issued are very different from what they are now. Growth is at a two-year low, system liquidity is in deficit to the tune of ₹1.75 lakh crore on average, the rupee has depreciated 3% since November and credit growth slowed to 11.5% on January 10 from 20% a year ago.

“The RBI is making such regulations (of LCR) by being vigilant and prudent of the overall banking system,” said the treasury head at a private bank. “These regulations cannot be guided by cyclical and seasonal conditions like tight liquidity or tepid growth. Cyclical things should not be the judge for implementation of LCR.”

An implementation of the draft guidelines in its current form on April 1 would be a “massive negative shock” to the system, said a senior economist at a foreign bank. “We expect a commentary regarding the LCR norms during the monetary policy on February 7,” he said.