Even as most large VC and PE funds in India are moving the focus away from growth stage investments, Yash Kela-led Singularity AMC seems to be bucking the trend.

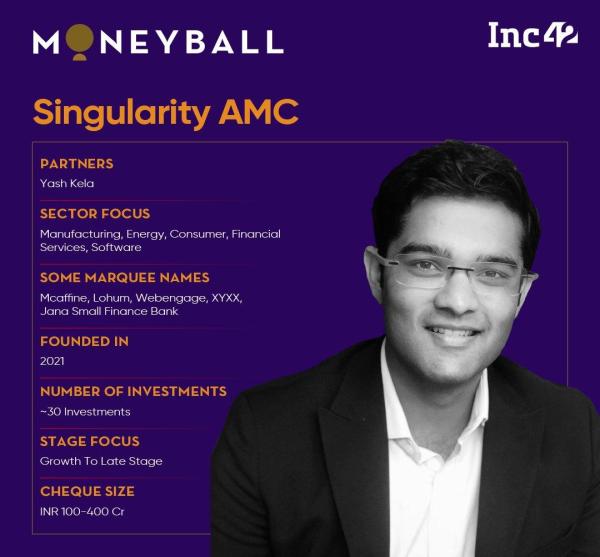

Founded in 2016, Singularity’s core philosophy revolves around “innovation that distinguishes between a leader and a follower.”

In an exclusive interview as part of Inc42’s Moneyball series, Kela also credits his background in shaping his approach to investments.

Raised in Raipur, Chhattisgarh, in a business-oriented family, Kela was influenced by his father, who built a business in the agri-commodity sector. Besides this his uncle, Madhusudhan Kela, founder of MK Ventures, was an experienced investor in capital markets, which increased Yash’s exposure to this domain.

From an early age, Yash Kela became familiar with tech-first business models, capital allocation strategies, and sharp decision making which has since been seen in Singularity AMC’s portfolio.

In the last eight years, Singularity AMC has built a portfolio of some of the most promising startups in India, with notable investments in B2C and B2B segments, including the likes of mCaffeine, Exotel, WebEngage, XYXX, and Lohum Cleantech.

In 2021, Singularity launched its first fund of INR 560 Cr, which was closed in March 2023 and is fully deployed across 17 companies, with 16 being private equity investments and one listed company.

Building on this momentum, the firm announced the first close of its second fund, Singularity Growth Opportunities Fund II, at INR 500 Cr, with a in October 2023.

“The fund is already oversubscribed to the tune of INR 1800 Cr. In the second Growth Fund (Growth Fund 2), INR 600 Cr has been deployed so far across five companies,” Kela told Inc42.

As Singularity continues to evolve, it remains committed to identifying and nurturing innovative companies, embodying the belief that “the best way to predict the future is to create it.” With a focus on growth-stage investments, the firm aims to support companies that are scaling their operations and expanding their market reach.

Here Kela gives us insights into Singularity’s investment thesis, ecosystem trends, and future outlook.

Edited excerpts

Inc42: Give us an idea of how the investment thesis at Singularity AMC has evolved in the last eight years. What is your big focus right now?

Yash Kela: We operate with two pools of capital—private equity and public equity. Within private equity, we have launched two funds, while our public equity fund is open-ended. This structure allows us to remain invested in high-quality businesses for a long period across both private and public markets.

Our approach is inspired by firms like WestBridge and Premji Invest, which have successfully executed similar models with dollar capital. Our goal is to achieve this with rupee capital. In 2021, we launched the Singularity Growth Series, focussing on growth equity investments.

There are four key pillars to our strategy:

Inc42: Take us through the journey of raising funds — first in 2021 and now in 2025. What has changed in the past few years after you closed the first fund?

Yash Kela: We started our first growth equity fund in September 2021 and completed the first close in March 2023. That fund is now fully deployed. In August 2023, we launched our second fund, which is currently in its final closing stage.

Today, Singularity manages approximately INR 4,500 Cr across both funds. Around 20% of this capital comes from sponsor commitments. Our average ticket size varies between INR 100 Cr to INR 400 Cr.

Regarding investment sizes, the firm’s recent deals have ranged between INR 400 Cr to INR 500 Cr.

Singularity follows a structured investment approach where 50% of the investment comes from the fund itself—which includes both private and public investments—while the remaining 50% is leveraged through co-investment lines provided by its LPs (Limited Partners).

This strategy enables the firm to optimise its capital allocation while ensuring strong financial backing for its portfolio companies.

We believe in maintaining high alignment with our LPs and portfolio companies. Around 20% of our fund capital is sponsor capital, ensuring strong skin in the game. Additionally, our ability to invest across private and public markets allows us to capitalise on market cycles effectively.

By leveraging structured risk assessment, sector-specific expertise, and strategic capital allocation, we aim to build sustainable, high-growth businesses in India’s evolving market landscape.

Inc42: What criteria do you use to select startups?

Yash Kela: Since we focus on growth equity, we position ourselves closer to private equity rather than venture capital. As I said above, we underwrite only two types of risks—scale-up and exit. To mitigate exit risks, we aim to take our portfolio companies public.

In our first fund, five out of 17 companies are already listed, and another eight are expected to list within the next 12-24 months.

Our selection criteria vary by sector. We primarily focus on four sectors:

Inc42: Now, tell us a little about why you have chosen to invest in the healthcare and pharma sector?

Yash Kela: There are a few key reasons. Historically, our platform has had a strong background in healthcare and pharma investments.

Our ecosystem has been actively involved in businesses like DVS Group, which have grown into large enterprises in India. Additionally, we see an interesting intersection between consumer and healthcare.

For instance, we recently invested in a mother-and-child platform in Kerala, which operates a 100,000-square-foot hospital. This intersection between healthcare and consumer experience presents a compelling opportunity for growth.

Inc42: What key trends in healthcare and pharma are influencing your investment decisions?

Yash Kela: We are particularly focussed on areas where we see strong growth potential and early profitability.

One notable trend is the evolving consumer experience in healthcare. Just like in retail, where customer engagement is key, healthcare providers must enhance the patient experience to stand out.

Another trend is valuation disparity—healthcare businesses often trade at 8-10x EBITDA, whereas consumer businesses trade at 40x. We believe this gap will narrow to around 20-30x over time, presenting significant value creation opportunities.

Additionally, the increasing presence of large hospital chains like Dr. Agarwala Hospitals, which is set to be listed, highlights the growing convergence of consumer and healthcare businesses.

Inc42: Are there specific areas within healthcare that you are primarily focussing on?

Yash Kela: Yes, our primary focus is on hospital chains and medical devices. For instance, we are investing in mid-sized specialty hospital chains as well as med-tech companies that have the potential to scale rapidly.

We see medical devices as a particularly important sector for India’s growth. Without local manufacturing, India will have a high reliance on imports, similar to what we’ve seen in the auto and electronics industries.

However, some Indian companies have already demonstrated their ability to manufacture high-quality medical devices, and the government is actively supporting this sector with initiatives like the dedicated MedTech Zone in Visakhapatnam.

Inc42: Are you considering investments in healthtech startups?

Yash Kela: It depends on how you define healthtech. We consider medical devices to be part of healthcare technology. However, we tend to avoid capital-intensive plays like online pharmacies, which require significant investment in network building and logistics.

That said, we do see value in businesses that can scale efficiently and become profitable quickly. For example, Zota Healthcare, which operates over 1,000 stores across India, is growing rapidly while maintaining profitability. We prefer such businesses over those that require extensive capital infusion.

Inc42: Does Singularity AMC invest in early-stage companies?

Yash Kela: While our primary focus is on growth-stage investments, we selectively invest early in sectors with strong long-term growth potential.

For example, we identified an opportunity in premium men’s apparel with Bombay Shirt Company and backed the business early, applying principles similar to those used in CaratLane.

In Sterling Wilson Data Center EPC, we participated in a financial-backed buyout, helping to separate the business from its parent group.

Additionally, in the electric vehicle sector, we supported a team of experienced professionals in building an electric light and heavy commercial vehicle (EV LCV & HCV) company.

In such investments, we focus on industries expected to grow at 25%-30% annually over the next decade, ensuring early profitability.

Inc42: Beyond capital, how do you support the companies in your portfolio? And what are the biggest challenges for founders in your po

Yash Kela: We believe in an ecosystem-driven approach. Our limited partners are some of the top players across various industries, including energy, automotive, and manufacturing. If a company in our portfolio operates in an industry where our LPs have expertise, we facilitate collaborations and knowledge-sharing.

Additionally, we create synergies among our portfolio companies, whether in supply chains, customer networks, or strategic partnerships. This integrated approach allows our companies to scale more efficiently and navigate challenges effectively.

Different sectors will face different challenges, but overall, companies must focus on execution and cash flow management. If market conditions tighten and the inflow of capital slows, businesses that have over-leveraged themselves in anticipation of strong public markets will face significant pressure.

That’s why we emphasise self-sustaining growth rather than relying on external funding.

Another challenge is global supply chain dependencies—companies with high reliance on China and North America will need to diversify their sourcing to mitigate risks. On the flip side, we see opportunities in exports, particularly in sectors where India can replace Chinese suppliers.

The post appeared first on .